Thrivent Financial for Lutherans decreased its stake in Halozyme Therapeutics, Inc. (NASDAQ:HALO - Free Report) by 83.2% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 39,206 shares of the biopharmaceutical company's stock after selling 193,810 shares during the period. Thrivent Financial for Lutherans' holdings in Halozyme Therapeutics were worth $1,874,000 at the end of the most recent reporting period.

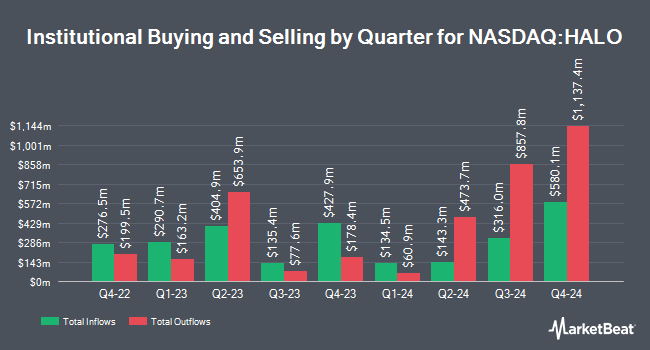

A number of other hedge funds have also recently modified their holdings of HALO. CBIZ Investment Advisory Services LLC acquired a new position in Halozyme Therapeutics in the fourth quarter valued at $29,000. Heck Capital Advisors LLC acquired a new stake in shares of Halozyme Therapeutics during the fourth quarter worth about $29,000. Smartleaf Asset Management LLC boosted its position in shares of Halozyme Therapeutics by 29.2% in the 4th quarter. Smartleaf Asset Management LLC now owns 871 shares of the biopharmaceutical company's stock valued at $42,000 after purchasing an additional 197 shares during the period. Venturi Wealth Management LLC purchased a new position in Halozyme Therapeutics during the 4th quarter worth approximately $69,000. Finally, Parkside Financial Bank & Trust increased its position in Halozyme Therapeutics by 21.8% during the fourth quarter. Parkside Financial Bank & Trust now owns 1,800 shares of the biopharmaceutical company's stock worth $86,000 after buying an additional 322 shares during the period. 97.79% of the stock is owned by hedge funds and other institutional investors.

Halozyme Therapeutics Stock Performance

Halozyme Therapeutics stock traded up $1.15 during trading hours on Wednesday, reaching $63.02. 1,571,854 shares of the stock were exchanged, compared to its average volume of 1,383,175. Halozyme Therapeutics, Inc. has a 52-week low of $37.73 and a 52-week high of $66.00. The stock has a market cap of $7.79 billion, a P/E ratio of 18.37, a P/E/G ratio of 0.42 and a beta of 1.32. The company has a debt-to-equity ratio of 4.14, a quick ratio of 9.15 and a current ratio of 7.80. The firm's 50 day moving average is $59.62 and its 200 day moving average is $54.90.

Halozyme Therapeutics (NASDAQ:HALO - Get Free Report) last posted its quarterly earnings results on Tuesday, February 18th. The biopharmaceutical company reported $1.19 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.17 by $0.02. The firm had revenue of $298.01 million during the quarter, compared to analysts' expectations of $285.74 million. Halozyme Therapeutics had a net margin of 43.74% and a return on equity of 157.78%. Analysts predict that Halozyme Therapeutics, Inc. will post 4.73 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently weighed in on HALO shares. Wells Fargo & Company decreased their price objective on Halozyme Therapeutics from $62.00 to $57.00 and set an "equal weight" rating for the company in a report on Monday, January 13th. HC Wainwright reiterated a "buy" rating on shares of Halozyme Therapeutics in a research note on Thursday, March 6th. Piper Sandler raised their price objective on shares of Halozyme Therapeutics from $52.00 to $53.00 and gave the stock a "neutral" rating in a research report on Friday, January 10th. Finally, Benchmark reaffirmed a "buy" rating and issued a $75.00 target price on shares of Halozyme Therapeutics in a report on Thursday, February 20th. Four investment analysts have rated the stock with a hold rating and six have issued a buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average price target of $62.78.

Check Out Our Latest Analysis on Halozyme Therapeutics

Insider Transactions at Halozyme Therapeutics

In other Halozyme Therapeutics news, SVP Michael J. Labarre sold 1,697 shares of the company's stock in a transaction dated Thursday, February 27th. The shares were sold at an average price of $58.28, for a total transaction of $98,901.16. Following the transaction, the senior vice president now directly owns 173,756 shares in the company, valued at approximately $10,126,499.68. This represents a 0.97 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director Jeffrey William Henderson sold 10,000 shares of the company's stock in a transaction that occurred on Monday, January 6th. The stock was sold at an average price of $50.01, for a total value of $500,100.00. Following the completion of the sale, the director now owns 43,611 shares in the company, valued at approximately $2,180,986.11. This represents a 18.65 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 32,200 shares of company stock valued at $1,786,668. Corporate insiders own 2.90% of the company's stock.

Halozyme Therapeutics Company Profile

(

Free Report)

Halozyme Therapeutics, Inc, a biopharma technology platform company, researches, develops, and commercializes proprietary enzymes and devices in the United States, Switzerland, Belgium, Japan, and internationally. The company's products are based on the patented recombinant human hyaluronidase enzyme (rHuPH20) that enables delivery of injectable biologics, such as monoclonal antibodies and other therapeutic molecules, as well as small molecules and fluids.

See Also

Before you consider Halozyme Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Halozyme Therapeutics wasn't on the list.

While Halozyme Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.