Thrivent Financial for Lutherans trimmed its position in shares of Elastic (NYSE:ESTC - Free Report) by 68.3% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 3,154 shares of the company's stock after selling 6,783 shares during the quarter. Thrivent Financial for Lutherans' holdings in Elastic were worth $242,000 as of its most recent SEC filing.

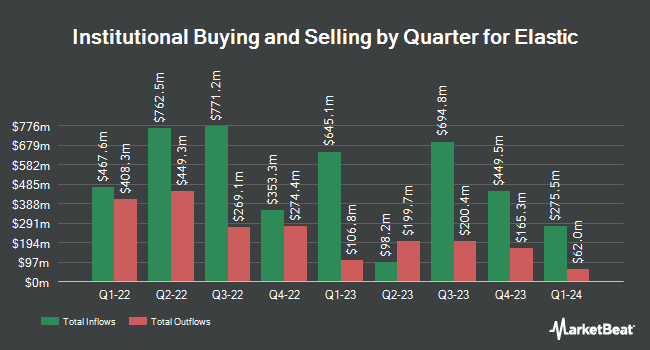

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Asset Dedication LLC raised its position in Elastic by 1,333.3% during the 2nd quarter. Asset Dedication LLC now owns 301 shares of the company's stock worth $34,000 after purchasing an additional 280 shares during the last quarter. AlphaCentric Advisors LLC bought a new position in shares of Elastic during the second quarter worth about $40,000. Quarry LP acquired a new position in shares of Elastic in the second quarter worth approximately $40,000. Signaturefd LLC boosted its holdings in Elastic by 44.1% in the second quarter. Signaturefd LLC now owns 389 shares of the company's stock valued at $44,000 after acquiring an additional 119 shares during the last quarter. Finally, Eastern Bank acquired a new stake in Elastic during the 3rd quarter valued at approximately $61,000. 97.03% of the stock is currently owned by institutional investors.

Insider Activity at Elastic

In other Elastic news, CTO Shay Banon sold 2,666 shares of the stock in a transaction dated Monday, September 9th. The shares were sold at an average price of $70.25, for a total value of $187,286.50. Following the completion of the sale, the chief technology officer now owns 4,543,190 shares in the company, valued at approximately $319,159,097.50. This trade represents a 0.06 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, insider Carolyn Herzog sold 11,145 shares of the business's stock in a transaction that occurred on Tuesday, November 26th. The stock was sold at an average price of $111.34, for a total value of $1,240,884.30. Following the completion of the transaction, the insider now owns 92,011 shares in the company, valued at $10,244,504.74. The trade was a 10.80 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 198,551 shares of company stock valued at $20,506,656. 15.90% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

A number of research analysts have recently issued reports on the stock. Stifel Nicolaus boosted their price target on shares of Elastic from $98.00 to $132.00 and gave the stock a "buy" rating in a research report on Friday, November 22nd. Needham & Company LLC restated a "hold" rating on shares of Elastic in a report on Friday, November 22nd. Robert W. Baird upgraded Elastic from a "neutral" rating to an "outperform" rating and increased their price target for the stock from $95.00 to $135.00 in a report on Friday, November 22nd. Wedbush raised Elastic from a "neutral" rating to an "outperform" rating and set a $135.00 price objective on the stock in a research note on Monday, November 25th. Finally, Wells Fargo & Company upped their target price on Elastic from $100.00 to $135.00 and gave the company an "overweight" rating in a research report on Friday, November 22nd. Five investment analysts have rated the stock with a hold rating, eighteen have assigned a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $126.33.

Get Our Latest Analysis on ESTC

Elastic Stock Down 0.5 %

Shares of ESTC stock traded down $0.55 during trading hours on Friday, reaching $110.98. The company had a trading volume of 1,585,904 shares, compared to its average volume of 1,904,214. The company has a market cap of $11.50 billion, a price-to-earnings ratio of 201.78 and a beta of 1.02. The company has a debt-to-equity ratio of 0.70, a current ratio of 1.99 and a quick ratio of 1.99. Elastic has a 12 month low of $69.00 and a 12 month high of $136.06. The business has a fifty day simple moving average of $88.79 and a 200-day simple moving average of $97.21.

Elastic Profile

(

Free Report)

Elastic N.V., a data analytics company, delivers solutions designed to run in public or private clouds in multi-cloud environments. It primarily offers Elastic Stack, a set of software products that ingest and store data from various sources and formats, as well as performs search, analysis, and visualization on that data.

See Also

Before you consider Elastic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elastic wasn't on the list.

While Elastic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.