Thrivent Financial for Lutherans increased its holdings in UGI Co. (NYSE:UGI - Free Report) by 105.8% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,507,263 shares of the utilities provider's stock after purchasing an additional 774,770 shares during the quarter. Thrivent Financial for Lutherans owned 0.70% of UGI worth $37,712,000 at the end of the most recent quarter.

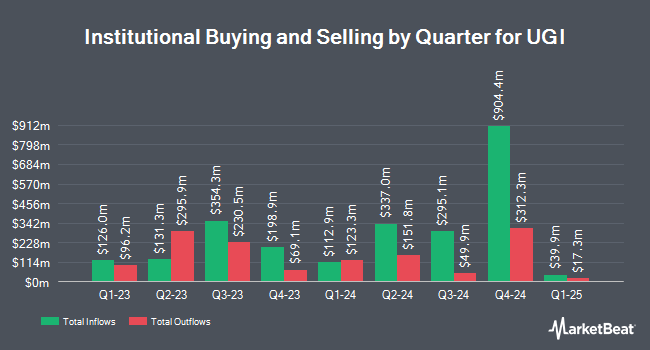

Other hedge funds and other institutional investors have also made changes to their positions in the company. Federated Hermes Inc. boosted its stake in UGI by 28.7% during the 2nd quarter. Federated Hermes Inc. now owns 3,537,729 shares of the utilities provider's stock valued at $81,014,000 after purchasing an additional 788,457 shares during the period. LSV Asset Management grew its holdings in UGI by 13.3% in the 2nd quarter. LSV Asset Management now owns 3,024,750 shares of the utilities provider's stock valued at $69,267,000 after buying an additional 356,200 shares in the last quarter. ProShare Advisors LLC lifted its position in shares of UGI by 84.9% during the 2nd quarter. ProShare Advisors LLC now owns 2,445,010 shares of the utilities provider's stock valued at $55,991,000 after acquiring an additional 1,122,766 shares during the period. Jupiter Asset Management Ltd. bought a new stake in shares of UGI during the 2nd quarter valued at approximately $53,371,000. Finally, Dimensional Fund Advisors LP raised its position in UGI by 32.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,327,248 shares of the utilities provider's stock worth $53,293,000 after purchasing an additional 566,416 shares during the last quarter. 82.34% of the stock is currently owned by institutional investors.

UGI Stock Down 1.2 %

NYSE UGI traded down $0.29 on Tuesday, reaching $24.15. The company had a trading volume of 1,340,133 shares, compared to its average volume of 2,110,951. The company has a quick ratio of 0.71, a current ratio of 0.91 and a debt-to-equity ratio of 1.34. The stock has a market capitalization of $5.18 billion, a P/E ratio of 7.83 and a beta of 1.13. The company's fifty day moving average is $24.26 and its 200 day moving average is $24.06. UGI Co. has a 52-week low of $21.51 and a 52-week high of $26.15.

Analysts Set New Price Targets

A number of brokerages have weighed in on UGI. StockNews.com downgraded UGI from a "buy" rating to a "hold" rating in a report on Tuesday, August 6th. Mizuho raised UGI from a "neutral" rating to an "outperform" rating and boosted their target price for the company from $27.00 to $30.00 in a research report on Friday. Finally, Wells Fargo & Company boosted their target price on UGI from $26.00 to $27.00 and gave the company an "equal weight" rating in a research report on Wednesday, October 16th.

View Our Latest Stock Report on UGI

UGI Company Profile

(

Free Report)

UGI Corporation, together with its subsidiaries, distributes, stores, transports, and markets energy products and related services in the United States and internationally. The company operates through four segments: AmeriGas Propane, UGI International, Midstream & Marketing, and UGI Utilities. It distributes propane to approximately 1.3 million residential, commercial/industrial, motor fuel, agricultural, and wholesale customers through 1,400 propane distribution locations.

Featured Articles

Before you consider UGI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UGI wasn't on the list.

While UGI currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.