Thrivent Financial for Lutherans reduced its stake in shares of EchoStar Co. (NASDAQ:SATS - Free Report) by 18.3% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 94,773 shares of the communications equipment provider's stock after selling 21,261 shares during the period. Thrivent Financial for Lutherans' holdings in EchoStar were worth $2,352,000 at the end of the most recent quarter.

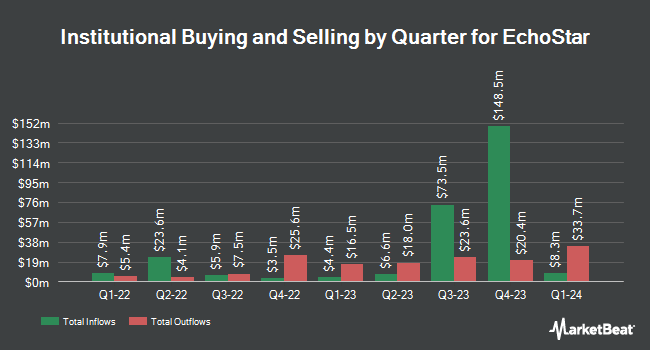

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. State Board of Administration of Florida Retirement System acquired a new stake in shares of EchoStar during the 1st quarter worth approximately $237,000. Vanguard Group Inc. increased its holdings in shares of EchoStar by 238.7% during the first quarter. Vanguard Group Inc. now owns 13,707,909 shares of the communications equipment provider's stock valued at $195,338,000 after purchasing an additional 9,661,167 shares during the period. American International Group Inc. lifted its holdings in EchoStar by 8.4% in the first quarter. American International Group Inc. now owns 65,594 shares of the communications equipment provider's stock worth $935,000 after purchasing an additional 5,070 shares during the period. CANADA LIFE ASSURANCE Co grew its position in EchoStar by 2,084.9% in the 1st quarter. CANADA LIFE ASSURANCE Co now owns 108,611 shares of the communications equipment provider's stock valued at $1,547,000 after buying an additional 103,640 shares in the last quarter. Finally, Lazard Asset Management LLC raised its position in shares of EchoStar by 1,932.1% during the 1st quarter. Lazard Asset Management LLC now owns 51,127 shares of the communications equipment provider's stock worth $728,000 after buying an additional 48,611 shares in the last quarter. 33.62% of the stock is owned by institutional investors.

Insider Activity

In other EchoStar news, Chairman Charles W. Ergen purchased 1,551,355 shares of the company's stock in a transaction that occurred on Tuesday, November 12th. The shares were purchased at an average cost of $28.04 per share, with a total value of $43,499,994.20. Following the completion of the transaction, the chairman now owns 1,551,355 shares of the company's stock, valued at approximately $43,499,994.20. This represents a ∞ increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which can be accessed through this link. Corporate insiders own 55.90% of the company's stock.

Analyst Ratings Changes

Several brokerages recently commented on SATS. Raymond James cut EchoStar from a "strong-buy" rating to a "market perform" rating in a report on Tuesday, October 1st. Morgan Stanley boosted their price target on shares of EchoStar from $14.00 to $20.00 and gave the stock an "equal weight" rating in a research report on Friday, September 13th. StockNews.com upgraded shares of EchoStar to a "sell" rating in a report on Saturday, November 9th. UBS Group lifted their price target on shares of EchoStar from $14.00 to $15.00 and gave the stock a "neutral" rating in a research report on Tuesday, August 13th. Finally, TD Cowen cut their price objective on EchoStar from $37.00 to $30.00 and set a "buy" rating for the company in a research report on Wednesday, November 13th. Two equities research analysts have rated the stock with a sell rating, three have issued a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and an average price target of $19.25.

Check Out Our Latest Research Report on EchoStar

EchoStar Trading Up 0.6 %

EchoStar stock traded up $0.16 during midday trading on Thursday, reaching $25.03. The stock had a trading volume of 1,402,574 shares, compared to its average volume of 1,818,512. EchoStar Co. has a twelve month low of $10.18 and a twelve month high of $30.08. The company has a debt-to-equity ratio of 1.11, a current ratio of 0.67 and a quick ratio of 0.61. The firm has a market cap of $6.80 billion, a price-to-earnings ratio of -2.73 and a beta of 0.70. The firm's fifty day simple moving average is $24.84 and its two-hundred day simple moving average is $21.04.

About EchoStar

(

Free Report)

EchoStar Corporation, together with its subsidiaries, provides networking technologies and services worldwide. The company operates in four segments: Pay-TV, Retail Wireless, 5G Network Deployment, Broadband and Satellite Services. The Pay-TV segment offers a direct broadcast and fixed satellite services; designs, develops, and distributes receiver system; and provides digital broadcast operations, including satellite uplinking/downlinking, transmission and, other services to third-party pay-TV providers; and multichannel, live-linear and on-demand streaming over-the-top internet-based domestic, international, Latino, and Freestream video programming services under the DISH and SLING brand names.

Read More

Before you consider EchoStar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EchoStar wasn't on the list.

While EchoStar currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.