Thrivent Financial for Lutherans lessened its position in shares of Globant S.A. (NYSE:GLOB - Free Report) by 19.0% during the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 67,622 shares of the information technology services provider's stock after selling 15,903 shares during the quarter. Thrivent Financial for Lutherans owned about 0.16% of Globant worth $13,398,000 at the end of the most recent reporting period.

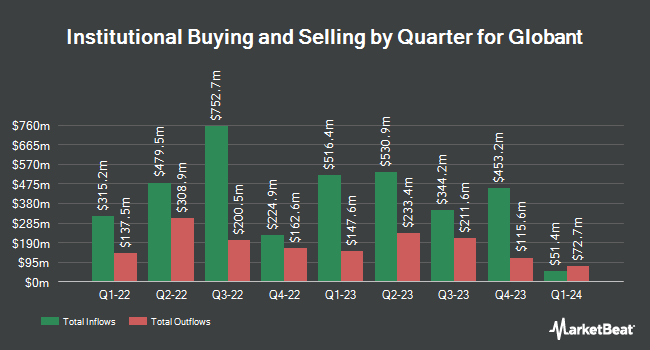

A number of other large investors have also recently added to or reduced their stakes in GLOB. Victory Capital Management Inc. raised its position in Globant by 1,817.5% in the third quarter. Victory Capital Management Inc. now owns 1,509,853 shares of the information technology services provider's stock valued at $299,162,000 after purchasing an additional 1,431,112 shares during the period. Manning & Napier Advisors LLC purchased a new stake in Globant in the 2nd quarter valued at about $99,396,000. Dimensional Fund Advisors LP lifted its position in Globant by 57.5% in the second quarter. Dimensional Fund Advisors LP now owns 442,312 shares of the information technology services provider's stock valued at $78,851,000 after buying an additional 161,512 shares during the last quarter. Sei Investments Co. boosted its stake in Globant by 43.4% during the second quarter. Sei Investments Co. now owns 512,916 shares of the information technology services provider's stock worth $91,432,000 after buying an additional 155,112 shares during the period. Finally, The Manufacturers Life Insurance Company increased its position in shares of Globant by 89.9% during the second quarter. The Manufacturers Life Insurance Company now owns 266,184 shares of the information technology services provider's stock valued at $47,450,000 after acquiring an additional 126,030 shares during the last quarter. 91.60% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several equities analysts have recently commented on the stock. Deutsche Bank Aktiengesellschaft initiated coverage on shares of Globant in a report on Thursday, August 22nd. They issued a "hold" rating and a $210.00 price objective on the stock. Scotiabank upped their price target on Globant from $210.00 to $220.00 and gave the stock a "sector perform" rating in a research note on Tuesday. KeyCorp boosted their price objective on Globant from $220.00 to $235.00 and gave the company an "overweight" rating in a report on Friday, August 16th. Canaccord Genuity Group restated a "hold" rating and set a $205.00 target price on shares of Globant in a report on Monday. Finally, JPMorgan Chase & Co. lifted their target price on Globant from $237.00 to $248.00 and gave the company an "overweight" rating in a research report on Wednesday, October 30th. Two analysts have rated the stock with a sell rating, six have assigned a hold rating and twelve have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $229.06.

Read Our Latest Research Report on Globant

Globant Stock Up 3.0 %

Globant stock traded up $6.59 during midday trading on Friday, reaching $229.28. The company's stock had a trading volume of 392,389 shares, compared to its average volume of 486,743. The company has a market cap of $9.88 billion, a P/E ratio of 58.06, a P/E/G ratio of 2.55 and a beta of 1.39. The business has a 50-day simple moving average of $210.11 and a 200-day simple moving average of $191.90. Globant S.A. has a fifty-two week low of $151.68 and a fifty-two week high of $251.50.

Globant Company Profile

(

Free Report)

Globant SA, together with its subsidiaries, provides technology services worldwide. It provides digital solutions comprising blockchain, cloud technologies, cybersecurity, data and artificial intelligence, digital experience and performance, code, Internet of Things, metaverse, and engineering and testing; and enterprise technology solutions and services, such as Agile organization, Cultural Hacking, process optimization services, as well as AWS, Google Cloud, Microsoft, Oracle, SalesForce, SAP, and ServiceNow technology solutions.

Further Reading

Before you consider Globant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Globant wasn't on the list.

While Globant currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.