Tidal Investments LLC boosted its stake in shares of Boston Scientific Co. (NYSE:BSX - Free Report) by 8.8% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 86,507 shares of the medical equipment provider's stock after buying an additional 6,990 shares during the period. Tidal Investments LLC's holdings in Boston Scientific were worth $7,249,000 at the end of the most recent reporting period.

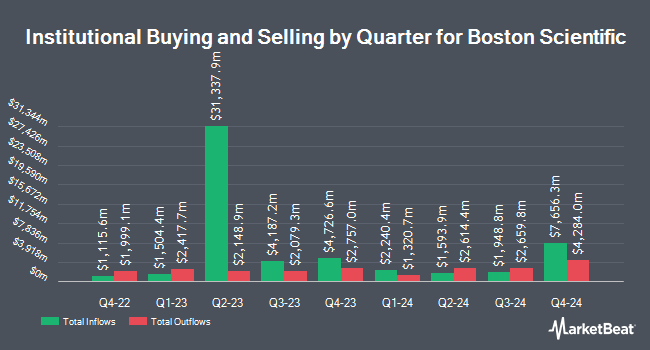

Other large investors have also added to or reduced their stakes in the company. Diversified Trust Co boosted its stake in Boston Scientific by 13.4% in the 2nd quarter. Diversified Trust Co now owns 5,627 shares of the medical equipment provider's stock worth $433,000 after purchasing an additional 666 shares in the last quarter. Wealth Enhancement Advisory Services LLC lifted its stake in shares of Boston Scientific by 7.6% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 71,068 shares of the medical equipment provider's stock worth $5,473,000 after buying an additional 5,044 shares in the last quarter. ORG Partners LLC grew its holdings in shares of Boston Scientific by 6,094.7% during the second quarter. ORG Partners LLC now owns 1,177 shares of the medical equipment provider's stock valued at $90,000 after buying an additional 1,158 shares during the last quarter. Triad Wealth Partners LLC bought a new stake in shares of Boston Scientific during the second quarter valued at approximately $26,000. Finally, Old Port Advisors purchased a new position in Boston Scientific in the 2nd quarter worth approximately $207,000. Hedge funds and other institutional investors own 89.07% of the company's stock.

Boston Scientific Trading Down 0.2 %

BSX stock traded down $0.14 during mid-day trading on Friday, reaching $90.28. 1,816,105 shares of the stock traded hands, compared to its average volume of 5,964,276. Boston Scientific Co. has a one year low of $54.95 and a one year high of $91.93. The stock has a market capitalization of $133.06 billion, a PE ratio of 74.73, a PEG ratio of 2.67 and a beta of 0.80. The company has a debt-to-equity ratio of 0.44, a quick ratio of 1.02 and a current ratio of 1.48. The business has a 50-day moving average price of $87.87 and a two-hundred day moving average price of $81.67.

Boston Scientific (NYSE:BSX - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The medical equipment provider reported $0.63 EPS for the quarter, beating the consensus estimate of $0.59 by $0.04. Boston Scientific had a net margin of 11.26% and a return on equity of 17.23%. The company had revenue of $4.21 billion for the quarter, compared to the consensus estimate of $4.04 billion. During the same period in the prior year, the firm posted $0.50 EPS. The firm's revenue was up 19.3% compared to the same quarter last year. Equities research analysts expect that Boston Scientific Co. will post 2.46 EPS for the current year.

Wall Street Analysts Forecast Growth

Several research firms have recently weighed in on BSX. Royal Bank of Canada boosted their price target on Boston Scientific from $95.00 to $98.00 and gave the stock an "outperform" rating in a research note on Thursday, October 24th. Canaccord Genuity Group upped their target price on shares of Boston Scientific from $98.00 to $101.00 and gave the company a "buy" rating in a research note on Monday. Truist Financial lifted their price target on shares of Boston Scientific from $90.00 to $100.00 and gave the stock a "buy" rating in a research note on Monday, October 14th. Stifel Nicolaus raised their target price on shares of Boston Scientific from $85.00 to $100.00 and gave the stock a "buy" rating in a report on Friday, October 18th. Finally, Morgan Stanley increased their price target on Boston Scientific from $92.00 to $100.00 and gave the company an "overweight" rating in a report on Thursday, October 24th. Four equities research analysts have rated the stock with a hold rating, nineteen have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $94.43.

Get Our Latest Stock Analysis on Boston Scientific

Insider Activity at Boston Scientific

In other Boston Scientific news, EVP Wendy Carruthers sold 6,983 shares of Boston Scientific stock in a transaction on Tuesday, October 1st. The stock was sold at an average price of $83.86, for a total transaction of $585,594.38. Following the completion of the sale, the executive vice president now directly owns 34,748 shares of the company's stock, valued at $2,913,967.28. The trade was a 16.73 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, EVP Arthur C. Butcher sold 14,010 shares of Boston Scientific stock in a transaction dated Monday, November 25th. The shares were sold at an average price of $89.27, for a total value of $1,250,672.70. Following the completion of the sale, the executive vice president now owns 978 shares of the company's stock, valued at $87,306.06. The trade was a 93.47 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 328,157 shares of company stock worth $27,957,676 in the last quarter. 0.50% of the stock is owned by company insiders.

About Boston Scientific

(

Free Report)

Boston Scientific Corporation develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide. It operates through two segments, MedSurg and Cardiovascular. The company offers devices to diagnose and treat gastrointestinal and pulmonary conditions, such as resolution clips, biliary stent systems, stents and electrocautery enhanced delivery systems, direct visualization systems, digital catheters, and single-use duodenoscopes; devices to treat urological conditions, including ureteral stents, catheters, baskets, guidewires, sheaths, balloons, single-use digital flexible ureteroscopes, holmium laser systems, artificial urinary sphincter, laser system, fiber, and hydrogel systems; and devices to treat neurological movement disorders and manage chronic pain, such as spinal cord stimulator system, proprietary programming software, radiofrequency generator, indirect decompression systems, practice optimization tools, and deep brain stimulation system.

Further Reading

Before you consider Boston Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Scientific wasn't on the list.

While Boston Scientific currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.