Tidal Investments LLC raised its position in Comcast Co. (NASDAQ:CMCSA - Free Report) by 15.2% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 171,440 shares of the cable giant's stock after purchasing an additional 22,684 shares during the quarter. Tidal Investments LLC's holdings in Comcast were worth $7,161,000 as of its most recent filing with the Securities and Exchange Commission.

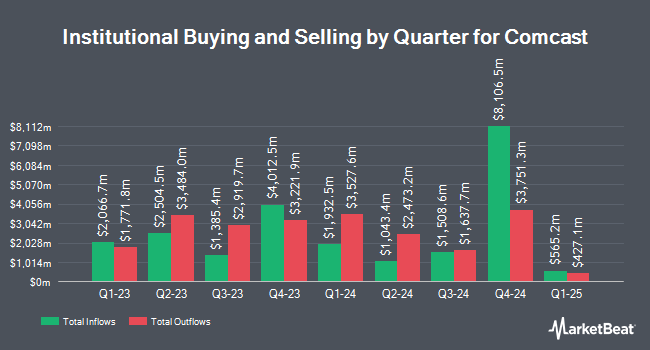

A number of other hedge funds also recently made changes to their positions in CMCSA. FMR LLC grew its position in Comcast by 5.4% in the 3rd quarter. FMR LLC now owns 117,420,328 shares of the cable giant's stock valued at $4,904,647,000 after buying an additional 6,062,658 shares in the last quarter. Dimensional Fund Advisors LP lifted its stake in shares of Comcast by 2.7% in the 2nd quarter. Dimensional Fund Advisors LP now owns 38,329,384 shares of the cable giant's stock worth $1,500,722,000 after acquiring an additional 1,000,626 shares during the period. Charles Schwab Investment Management Inc. boosted its holdings in shares of Comcast by 1.3% in the third quarter. Charles Schwab Investment Management Inc. now owns 31,871,235 shares of the cable giant's stock valued at $1,331,192,000 after acquiring an additional 416,759 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its stake in shares of Comcast by 6.0% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 30,364,136 shares of the cable giant's stock valued at $1,268,310,000 after acquiring an additional 1,717,762 shares during the period. Finally, Ontario Teachers Pension Plan Board raised its holdings in Comcast by 5.4% during the third quarter. Ontario Teachers Pension Plan Board now owns 15,983,230 shares of the cable giant's stock worth $667,620,000 after purchasing an additional 822,936 shares in the last quarter. Institutional investors own 84.32% of the company's stock.

Insider Activity

In related news, CEO Brian L. Roberts sold 234,464 shares of the company's stock in a transaction on Tuesday, November 26th. The shares were sold at an average price of $42.66, for a total transaction of $10,002,234.24. Following the completion of the transaction, the chief executive officer now directly owns 6,669,928 shares in the company, valued at $284,539,128.48. This represents a 3.40 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, President Michael J. Cavanagh sold 25,537 shares of the business's stock in a transaction dated Tuesday, November 26th. The stock was sold at an average price of $42.59, for a total transaction of $1,087,620.83. Following the transaction, the president now owns 534,849 shares in the company, valued at approximately $22,779,218.91. The trade was a 4.56 % decrease in their position. The disclosure for this sale can be found here. 1.26% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

CMCSA has been the topic of a number of research analyst reports. Wells Fargo & Company lifted their target price on Comcast from $43.00 to $46.00 and gave the stock an "equal weight" rating in a report on Friday, November 1st. KeyCorp raised their price objective on shares of Comcast from $44.00 to $47.00 and gave the company an "overweight" rating in a research report on Friday, November 1st. Rosenblatt Securities reiterated a "neutral" rating and issued a $45.00 target price on shares of Comcast in a report on Wednesday, November 6th. Evercore ISI upgraded shares of Comcast to a "strong-buy" rating in a report on Thursday, November 21st. Finally, StockNews.com lowered shares of Comcast from a "strong-buy" rating to a "buy" rating in a research report on Wednesday, December 4th. One equities research analyst has rated the stock with a sell rating, five have given a hold rating, ten have given a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat.com, Comcast has an average rating of "Moderate Buy" and a consensus target price of $47.19.

Read Our Latest Stock Report on Comcast

Comcast Stock Down 0.8 %

NASDAQ CMCSA traded down $0.32 during trading on Friday, reaching $39.92. The company's stock had a trading volume of 18,032,626 shares, compared to its average volume of 19,639,029. The business has a 50-day moving average price of $42.31 and a 200-day moving average price of $40.32. Comcast Co. has a 1-year low of $36.43 and a 1-year high of $47.11. The stock has a market capitalization of $152.76 billion, a PE ratio of 10.73, a PEG ratio of 1.50 and a beta of 0.99. The company has a current ratio of 0.72, a quick ratio of 0.72 and a debt-to-equity ratio of 1.14.

Comcast (NASDAQ:CMCSA - Get Free Report) last announced its quarterly earnings results on Thursday, October 31st. The cable giant reported $1.12 earnings per share for the quarter, topping analysts' consensus estimates of $1.06 by $0.06. The company had revenue of $32.07 billion during the quarter, compared to analysts' expectations of $31.78 billion. Comcast had a return on equity of 19.81% and a net margin of 11.92%. The business's quarterly revenue was up 6.5% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $1.08 earnings per share. On average, research analysts forecast that Comcast Co. will post 4.26 earnings per share for the current fiscal year.

Comcast Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 29th. Shareholders of record on Wednesday, January 8th will be issued a dividend of $0.31 per share. This represents a $1.24 dividend on an annualized basis and a yield of 3.11%. The ex-dividend date is Wednesday, January 8th. Comcast's dividend payout ratio (DPR) is 33.33%.

About Comcast

(

Free Report)

Comcast Corporation operates as a media and technology company worldwide. It operates through Residential Connectivity & Platforms, Business Services Connectivity, Media, Studios, and Theme Parks segments. The Residential Connectivity & Platforms segment provides residential broadband and wireless connectivity services, residential and business video services, sky-branded entertainment television networks, and advertising.

Featured Stories

Before you consider Comcast, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comcast wasn't on the list.

While Comcast currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report