Tidal Investments LLC lessened its stake in Markel Group Inc. (NYSE:MKL - Free Report) by 42.9% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,031 shares of the insurance provider's stock after selling 776 shares during the quarter. Tidal Investments LLC's holdings in Markel Group were worth $1,617,000 at the end of the most recent reporting period.

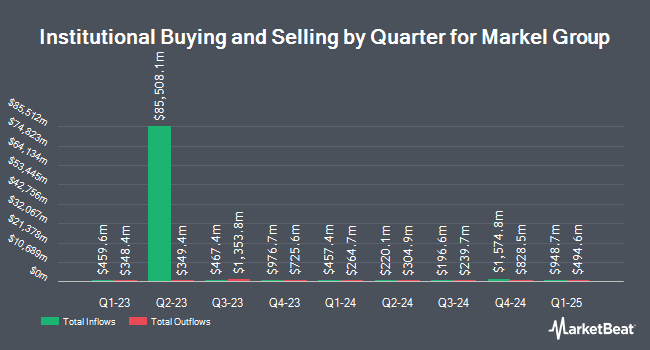

Other hedge funds and other institutional investors have also made changes to their positions in the company. SpiderRock Advisors LLC raised its stake in shares of Markel Group by 199.4% in the 3rd quarter. SpiderRock Advisors LLC now owns 473 shares of the insurance provider's stock valued at $742,000 after purchasing an additional 315 shares during the period. Versor Investments LP lifted its stake in Markel Group by 72.4% in the 3rd quarter. Versor Investments LP now owns 381 shares of the insurance provider's stock valued at $598,000 after acquiring an additional 160 shares in the last quarter. Sanctuary Advisors LLC acquired a new position in Markel Group during the 2nd quarter worth approximately $2,803,000. Solitude Financial Services raised its holdings in shares of Markel Group by 43.3% in the third quarter. Solitude Financial Services now owns 1,075 shares of the insurance provider's stock valued at $1,686,000 after purchasing an additional 325 shares during the last quarter. Finally, State Street Corp lifted its position in shares of Markel Group by 4.2% in the third quarter. State Street Corp now owns 329,209 shares of the insurance provider's stock worth $516,391,000 after purchasing an additional 13,372 shares in the last quarter. 77.12% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several equities research analysts have commented on the stock. TD Cowen cut shares of Markel Group from a "buy" rating to a "hold" rating and cut their price target for the stock from $1,986.00 to $1,836.00 in a research report on Monday, December 2nd. Royal Bank of Canada lowered their price target on Markel Group from $1,700.00 to $1,675.00 and set a "sector perform" rating on the stock in a research report on Friday, November 1st. StockNews.com cut shares of Markel Group from a "buy" rating to a "hold" rating in a research note on Wednesday, November 27th. Finally, Jefferies Financial Group increased their price target on shares of Markel Group from $1,590.00 to $1,600.00 and gave the company a "hold" rating in a research note on Wednesday, October 9th. One investment analyst has rated the stock with a sell rating and six have assigned a hold rating to the company. According to MarketBeat, the company presently has an average rating of "Hold" and a consensus price target of $1,626.83.

Get Our Latest Analysis on Markel Group

Markel Group Stock Performance

MKL stock traded down $32.68 during trading hours on Wednesday, hitting $1,677.46. 54,347 shares of the stock were exchanged, compared to its average volume of 43,906. Markel Group Inc. has a 12 month low of $1,342.66 and a 12 month high of $1,809.11. The firm has a market capitalization of $21.58 billion, a P/E ratio of 7.74 and a beta of 0.77. The company has a 50-day simple moving average of $1,660.68 and a two-hundred day simple moving average of $1,600.81. The company has a current ratio of 0.60, a quick ratio of 0.60 and a debt-to-equity ratio of 0.26.

Markel Group (NYSE:MKL - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The insurance provider reported $17.34 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $21.97 by ($4.63). Markel Group had a return on equity of 10.86% and a net margin of 17.03%. The firm had revenue of $3.69 billion for the quarter, compared to analyst estimates of $3.74 billion. On average, analysts forecast that Markel Group Inc. will post 86.73 earnings per share for the current fiscal year.

About Markel Group

(

Free Report)

Markel Group Inc, a diverse holding company, engages in marketing and underwriting specialty insurance products in the United States, Bermuda, the United Kingdom, and Germany. The company offers general and professional liability, personal lines, marine and energy, specialty programs, and workers' compensation insurance products; and property coverages that include fire, allied lines, and other specialized property coverages, including catastrophe-exposed property risks, such as earthquake and wind.

See Also

Before you consider Markel Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Markel Group wasn't on the list.

While Markel Group currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.