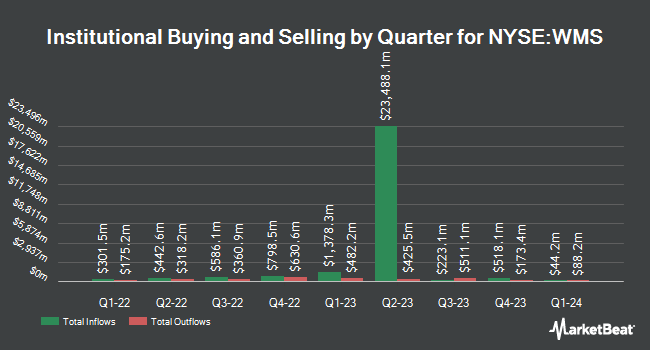

Thrivent Financial for Lutherans lessened its holdings in Advanced Drainage Systems, Inc. (NYSE:WMS - Free Report) by 6.3% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,294,936 shares of the construction company's stock after selling 87,799 shares during the quarter. Thrivent Financial for Lutherans owned 1.67% of Advanced Drainage Systems worth $203,512,000 as of its most recent SEC filing.

A number of other institutional investors have also made changes to their positions in the business. Natixis Advisors LLC lifted its position in shares of Advanced Drainage Systems by 2.6% in the third quarter. Natixis Advisors LLC now owns 21,711 shares of the construction company's stock worth $3,412,000 after purchasing an additional 550 shares in the last quarter. CIBC Asset Management Inc increased its holdings in Advanced Drainage Systems by 3.6% during the third quarter. CIBC Asset Management Inc now owns 2,271 shares of the construction company's stock worth $357,000 after buying an additional 79 shares during the last quarter. Huntington National Bank increased its holdings in Advanced Drainage Systems by 123.1% during the third quarter. Huntington National Bank now owns 386 shares of the construction company's stock worth $61,000 after buying an additional 213 shares during the last quarter. KBC Group NV increased its holdings in Advanced Drainage Systems by 0.3% during the third quarter. KBC Group NV now owns 609,497 shares of the construction company's stock worth $95,789,000 after buying an additional 1,773 shares during the last quarter. Finally, MQS Management LLC acquired a new position in Advanced Drainage Systems during the third quarter worth $426,000. Institutional investors own 89.83% of the company's stock.

Wall Street Analysts Forecast Growth

WMS has been the topic of a number of recent analyst reports. Loop Capital lowered their target price on shares of Advanced Drainage Systems from $180.00 to $170.00 and set a "buy" rating on the stock in a report on Monday, November 11th. Robert W. Baird decreased their price objective on shares of Advanced Drainage Systems from $174.00 to $161.00 and set an "outperform" rating on the stock in a report on Monday, November 11th. Oppenheimer decreased their price objective on shares of Advanced Drainage Systems from $192.00 to $184.00 and set an "outperform" rating on the stock in a report on Monday, November 11th. Stephens reiterated an "equal weight" rating and issued a $135.00 price objective (down from $170.00) on shares of Advanced Drainage Systems in a report on Wednesday. Finally, KeyCorp decreased their price objective on shares of Advanced Drainage Systems from $195.00 to $180.00 and set an "overweight" rating on the stock in a report on Monday, November 11th. Two investment analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to data from MarketBeat.com, Advanced Drainage Systems has a consensus rating of "Moderate Buy" and an average price target of $170.29.

View Our Latest Report on Advanced Drainage Systems

Advanced Drainage Systems Price Performance

WMS traded up $1.16 on Friday, hitting $131.42. 792,002 shares of the stock were exchanged, compared to its average volume of 577,462. Advanced Drainage Systems, Inc. has a 12 month low of $116.98 and a 12 month high of $184.27. The business has a 50-day moving average of $150.26 and a two-hundred day moving average of $158.76. The company has a debt-to-equity ratio of 0.97, a current ratio of 3.19 and a quick ratio of 2.15. The firm has a market capitalization of $10.19 billion, a price-to-earnings ratio of 20.93, a PEG ratio of 1.19 and a beta of 1.53.

Advanced Drainage Systems (NYSE:WMS - Get Free Report) last posted its quarterly earnings data on Friday, November 8th. The construction company reported $1.70 earnings per share for the quarter, missing the consensus estimate of $1.93 by ($0.23). Advanced Drainage Systems had a return on equity of 40.31% and a net margin of 16.89%. The firm had revenue of $782.60 million for the quarter, compared to the consensus estimate of $819.41 million. During the same period in the prior year, the company earned $1.71 EPS. The company's revenue for the quarter was up .3% compared to the same quarter last year. Sell-side analysts forecast that Advanced Drainage Systems, Inc. will post 6.5 EPS for the current fiscal year.

Advanced Drainage Systems Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 2nd will be issued a $0.16 dividend. The ex-dividend date of this dividend is Monday, December 2nd. This represents a $0.64 dividend on an annualized basis and a dividend yield of 0.49%. Advanced Drainage Systems's dividend payout ratio (DPR) is currently 10.19%.

Advanced Drainage Systems Company Profile

(

Free Report)

Advanced Drainage Systems, Inc designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in North America and internationally. The company operates through Pipe, International, Infiltrator, and Allied Products & Other segments. It offers single, double, and triple wall corrugated polypropylene and polyethylene pipes; plastic leachfield chambers and systems; EZflow synthetic aggregate bundles; wastewater purification through mechanical aeration wastewater for residential and commercial systems; septic tanks and accessories; combined treatment and dispersal systems, including advanced enviro-septic and advanced treatment leachfield systems; and allied products, including storm retention/detention and septic chambers, polyvinyl chloride drainage structures, fittings, and water quality filters and separators.

See Also

Before you consider Advanced Drainage Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Drainage Systems wasn't on the list.

While Advanced Drainage Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.