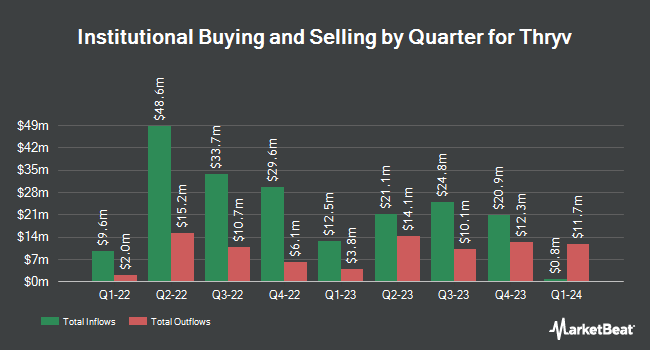

RBF Capital LLC boosted its stake in shares of Thryv Holdings, Inc. (NASDAQ:THRY - Free Report) by 117.7% during the 4th quarter, according to its most recent filing with the SEC. The firm owned 110,514 shares of the company's stock after purchasing an additional 59,761 shares during the period. RBF Capital LLC owned approximately 0.26% of Thryv worth $1,662,000 at the end of the most recent quarter.

A number of other institutional investors have also modified their holdings of THRY. XTX Topco Ltd grew its holdings in Thryv by 2.2% during the fourth quarter. XTX Topco Ltd now owns 29,665 shares of the company's stock worth $439,000 after acquiring an additional 633 shares during the period. Summit Investment Advisors Inc. increased its holdings in shares of Thryv by 27.7% during the 4th quarter. Summit Investment Advisors Inc. now owns 3,906 shares of the company's stock valued at $58,000 after purchasing an additional 848 shares in the last quarter. Oregon Public Employees Retirement Fund lifted its stake in shares of Thryv by 18.7% in the 4th quarter. Oregon Public Employees Retirement Fund now owns 9,509 shares of the company's stock valued at $141,000 after purchasing an additional 1,500 shares during the period. Corebridge Financial Inc. boosted its holdings in Thryv by 8.9% during the fourth quarter. Corebridge Financial Inc. now owns 19,984 shares of the company's stock worth $296,000 after buying an additional 1,631 shares in the last quarter. Finally, Amalgamated Bank grew its position in Thryv by 17.6% during the fourth quarter. Amalgamated Bank now owns 11,446 shares of the company's stock valued at $169,000 after buying an additional 1,715 shares during the period. Hedge funds and other institutional investors own 96.38% of the company's stock.

Analyst Ratings Changes

THRY has been the topic of several recent analyst reports. Royal Bank of Canada assumed coverage on shares of Thryv in a research note on Thursday, March 27th. They set a "sector perform" rating and a $17.00 target price on the stock. Needham & Company LLC reissued a "buy" rating and issued a $28.00 price objective on shares of Thryv in a report on Thursday, April 10th. Finally, B. Riley reduced their target price on Thryv from $30.00 to $26.00 and set a "buy" rating for the company in a research note on Tuesday. One investment analyst has rated the stock with a hold rating and four have given a buy rating to the stock. According to MarketBeat, Thryv presently has an average rating of "Moderate Buy" and a consensus target price of $23.20.

Read Our Latest Stock Report on THRY

Thryv Stock Performance

Shares of NASDAQ:THRY opened at $11.90 on Wednesday. The business's 50 day moving average price is $14.75 and its 200-day moving average price is $15.55. Thryv Holdings, Inc. has a 1 year low of $10.03 and a 1 year high of $26.42. The company has a debt-to-equity ratio of 2.70, a current ratio of 1.04 and a quick ratio of 1.04. The firm has a market capitalization of $516.11 million, a PE ratio of -1.23 and a beta of 1.03.

Thryv (NASDAQ:THRY - Get Free Report) last released its earnings results on Thursday, February 27th. The company reported $0.19 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.07) by $0.26. The business had revenue of $186.60 million during the quarter, compared to analyst estimates of $183.02 million. Thryv had a negative net margin of 38.87% and a negative return on equity of 42.95%. As a group, equities research analysts expect that Thryv Holdings, Inc. will post -2.24 earnings per share for the current fiscal year.

Thryv Profile

(

Free Report)

Thryv Holdings, Inc provides digital marketing solutions and cloud-based tools to the small-to-medium sized businesses in the United States. It operates through four segments: Thryv U.S. Marketing Services, Thryv U.S. SaaS, Thryv International Marketing Services, and Thryv International SaaS. The company provides print yellow pages, internet yellow pages, and search engine marketing; and other digital media solutions, such as online display and social advertising, online presence and video, and search engine optimization tools.

Further Reading

Want to see what other hedge funds are holding THRY? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Thryv Holdings, Inc. (NASDAQ:THRY - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Thryv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thryv wasn't on the list.

While Thryv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.