Tidal Investments LLC lessened its holdings in ZIM Integrated Shipping Services Ltd. (NYSE:ZIM - Free Report) by 87.3% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 68,530 shares of the company's stock after selling 470,523 shares during the quarter. Tidal Investments LLC owned 0.06% of ZIM Integrated Shipping Services worth $1,758,000 as of its most recent filing with the Securities & Exchange Commission.

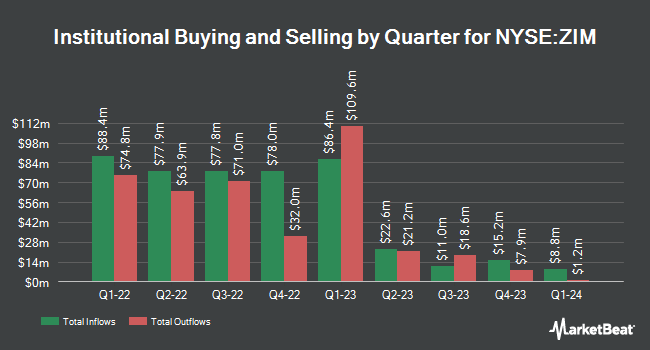

Other hedge funds have also added to or reduced their stakes in the company. Van ECK Associates Corp increased its stake in shares of ZIM Integrated Shipping Services by 1.6% in the third quarter. Van ECK Associates Corp now owns 38,079 shares of the company's stock worth $977,000 after buying an additional 591 shares during the period. Janney Montgomery Scott LLC raised its stake in shares of ZIM Integrated Shipping Services by 2.1% during the third quarter. Janney Montgomery Scott LLC now owns 44,292 shares of the company's stock valued at $1,137,000 after acquiring an additional 915 shares during the last quarter. Fairman Group LLC purchased a new stake in shares of ZIM Integrated Shipping Services during the third quarter worth about $26,000. Olympiad Research LP grew its stake in shares of ZIM Integrated Shipping Services by 12.9% in the third quarter. Olympiad Research LP now owns 10,588 shares of the company's stock worth $272,000 after purchasing an additional 1,212 shares during the last quarter. Finally, Thurston Springer Miller Herd & Titak Inc. bought a new position in ZIM Integrated Shipping Services during the 3rd quarter valued at approximately $31,000. 21.42% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

A number of brokerages have recently weighed in on ZIM. Fearnley Fonds lowered ZIM Integrated Shipping Services from a "hold" rating to a "strong sell" rating in a research report on Thursday, November 21st. Bank of America upped their price objective on shares of ZIM Integrated Shipping Services from $12.20 to $13.70 and gave the stock an "underperform" rating in a report on Wednesday, August 28th. Jefferies Financial Group cut their target price on shares of ZIM Integrated Shipping Services from $28.00 to $22.00 and set a "hold" rating on the stock in a research note on Tuesday. Clarkson Capital raised shares of ZIM Integrated Shipping Services from a "hold" rating to a "strong-buy" rating in a research note on Friday, November 22nd. Finally, JPMorgan Chase & Co. reaffirmed an "underweight" rating and set a $10.50 price objective on shares of ZIM Integrated Shipping Services in a research report on Tuesday, September 10th. Five investment analysts have rated the stock with a sell rating, one has given a hold rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $15.14.

Get Our Latest Analysis on ZIM Integrated Shipping Services

ZIM Integrated Shipping Services Stock Up 0.3 %

NYSE:ZIM traded up $0.06 during trading hours on Wednesday, reaching $18.48. 841,871 shares of the company traded hands, compared to its average volume of 6,231,416. The company has a current ratio of 1.33, a quick ratio of 1.26 and a debt-to-equity ratio of 1.11. The business's 50-day moving average price is $22.38 and its two-hundred day moving average price is $20.66. ZIM Integrated Shipping Services Ltd. has a 1 year low of $9.08 and a 1 year high of $30.15. The stock has a market capitalization of $2.22 billion, a P/E ratio of 1.54, a P/E/G ratio of 0.04 and a beta of 1.78.

ZIM Integrated Shipping Services Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, December 9th. Shareholders of record on Monday, December 2nd were paid a dividend of $2.81 per share. This is a positive change from ZIM Integrated Shipping Services's previous quarterly dividend of $0.93. This represents a $11.24 dividend on an annualized basis and a yield of 60.82%. The ex-dividend date was Monday, December 2nd. ZIM Integrated Shipping Services's dividend payout ratio (DPR) is currently 9.72%.

About ZIM Integrated Shipping Services

(

Free Report)

ZIM Integrated Shipping Services Ltd., together with its subsidiaries, provides container shipping and related services in Israel and internationally. It provides door-to-door and port-to-port transportation services for various types of customers, including end-users, consolidators, and freight forwarders.

Featured Stories

Before you consider ZIM Integrated Shipping Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ZIM Integrated Shipping Services wasn't on the list.

While ZIM Integrated Shipping Services currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.