Thrivent Financial for Lutherans lessened its holdings in LXP Industrial Trust (NYSE:LXP - Free Report) by 67.9% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 231,142 shares of the real estate investment trust's stock after selling 489,045 shares during the quarter. Thrivent Financial for Lutherans owned approximately 0.08% of LXP Industrial Trust worth $2,323,000 at the end of the most recent quarter.

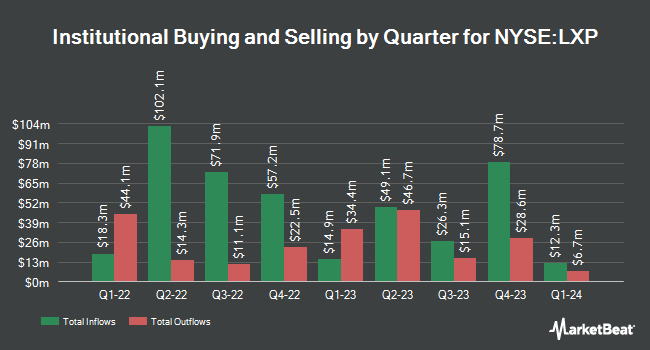

A number of other hedge funds and other institutional investors also recently bought and sold shares of the business. Blue Trust Inc. boosted its holdings in shares of LXP Industrial Trust by 1,596.2% in the 2nd quarter. Blue Trust Inc. now owns 3,138 shares of the real estate investment trust's stock valued at $28,000 after buying an additional 2,953 shares in the last quarter. GAMMA Investing LLC grew its holdings in shares of LXP Industrial Trust by 81.1% during the third quarter. GAMMA Investing LLC now owns 3,421 shares of the real estate investment trust's stock worth $34,000 after purchasing an additional 1,532 shares during the last quarter. Sequoia Financial Advisors LLC acquired a new stake in shares of LXP Industrial Trust during the second quarter worth about $92,000. KBC Group NV increased its position in shares of LXP Industrial Trust by 32.7% during the third quarter. KBC Group NV now owns 10,170 shares of the real estate investment trust's stock worth $102,000 after purchasing an additional 2,504 shares in the last quarter. Finally, Sage Rhino Capital LLC purchased a new stake in shares of LXP Industrial Trust in the 2nd quarter valued at about $102,000. 93.52% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Separately, Evercore ISI raised their price target on LXP Industrial Trust from $10.00 to $11.00 and gave the stock an "in-line" rating in a research note on Monday, September 16th. One research analyst has rated the stock with a sell rating, one has issued a hold rating and three have issued a buy rating to the company. According to MarketBeat, the company has an average rating of "Hold" and a consensus target price of $11.25.

Get Our Latest Stock Report on LXP Industrial Trust

LXP Industrial Trust Stock Performance

NYSE LXP traded up $0.09 during trading on Thursday, reaching $9.42. The company's stock had a trading volume of 924,850 shares, compared to its average volume of 2,201,898. LXP Industrial Trust has a twelve month low of $8.23 and a twelve month high of $10.56. The firm has a market cap of $2.77 billion, a price-to-earnings ratio of 156.94 and a beta of 0.88. The business's fifty day moving average price is $9.62 and its 200-day moving average price is $9.54. The company has a debt-to-equity ratio of 0.21, a quick ratio of 0.12 and a current ratio of 0.12.

LXP Industrial Trust Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Tuesday, December 31st will be paid a dividend of $0.135 per share. The ex-dividend date is Tuesday, December 31st. This is an increase from LXP Industrial Trust's previous quarterly dividend of $0.13. This represents a $0.54 annualized dividend and a yield of 5.73%. LXP Industrial Trust's dividend payout ratio is currently 866.81%.

LXP Industrial Trust Company Profile

(

Free Report)

LXP Industrial Trust NYSE: LXP is a publicly traded real estate investment trust (REIT) focused on single-tenant industrial real estate investments across the United States. LXP seeks to expand its industrial portfolio through acquisitions, build-to-suit transactions, sale-leaseback transactions, development projects and other transactions.

Read More

Before you consider LXP Industrial Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LXP Industrial Trust wasn't on the list.

While LXP Industrial Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.