Tidal Investments LLC increased its position in Cal-Maine Foods, Inc. (NASDAQ:CALM - Free Report) by 418.6% in the 3rd quarter, according to its most recent filing with the SEC. The fund owned 47,653 shares of the basic materials company's stock after purchasing an additional 38,465 shares during the period. Tidal Investments LLC owned 0.10% of Cal-Maine Foods worth $3,566,000 at the end of the most recent quarter.

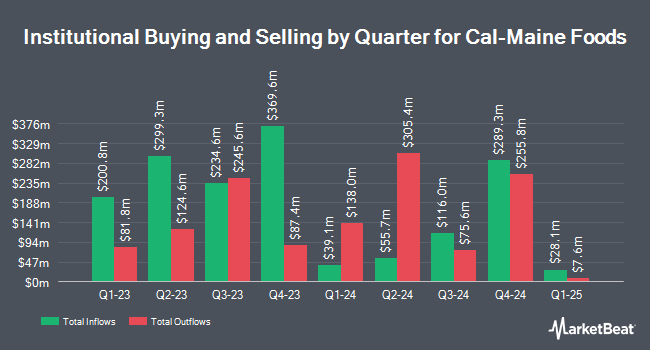

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Dimensional Fund Advisors LP raised its stake in shares of Cal-Maine Foods by 4.6% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,616,011 shares of the basic materials company's stock worth $159,863,000 after buying an additional 114,995 shares in the last quarter. Renaissance Technologies LLC raised its stake in shares of Cal-Maine Foods by 5.5% during the 2nd quarter. Renaissance Technologies LLC now owns 2,115,624 shares of the basic materials company's stock worth $129,286,000 after buying an additional 110,900 shares in the last quarter. State Street Corp raised its stake in shares of Cal-Maine Foods by 3.0% during the 3rd quarter. State Street Corp now owns 1,609,388 shares of the basic materials company's stock worth $120,447,000 after buying an additional 46,187 shares in the last quarter. Pacer Advisors Inc. raised its stake in shares of Cal-Maine Foods by 4.3% during the 3rd quarter. Pacer Advisors Inc. now owns 1,561,672 shares of the basic materials company's stock worth $116,876,000 after buying an additional 64,489 shares in the last quarter. Finally, American Century Companies Inc. raised its stake in shares of Cal-Maine Foods by 8.9% during the 2nd quarter. American Century Companies Inc. now owns 1,013,713 shares of the basic materials company's stock worth $61,948,000 after buying an additional 82,772 shares in the last quarter. 84.67% of the stock is owned by hedge funds and other institutional investors.

Cal-Maine Foods Stock Performance

Shares of CALM traded up $2.23 during trading hours on Friday, hitting $108.12. The stock had a trading volume of 592,178 shares, compared to its average volume of 591,483. The firm has a market cap of $5.30 billion, a P/E ratio of 12.38 and a beta of -0.10. The company's fifty day simple moving average is $93.60 and its 200 day simple moving average is $76.41. Cal-Maine Foods, Inc. has a 12-month low of $53.02 and a 12-month high of $108.22.

Cal-Maine Foods (NASDAQ:CALM - Get Free Report) last issued its earnings results on Tuesday, October 1st. The basic materials company reported $3.06 earnings per share for the quarter, missing the consensus estimate of $3.36 by ($0.30). The firm had revenue of $785.87 million during the quarter, compared to analysts' expectations of $704.65 million. Cal-Maine Foods had a return on equity of 24.25% and a net margin of 16.09%. The company's quarterly revenue was up 71.1% compared to the same quarter last year. During the same period last year, the business posted $0.02 earnings per share. As a group, sell-side analysts predict that Cal-Maine Foods, Inc. will post 8.54 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of equities research analysts recently weighed in on CALM shares. StockNews.com cut Cal-Maine Foods from a "buy" rating to a "hold" rating in a report on Saturday, November 23rd. Stephens began coverage on Cal-Maine Foods in a report on Thursday, October 3rd. They set an "equal weight" rating and a $82.00 target price on the stock.

Get Our Latest Analysis on CALM

Cal-Maine Foods Company Profile

(

Free Report)

Cal-Maine Foods, Inc, together with its subsidiaries, produces, grades, packages, markets, and distributes shell eggs. The company offers specialty shell eggs, such as nutritionally enhanced, cage free, organic, free-range, pasture-raised, and brown eggs under the Egg-Land's Best, Land O' Lakes, Farmhouse Eggs, Sunups, Sunny Meadow, and 4Grain brand names.

See Also

Before you consider Cal-Maine Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cal-Maine Foods wasn't on the list.

While Cal-Maine Foods currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.