Tidal Investments LLC lifted its holdings in shares of Cellebrite DI Ltd. (NASDAQ:CLBT - Free Report) by 59.3% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 104,478 shares of the company's stock after purchasing an additional 38,887 shares during the period. Tidal Investments LLC owned 0.05% of Cellebrite DI worth $1,759,000 as of its most recent filing with the SEC.

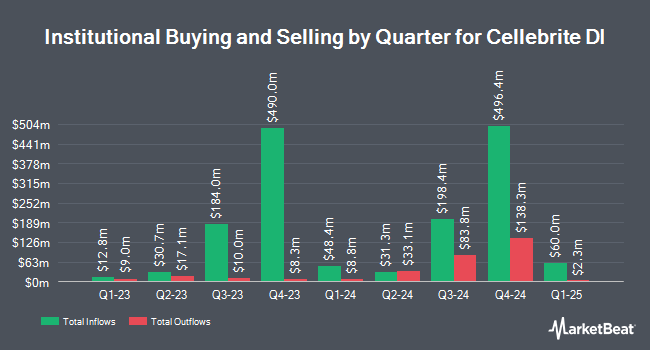

Other institutional investors also recently modified their holdings of the company. Barclays PLC increased its position in Cellebrite DI by 29.1% during the 3rd quarter. Barclays PLC now owns 263,657 shares of the company's stock valued at $4,439,000 after purchasing an additional 59,395 shares during the period. Public Employees Retirement System of Ohio bought a new stake in shares of Cellebrite DI in the 3rd quarter valued at $4,936,000. Y Intercept Hong Kong Ltd increased its position in shares of Cellebrite DI by 35.5% during the third quarter. Y Intercept Hong Kong Ltd now owns 19,510 shares of the company's stock worth $329,000 after buying an additional 5,113 shares during the period. XTX Topco Ltd lifted its holdings in Cellebrite DI by 66.0% in the third quarter. XTX Topco Ltd now owns 56,360 shares of the company's stock valued at $949,000 after buying an additional 22,416 shares during the period. Finally, Two Sigma Advisers LP boosted its position in Cellebrite DI by 9.8% during the third quarter. Two Sigma Advisers LP now owns 1,341,100 shares of the company's stock valued at $22,584,000 after acquiring an additional 120,000 shares during the last quarter. Institutional investors own 45.88% of the company's stock.

Cellebrite DI Price Performance

Shares of CLBT stock traded down $0.01 during trading hours on Wednesday, reaching $20.22. The company had a trading volume of 200,885 shares, compared to its average volume of 1,174,269. The business has a fifty day simple moving average of $19.02 and a 200-day simple moving average of $15.95. Cellebrite DI Ltd. has a 12 month low of $7.91 and a 12 month high of $21.72. The company has a market cap of $4.16 billion, a price-to-earnings ratio of -13.05, a price-to-earnings-growth ratio of 2.71 and a beta of 1.51.

Cellebrite DI (NASDAQ:CLBT - Get Free Report) last posted its earnings results on Wednesday, November 6th. The company reported $0.14 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.09 by $0.05. Cellebrite DI had a negative net margin of 82.28% and a positive return on equity of 122.59%. The firm had revenue of $106.90 million during the quarter, compared to analyst estimates of $102.06 million. During the same quarter in the prior year, the business posted $0.09 EPS. The business's revenue was up 27.0% compared to the same quarter last year. On average, equities research analysts expect that Cellebrite DI Ltd. will post 0.32 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of research analysts have recently issued reports on the company. TD Cowen boosted their price objective on Cellebrite DI from $20.00 to $23.00 and gave the company a "buy" rating in a research note on Monday, September 23rd. Needham & Company LLC lifted their price objective on shares of Cellebrite DI from $17.00 to $21.00 and gave the company a "buy" rating in a research note on Thursday, November 7th. Craig Hallum boosted their target price on shares of Cellebrite DI from $23.00 to $24.00 and gave the company a "buy" rating in a research report on Thursday, November 7th. Finally, JPMorgan Chase & Co. raised their price target on shares of Cellebrite DI from $22.00 to $24.00 and gave the stock an "overweight" rating in a report on Monday. Eight analysts have rated the stock with a buy rating, According to data from MarketBeat, the company has an average rating of "Buy" and a consensus target price of $20.57.

Get Our Latest Analysis on CLBT

Cellebrite DI Company Profile

(

Free Report)

Cellebrite DI Ltd. develops solutions for legally sanctioned investigations in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific. The company's DI suite of solutions allows users to collect, review, analyze, and manage digital data across the investigative lifecycle with respect to legally sanctioned investigations used in various cases, including child exploitation, homicide, anti-terror, border control, sexual crimes, human trafficking, corporate security, cryptocurrency, and intellectual property theft.

Featured Stories

Before you consider Cellebrite DI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cellebrite DI wasn't on the list.

While Cellebrite DI currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.