Tidal Investments LLC acquired a new position in shares of Blackstone Mortgage Trust, Inc. (NYSE:BXMT - Free Report) in the 3rd quarter, according to its most recent disclosure with the SEC. The fund acquired 46,435 shares of the real estate investment trust's stock, valued at approximately $883,000.

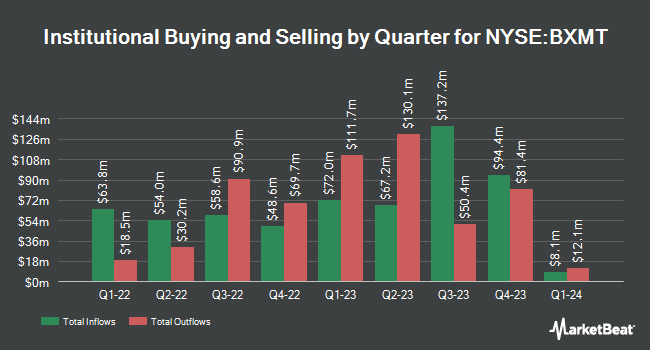

A number of other institutional investors and hedge funds have also recently modified their holdings of the company. Harbor Capital Advisors Inc. acquired a new position in Blackstone Mortgage Trust in the third quarter valued at approximately $39,000. McIlrath & Eck LLC acquired a new position in Blackstone Mortgage Trust in the third quarter valued at $63,000. Wellington Shields & Co. LLC grew its stake in Blackstone Mortgage Trust by 98.0% during the 2nd quarter. Wellington Shields & Co. LLC now owns 4,555 shares of the real estate investment trust's stock worth $79,000 after buying an additional 2,255 shares during the last quarter. Ashton Thomas Private Wealth LLC acquired a new stake in shares of Blackstone Mortgage Trust in the second quarter valued at approximately $87,000. Finally, Future Financial Wealth Managment LLC purchased a new position in shares of Blackstone Mortgage Trust during the third quarter worth approximately $95,000. Institutional investors and hedge funds own 64.15% of the company's stock.

Blackstone Mortgage Trust Stock Up 2.4 %

Shares of NYSE:BXMT traded up $0.42 during trading on Friday, reaching $18.15. The stock had a trading volume of 3,158,425 shares, compared to its average volume of 1,897,443. The stock has a market cap of $3.14 billion, a P/E ratio of -13.06 and a beta of 1.50. The business has a fifty day moving average price of $18.66 and a 200-day moving average price of $18.35. Blackstone Mortgage Trust, Inc. has a fifty-two week low of $16.53 and a fifty-two week high of $23.10.

Blackstone Mortgage Trust Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Shareholders of record on Tuesday, December 31st will be paid a dividend of $0.47 per share. This represents a $1.88 dividend on an annualized basis and a yield of 10.36%. The ex-dividend date is Tuesday, December 31st. Blackstone Mortgage Trust's dividend payout ratio is currently -135.25%.

Wall Street Analyst Weigh In

Several research firms have commented on BXMT. Wolfe Research raised Blackstone Mortgage Trust from a "peer perform" rating to an "outperform" rating and set a $20.00 price objective for the company in a research note on Wednesday, December 11th. Wells Fargo & Company increased their price target on Blackstone Mortgage Trust from $19.00 to $22.00 and gave the stock an "overweight" rating in a report on Friday, September 20th. Five analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $20.07.

Check Out Our Latest Stock Report on BXMT

Blackstone Mortgage Trust Company Profile

(

Free Report)

Blackstone Mortgage Trust, Inc, a real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia. The company originates and acquires senior floating rate mortgage loans that are secured by a first-priority mortgage on commercial real estate assets.

Featured Articles

Before you consider Blackstone Mortgage Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blackstone Mortgage Trust wasn't on the list.

While Blackstone Mortgage Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.