Tidal Investments LLC lifted its stake in Veeva Systems Inc. (NYSE:VEEV - Free Report) by 77.1% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 22,330 shares of the technology company's stock after acquiring an additional 9,724 shares during the period. Tidal Investments LLC's holdings in Veeva Systems were worth $4,686,000 at the end of the most recent quarter.

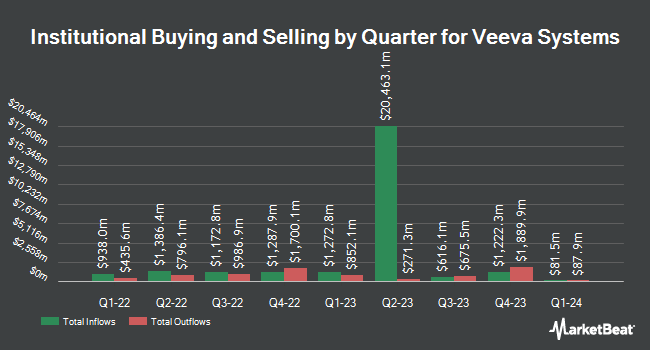

Other institutional investors also recently added to or reduced their stakes in the company. Mowery & Schoenfeld Wealth Management LLC acquired a new position in Veeva Systems during the 3rd quarter valued at approximately $26,000. True Wealth Design LLC increased its position in shares of Veeva Systems by 3,375.0% in the 3rd quarter. True Wealth Design LLC now owns 139 shares of the technology company's stock valued at $29,000 after acquiring an additional 135 shares during the period. Blue Trust Inc. raised its stake in Veeva Systems by 3,460.0% in the 2nd quarter. Blue Trust Inc. now owns 178 shares of the technology company's stock worth $33,000 after acquiring an additional 173 shares during the last quarter. DT Investment Partners LLC acquired a new stake in Veeva Systems during the 2nd quarter worth about $35,000. Finally, Fairscale Capital LLC purchased a new stake in Veeva Systems during the 2nd quarter valued at about $46,000. Institutional investors own 88.20% of the company's stock.

Analysts Set New Price Targets

Several research analysts recently issued reports on the stock. Stifel Nicolaus raised their target price on shares of Veeva Systems from $240.00 to $272.00 and gave the stock a "buy" rating in a report on Friday, December 6th. Royal Bank of Canada upped their target price on Veeva Systems from $275.00 to $285.00 and gave the stock an "outperform" rating in a research note on Friday, December 6th. Evercore ISI lifted their price target on Veeva Systems from $220.00 to $245.00 and gave the company an "in-line" rating in a research report on Friday, December 6th. Truist Financial restated a "hold" rating and issued a $261.00 price objective (up previously from $207.00) on shares of Veeva Systems in a research report on Friday, December 6th. Finally, BNP Paribas began coverage on shares of Veeva Systems in a report on Tuesday, October 8th. They set an "outperform" rating and a $286.00 target price for the company. One analyst has rated the stock with a sell rating, eight have issued a hold rating and eighteen have issued a buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $255.35.

Get Our Latest Analysis on Veeva Systems

Insider Buying and Selling

In other Veeva Systems news, insider Thomas D. Schwenger sold 1,126 shares of the company's stock in a transaction on Friday, November 8th. The stock was sold at an average price of $240.01, for a total transaction of $270,251.26. Following the transaction, the insider now directly owns 27,013 shares in the company, valued at $6,483,390.13. This represents a 4.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, SVP Jonathan Faddis sold 1,694 shares of Veeva Systems stock in a transaction on Wednesday, December 4th. The shares were sold at an average price of $230.30, for a total value of $390,128.20. Following the completion of the sale, the senior vice president now directly owns 8,061 shares of the company's stock, valued at $1,856,448.30. The trade was a 17.37 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 10.50% of the company's stock.

Veeva Systems Price Performance

VEEV traded down $3.70 during trading hours on Friday, reaching $228.78. The company's stock had a trading volume of 814,087 shares, compared to its average volume of 983,160. The stock has a market cap of $37.05 billion, a PE ratio of 56.49, a P/E/G ratio of 2.07 and a beta of 0.82. Veeva Systems Inc. has a fifty-two week low of $170.25 and a fifty-two week high of $258.93. The business's 50-day moving average is $221.36 and its 200-day moving average is $204.00.

About Veeva Systems

(

Free Report)

Veeva Systems Inc provides cloud-based software for the life sciences industry. It offers Veeva Commercial Cloud, a suite of software and analytics solutions, such as Veeva customer relationship management (CRM) that enable customer-facing employees at pharmaceutical and biotechnology companies; Veeva Vault PromoMats, an end-to-end content and digital asset management solution; Veeva Vault Medical that provides source of medical content across multiple channels and geographies; Veeva Crossix, an analytics platform for pharmaceutical brands; Veeva OpenData, a customer reference data solution; Veeva Link, a data application that allows link to generate real-time intelligence; and Veeva Compass includes de-identified and longitudinal patient data for the United States.

Read More

Before you consider Veeva Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veeva Systems wasn't on the list.

While Veeva Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.