Tidal Investments LLC cut its stake in shares of Interactive Brokers Group, Inc. (NASDAQ:IBKR - Free Report) by 51.4% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 13,820 shares of the financial services provider's stock after selling 14,631 shares during the period. Tidal Investments LLC's holdings in Interactive Brokers Group were worth $1,926,000 as of its most recent SEC filing.

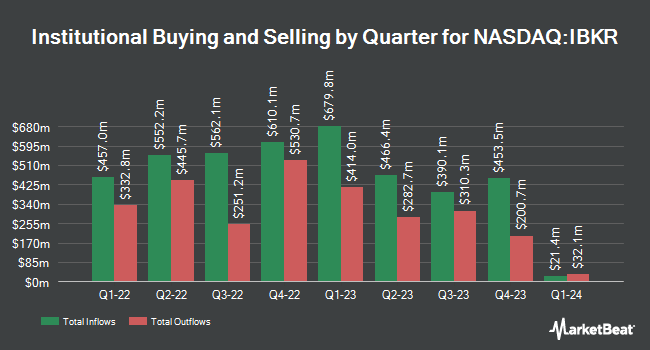

A number of other large investors also recently modified their holdings of the company. Millennium Management LLC raised its position in Interactive Brokers Group by 1,292.1% in the second quarter. Millennium Management LLC now owns 1,082,017 shares of the financial services provider's stock valued at $132,655,000 after purchasing an additional 1,004,289 shares during the last quarter. Sumitomo Mitsui Trust Group Inc. bought a new position in Interactive Brokers Group in the 3rd quarter valued at approximately $83,630,000. Marshall Wace LLP boosted its position in Interactive Brokers Group by 23.8% during the 2nd quarter. Marshall Wace LLP now owns 2,507,059 shares of the financial services provider's stock worth $307,365,000 after buying an additional 481,826 shares during the period. Waverton Investment Management Ltd bought a new stake in Interactive Brokers Group during the 3rd quarter worth approximately $26,946,000. Finally, Allspring Global Investments Holdings LLC grew its holdings in Interactive Brokers Group by 262.1% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 258,353 shares of the financial services provider's stock worth $36,004,000 after acquiring an additional 187,010 shares during the last quarter. 23.80% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

A number of equities analysts have recently commented on IBKR shares. The Goldman Sachs Group lifted their price target on shares of Interactive Brokers Group from $171.00 to $195.00 and gave the stock a "buy" rating in a report on Tuesday, December 3rd. Jefferies Financial Group lifted their target price on Interactive Brokers Group from $152.00 to $165.00 and gave the stock a "buy" rating in a report on Friday, October 4th. Barclays increased their price target on Interactive Brokers Group from $165.00 to $214.00 and gave the company an "overweight" rating in a research note on Monday, December 9th. Piper Sandler reaffirmed an "overweight" rating and issued a $163.00 price objective on shares of Interactive Brokers Group in a research note on Wednesday, October 16th. Finally, UBS Group upped their target price on Interactive Brokers Group from $155.00 to $170.00 and gave the company a "buy" rating in a report on Tuesday, October 8th. One analyst has rated the stock with a hold rating and seven have issued a buy rating to the stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $166.13.

Check Out Our Latest Report on IBKR

Interactive Brokers Group Stock Performance

Shares of Interactive Brokers Group stock traded down $1.30 on Tuesday, reaching $178.90. 1,129,271 shares of the company's stock were exchanged, compared to its average volume of 1,019,790. The company has a market capitalization of $75.59 billion, a P/E ratio of 27.51, a price-to-earnings-growth ratio of 1.42 and a beta of 0.85. Interactive Brokers Group, Inc. has a 52 week low of $80.00 and a 52 week high of $193.42. The firm's 50-day moving average is $169.42 and its two-hundred day moving average is $140.47.

Interactive Brokers Group (NASDAQ:IBKR - Get Free Report) last posted its quarterly earnings results on Tuesday, October 15th. The financial services provider reported $1.75 EPS for the quarter, missing analysts' consensus estimates of $1.78 by ($0.03). The company had revenue of $2.45 billion during the quarter, compared to analyst estimates of $1.32 billion. Interactive Brokers Group had a return on equity of 4.83% and a net margin of 7.89%. During the same quarter in the previous year, the business posted $1.55 earnings per share. On average, analysts expect that Interactive Brokers Group, Inc. will post 6.82 EPS for the current fiscal year.

Interactive Brokers Group Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Friday, December 13th. Shareholders of record on Friday, November 29th were issued a $0.25 dividend. The ex-dividend date of this dividend was Friday, November 29th. This represents a $1.00 annualized dividend and a yield of 0.56%. Interactive Brokers Group's payout ratio is currently 15.27%.

About Interactive Brokers Group

(

Free Report)

Interactive Brokers Group, Inc operates as an automated electronic broker worldwide. The company engages in the execution, clearance, and settlement of trades in stocks, options, futures, foreign exchange instruments, bonds, mutual funds, exchange traded funds (ETFs), precious metals, and cryptocurrencies.

See Also

Before you consider Interactive Brokers Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Interactive Brokers Group wasn't on the list.

While Interactive Brokers Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.