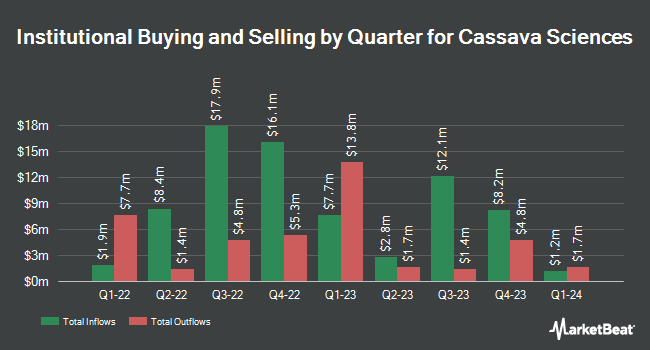

Tidal Investments LLC purchased a new position in shares of Cassava Sciences, Inc. (NASDAQ:SAVA - Free Report) in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund purchased 375,000 shares of the company's stock, valued at approximately $11,036,000. Tidal Investments LLC owned approximately 0.78% of Cassava Sciences as of its most recent filing with the Securities & Exchange Commission.

Several other hedge funds have also recently added to or reduced their stakes in the company. KBC Group NV acquired a new stake in shares of Cassava Sciences in the third quarter valued at approximately $57,000. Quest Partners LLC boosted its position in shares of Cassava Sciences by 117.8% during the 3rd quarter. Quest Partners LLC now owns 1,997 shares of the company's stock valued at $59,000 after acquiring an additional 1,080 shares during the last quarter. Dark Forest Capital Management LP purchased a new stake in shares of Cassava Sciences in the second quarter valued at about $131,000. Arizona State Retirement System increased its position in Cassava Sciences by 4.2% during the second quarter. Arizona State Retirement System now owns 11,495 shares of the company's stock worth $142,000 after purchasing an additional 468 shares during the last quarter. Finally, Profund Advisors LLC raised its stake in Cassava Sciences by 4.6% during the second quarter. Profund Advisors LLC now owns 13,440 shares of the company's stock worth $166,000 after purchasing an additional 591 shares during the period. 38.05% of the stock is owned by institutional investors and hedge funds.

Cassava Sciences Trading Up 1.8 %

SAVA traded up $0.05 on Friday, hitting $2.84. The company had a trading volume of 1,789,959 shares, compared to its average volume of 2,579,046. The company's fifty day moving average price is $20.34 and its 200 day moving average price is $21.59. Cassava Sciences, Inc. has a 1 year low of $2.69 and a 1 year high of $42.20. The firm has a market cap of $136.63 million, a P/E ratio of -1.96 and a beta of -0.86.

Cassava Sciences (NASDAQ:SAVA - Get Free Report) last issued its quarterly earnings data on Thursday, November 7th. The company reported ($0.58) EPS for the quarter, topping the consensus estimate of ($1.37) by $0.79. During the same quarter last year, the business earned ($0.61) earnings per share. On average, analysts predict that Cassava Sciences, Inc. will post -3.97 earnings per share for the current year.

Insider Activity

In other news, CFO Eric Schoen sold 59,800 shares of the firm's stock in a transaction that occurred on Friday, November 29th. The shares were sold at an average price of $3.86, for a total value of $230,828.00. Following the completion of the transaction, the chief financial officer now owns 11,500 shares of the company's stock, valued at approximately $44,390. This trade represents a 83.87 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Insiders own 9.00% of the company's stock.

Analyst Ratings Changes

Separately, HC Wainwright downgraded shares of Cassava Sciences from a "buy" rating to a "neutral" rating and set a $116.00 price target for the company. in a report on Tuesday, November 26th.

Read Our Latest Report on Cassava Sciences

Cassava Sciences Company Profile

(

Free Report)

Cassava Sciences, Inc, a clinical stage biotechnology company, develops drugs for neurodegenerative diseases. Its lead therapeutic product candidate is simufilam, a small molecule drug, which is completed Phase 2 clinical trial; and investigational diagnostic product candidate is SavaDx, a blood-based biomarker/diagnostic to detect Alzheimer's disease.

See Also

Before you consider Cassava Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cassava Sciences wasn't on the list.

While Cassava Sciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.