Thrivent Financial for Lutherans decreased its position in Tyler Technologies, Inc. (NYSE:TYL - Free Report) by 85.6% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 30,189 shares of the technology company's stock after selling 179,239 shares during the quarter. Thrivent Financial for Lutherans owned about 0.07% of Tyler Technologies worth $17,622,000 at the end of the most recent reporting period.

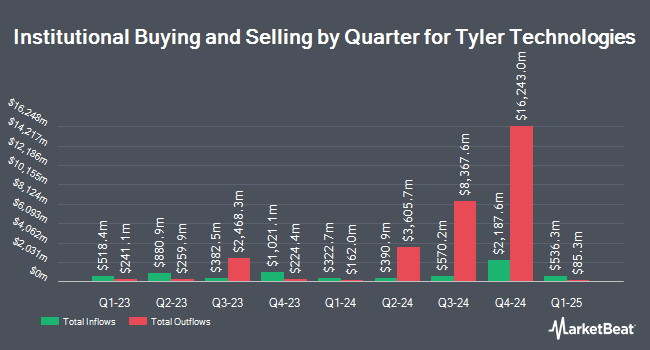

A number of other hedge funds have also recently bought and sold shares of TYL. Natixis Advisors LLC grew its position in Tyler Technologies by 11.1% in the third quarter. Natixis Advisors LLC now owns 39,089 shares of the technology company's stock worth $22,817,000 after buying an additional 3,912 shares during the last quarter. Mizuho Securities USA LLC boosted its position in shares of Tyler Technologies by 466.4% in the 3rd quarter. Mizuho Securities USA LLC now owns 18,534 shares of the technology company's stock valued at $10,819,000 after purchasing an additional 15,262 shares during the period. Empowered Funds LLC increased its stake in Tyler Technologies by 15.3% in the 3rd quarter. Empowered Funds LLC now owns 2,321 shares of the technology company's stock worth $1,355,000 after purchasing an additional 308 shares in the last quarter. Empirical Finance LLC lifted its stake in Tyler Technologies by 2.6% during the third quarter. Empirical Finance LLC now owns 1,342 shares of the technology company's stock valued at $783,000 after buying an additional 34 shares in the last quarter. Finally, CIBC Asset Management Inc boosted its stake in Tyler Technologies by 8.8% in the 3rd quarter. CIBC Asset Management Inc now owns 6,211 shares of the technology company's stock worth $3,625,000 after purchasing an additional 501 shares during the period. 93.30% of the stock is owned by institutional investors and hedge funds.

Tyler Technologies Trading Up 0.1 %

NYSE:TYL traded up $0.62 during trading hours on Thursday, hitting $601.76. The stock had a trading volume of 13,480 shares, compared to its average volume of 229,232. The business's 50 day moving average is $594.40 and its 200-day moving average is $549.91. The company has a debt-to-equity ratio of 0.18, a quick ratio of 1.21 and a current ratio of 1.21. The company has a market cap of $25.76 billion, a price-to-earnings ratio of 109.70, a P/E/G ratio of 5.41 and a beta of 0.77. Tyler Technologies, Inc. has a one year low of $397.80 and a one year high of $631.43.

Tyler Technologies (NYSE:TYL - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The technology company reported $2.52 EPS for the quarter, topping the consensus estimate of $2.43 by $0.09. The firm had revenue of $543.34 million for the quarter, compared to the consensus estimate of $547.34 million. Tyler Technologies had a net margin of 11.39% and a return on equity of 9.79%. The business's quarterly revenue was up 9.8% on a year-over-year basis. During the same period last year, the company posted $1.66 EPS. Sell-side analysts anticipate that Tyler Technologies, Inc. will post 7.39 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

TYL has been the subject of several research analyst reports. Robert W. Baird increased their price objective on Tyler Technologies from $625.00 to $700.00 and gave the stock an "outperform" rating in a research note on Friday, October 25th. Wells Fargo & Company lifted their price objective on Tyler Technologies from $580.00 to $600.00 and gave the company an "overweight" rating in a research report on Friday, July 26th. JMP Securities raised their price target on shares of Tyler Technologies from $580.00 to $700.00 and gave the company a "market outperform" rating in a report on Friday, October 25th. Needham & Company LLC boosted their price target on Tyler Technologies from $600.00 to $700.00 and gave the stock a "buy" rating in a research report on Tuesday, October 22nd. Finally, BTIG Research upped their price objective on shares of Tyler Technologies from $550.00 to $630.00 and gave the stock a "buy" rating in a report on Friday, July 26th. Three equities research analysts have rated the stock with a hold rating and twelve have issued a buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $642.62.

View Our Latest Analysis on Tyler Technologies

Insiders Place Their Bets

In related news, CEO H Lynn Moore, Jr. sold 6,250 shares of the firm's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $605.82, for a total value of $3,786,375.00. Following the completion of the transaction, the chief executive officer now owns 75,000 shares of the company's stock, valued at approximately $45,436,500. This trade represents a 7.69 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CFO Brian K. Miller sold 2,500 shares of the business's stock in a transaction dated Friday, November 8th. The stock was sold at an average price of $624.41, for a total transaction of $1,561,025.00. Following the sale, the chief financial officer now directly owns 11,950 shares in the company, valued at $7,461,699.50. This trade represents a 17.30 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders sold 27,600 shares of company stock worth $16,412,595. Corporate insiders own 2.20% of the company's stock.

Tyler Technologies Company Profile

(

Free Report)

Tyler Technologies, Inc provides integrated information management solutions and services for the public sector. It operates in two segments, Enterprise Software and Platform Technologies. The company offers platform and transformative technology solutions, including cybersecurity for government agencies; data and insights solutions; digital solutions that helps workers and policymakers to share, communicate, and leverage data; payments solutions, such as billing, presentment, merchant onboarding, collections, reconciliation, and disbursements; platform technologies, an application development platform that enables government workers to build solutions and applications; and outdoor recreation solutions, including campsite reservations, activity registrations, licensing sales and renewals, and real-time data for conservation and park management.

Further Reading

Before you consider Tyler Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tyler Technologies wasn't on the list.

While Tyler Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.