Thrivent Financial for Lutherans lifted its holdings in Humana Inc. (NYSE:HUM - Free Report) by 55.6% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 600,317 shares of the insurance provider's stock after purchasing an additional 214,535 shares during the period. Thrivent Financial for Lutherans owned 0.50% of Humana worth $190,145,000 at the end of the most recent reporting period.

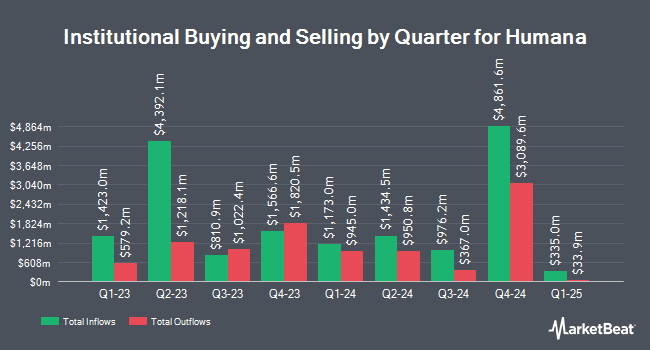

Several other institutional investors and hedge funds have also modified their holdings of HUM. Creative Financial Designs Inc. ADV lifted its stake in shares of Humana by 244.0% in the 3rd quarter. Creative Financial Designs Inc. ADV now owns 86 shares of the insurance provider's stock valued at $27,000 after purchasing an additional 61 shares during the last quarter. CarsonAllaria Wealth Management Ltd. lifted its position in Humana by 111.4% during the 2nd quarter. CarsonAllaria Wealth Management Ltd. now owns 74 shares of the insurance provider's stock worth $28,000 after acquiring an additional 39 shares during the last quarter. Atwood & Palmer Inc. acquired a new position in Humana during the 3rd quarter worth $29,000. Ashton Thomas Securities LLC acquired a new position in Humana during the 3rd quarter worth $31,000. Finally, Your Advocates Ltd. LLP lifted its position in Humana by 81.8% during the 3rd quarter. Your Advocates Ltd. LLP now owns 100 shares of the insurance provider's stock worth $32,000 after acquiring an additional 45 shares during the last quarter. Institutional investors and hedge funds own 92.38% of the company's stock.

Humana Price Performance

Shares of NYSE HUM traded down $7.47 during mid-day trading on Friday, hitting $275.67. 1,842,901 shares of the stock were exchanged, compared to its average volume of 2,301,719. Humana Inc. has a twelve month low of $213.31 and a twelve month high of $527.18. The stock's fifty day simple moving average is $281.36 and its two-hundred day simple moving average is $331.94. The company has a debt-to-equity ratio of 0.67, a quick ratio of 1.76 and a current ratio of 1.76. The company has a market cap of $33.19 billion, a P/E ratio of 24.42, a PEG ratio of 2.17 and a beta of 0.52.

Humana (NYSE:HUM - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The insurance provider reported $4.16 earnings per share for the quarter, beating analysts' consensus estimates of $3.48 by $0.68. The firm had revenue of $29.30 billion during the quarter, compared to analysts' expectations of $28.66 billion. Humana had a return on equity of 13.20% and a net margin of 1.18%. As a group, analysts forecast that Humana Inc. will post 15.86 EPS for the current fiscal year.

Humana Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, January 31st. Shareholders of record on Tuesday, December 31st will be paid a $0.885 dividend. This represents a $3.54 dividend on an annualized basis and a dividend yield of 1.28%. The ex-dividend date is Tuesday, December 31st. Humana's dividend payout ratio is presently 31.36%.

Wall Street Analysts Forecast Growth

A number of research analysts have weighed in on the stock. Leerink Partnrs lowered shares of Humana from a "strong-buy" rating to a "hold" rating in a research report on Wednesday, October 2nd. Cantor Fitzgerald reissued a "neutral" rating and set a $395.00 target price on shares of Humana in a research report on Tuesday, October 1st. KeyCorp assumed coverage on shares of Humana in a research report on Friday, October 11th. They set a "sector weight" rating for the company. Oppenheimer cut their target price on shares of Humana from $400.00 to $280.00 and set an "outperform" rating for the company in a research report on Thursday, October 3rd. Finally, Royal Bank of Canada dropped their price objective on shares of Humana from $400.00 to $265.00 and set an "outperform" rating on the stock in a report on Tuesday, October 8th. Twenty research analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $315.86.

Read Our Latest Stock Analysis on HUM

Humana Profile

(

Free Report)

Humana Inc, together with its subsidiaries, provides medical and specialty insurance products in the United States. It operates through two segments, Insurance and CenterWell. The company offers medical and supplemental benefit plans to individuals. It has a contract with Centers for Medicare and Medicaid Services to administer the Limited Income Newly Eligible Transition prescription drug plan program; and contracts with various states to provide Medicaid, dual eligible, and long-term support services benefits.

Further Reading

Before you consider Humana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Humana wasn't on the list.

While Humana currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.