Tidal Investments LLC lowered its holdings in MARA Holdings, Inc. (NASDAQ:MARA - Free Report) by 4.1% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 1,496,065 shares of the business services provider's stock after selling 63,408 shares during the period. Tidal Investments LLC owned 0.46% of MARA worth $24,266,000 as of its most recent SEC filing.

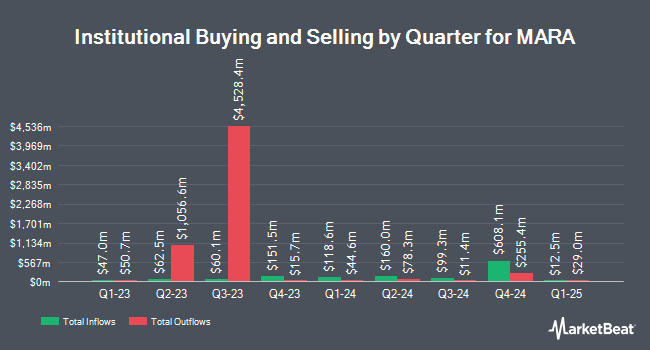

Several other institutional investors have also recently added to or reduced their stakes in the business. Private Advisor Group LLC lifted its holdings in shares of MARA by 27.7% during the 3rd quarter. Private Advisor Group LLC now owns 226,199 shares of the business services provider's stock valued at $3,669,000 after acquiring an additional 49,062 shares in the last quarter. Charles Schwab Investment Management Inc. lifted its position in MARA by 8.9% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 2,656,363 shares of the business services provider's stock worth $43,086,000 after acquiring an additional 217,106 shares in the last quarter. Mutual of America Capital Management LLC increased its stake in MARA by 112.4% during the 3rd quarter. Mutual of America Capital Management LLC now owns 203,975 shares of the business services provider's stock worth $3,308,000 after buying an additional 107,963 shares during the period. Everence Capital Management Inc. acquired a new stake in shares of MARA during the third quarter valued at about $640,000. Finally, Intech Investment Management LLC acquired a new position in shares of MARA in the third quarter worth about $1,107,000. 44.53% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at MARA

In other news, Director Jay P. Leupp sold 6,800 shares of the stock in a transaction dated Friday, November 29th. The shares were sold at an average price of $29.90, for a total value of $203,320.00. Following the completion of the sale, the director now directly owns 135,756 shares in the company, valued at $4,059,104.40. This represents a 4.77 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CEO Frederick G. Thiel sold 27,505 shares of the firm's stock in a transaction dated Monday, November 18th. The stock was sold at an average price of $19.80, for a total value of $544,599.00. Following the sale, the chief executive officer now directly owns 4,155,595 shares of the company's stock, valued at $82,280,781. The trade was a 0.66 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 152,622 shares of company stock worth $2,890,197. Insiders own 0.97% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities analysts have commented on the stock. Barclays assumed coverage on shares of MARA in a report on Monday, November 25th. They issued an "equal weight" rating and a $27.00 price objective for the company. Cantor Fitzgerald started coverage on shares of MARA in a research note on Thursday, October 10th. They issued an "overweight" rating and a $21.00 price target for the company. Needham & Company LLC reissued a "hold" rating on shares of MARA in a report on Wednesday, November 13th. JPMorgan Chase & Co. upgraded MARA from an "underweight" rating to a "neutral" rating and upped their price objective for the company from $12.00 to $23.00 in a report on Tuesday. Finally, HC Wainwright restated a "buy" rating and set a $28.00 target price on shares of MARA in a report on Wednesday, December 4th. One investment analyst has rated the stock with a sell rating, six have issued a hold rating and four have issued a buy rating to the company. According to MarketBeat.com, MARA has an average rating of "Hold" and a consensus price target of $24.56.

Read Our Latest Research Report on MARA

MARA Stock Performance

Shares of NASDAQ:MARA traded down $0.69 during midday trading on Thursday, reaching $22.58. 50,512,718 shares of the company traded hands, compared to its average volume of 56,879,895. MARA Holdings, Inc. has a 12 month low of $13.16 and a 12 month high of $34.09. The firm's fifty day moving average price is $20.62 and its two-hundred day moving average price is $19.26. The firm has a market capitalization of $7.27 billion, a price-to-earnings ratio of 28.58 and a beta of 5.63. The company has a quick ratio of 4.00, a current ratio of 4.00 and a debt-to-equity ratio of 0.22.

MARA (NASDAQ:MARA - Get Free Report) last issued its earnings results on Tuesday, November 12th. The business services provider reported ($0.42) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.38) by ($0.04). MARA had a negative return on equity of 8.40% and a net margin of 27.48%. The firm had revenue of $131.60 million during the quarter, compared to analysts' expectations of $140.26 million. During the same period last year, the firm posted ($0.05) earnings per share. The firm's quarterly revenue was up 34.4% on a year-over-year basis. On average, equities analysts expect that MARA Holdings, Inc. will post -1.02 earnings per share for the current year.

MARA Profile

(

Free Report)

MARA Holdings, Inc operates as a digital asset technology company that mines digital assets with a focus on the bitcoin ecosystem in United States. The company was formerly known as Marathon Digital Holdings, Inc and changed its name to MARA Holdings, Inc in August 2024. MARA Holdings, Inc was incorporated in 2010 and is headquartered in Fort Lauderdale, Florida.

Read More

Before you consider MARA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MARA wasn't on the list.

While MARA currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.