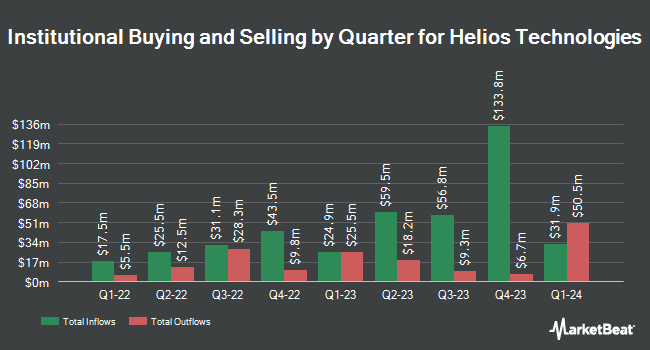

Thrivent Financial for Lutherans grew its stake in Helios Technologies, Inc. (NASDAQ:HLIO - Free Report) by 30.8% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 1,820,140 shares of the company's stock after acquiring an additional 428,110 shares during the quarter. Thrivent Financial for Lutherans owned about 5.48% of Helios Technologies worth $86,821,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also made changes to their positions in the company. Vaughan Nelson Investment Management L.P. acquired a new stake in Helios Technologies during the 3rd quarter worth about $583,000. Royce & Associates LP lifted its position in Helios Technologies by 34.1% during the 3rd quarter. Royce & Associates LP now owns 388,659 shares of the company's stock worth $18,539,000 after acquiring an additional 98,900 shares during the period. Oppenheimer Asset Management Inc. lifted its position in Helios Technologies by 23.0% during the 3rd quarter. Oppenheimer Asset Management Inc. now owns 30,808 shares of the company's stock worth $1,470,000 after acquiring an additional 5,760 shares during the period. Versor Investments LP acquired a new stake in Helios Technologies during the 3rd quarter worth about $253,000. Finally, Diamond Hill Capital Management Inc. acquired a new position in shares of Helios Technologies in the 3rd quarter valued at about $13,633,000. 94.72% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at Helios Technologies

In other news, Director Diana Sacchi sold 615 shares of the stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $53.91, for a total transaction of $33,154.65. Following the completion of the sale, the director now owns 3,636 shares in the company, valued at approximately $196,016.76. This represents a 14.47 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. 0.70% of the stock is currently owned by corporate insiders.

Helios Technologies Price Performance

Shares of HLIO stock traded up $0.37 during trading hours on Monday, reaching $50.23. The company had a trading volume of 239,385 shares, compared to its average volume of 206,725. The company has a debt-to-equity ratio of 0.52, a quick ratio of 1.54 and a current ratio of 3.03. The stock has a fifty day moving average of $47.16 and a 200-day moving average of $46.76. The company has a market capitalization of $1.67 billion, a price-to-earnings ratio of 44.45 and a beta of 0.84. Helios Technologies, Inc. has a 12-month low of $37.50 and a 12-month high of $57.29.

Helios Technologies (NASDAQ:HLIO - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The company reported $0.59 EPS for the quarter, beating analysts' consensus estimates of $0.54 by $0.05. Helios Technologies had a return on equity of 8.22% and a net margin of 4.57%. The firm had revenue of $194.50 million for the quarter, compared to analysts' expectations of $196.41 million. During the same period in the prior year, the firm posted $0.44 earnings per share. The firm's quarterly revenue was down 3.4% on a year-over-year basis. On average, equities analysts anticipate that Helios Technologies, Inc. will post 2.14 earnings per share for the current year.

Helios Technologies Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Monday, October 21st. Stockholders of record on Friday, October 4th were given a dividend of $0.09 per share. This represents a $0.36 dividend on an annualized basis and a dividend yield of 0.72%. The ex-dividend date was Friday, October 4th. Helios Technologies's dividend payout ratio is currently 31.86%.

Analyst Ratings Changes

Separately, Stifel Nicolaus decreased their price objective on Helios Technologies from $64.00 to $63.00 and set a "buy" rating for the company in a report on Wednesday, October 16th.

View Our Latest Analysis on HLIO

Helios Technologies Company Profile

(

Free Report)

Helios Technologies, Inc, together with its subsidiaries, provides engineered motion control and electronic control technology solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company operates in two segments, Hydraulics and Electronics. The Hydraulics segment offers cartridge valve technology products to control rates and direction of fluid flow, and to regulate and control pressures for industrial and mobile applications; hydraulic quick release coupling solutions for the agriculture, construction equipment, and industrial markets; motion control technology and fluid conveyance technology; cartridge valve technology; engineered solutions for machine users, manufacturers, or designers.

Read More

Before you consider Helios Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Helios Technologies wasn't on the list.

While Helios Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.