Tidal Investments LLC raised its position in Trane Technologies plc (NYSE:TT - Free Report) by 22.2% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 15,827 shares of the company's stock after purchasing an additional 2,874 shares during the quarter. Tidal Investments LLC's holdings in Trane Technologies were worth $6,152,000 at the end of the most recent reporting period.

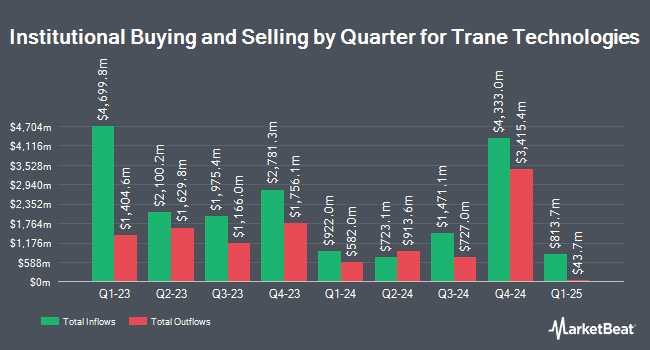

A number of other institutional investors also recently modified their holdings of the company. FMR LLC boosted its holdings in Trane Technologies by 4.0% during the third quarter. FMR LLC now owns 10,337,672 shares of the company's stock worth $4,018,563,000 after purchasing an additional 397,537 shares during the last quarter. State Street Corp boosted its stake in shares of Trane Technologies by 0.8% during the 3rd quarter. State Street Corp now owns 9,769,161 shares of the company's stock worth $3,797,565,000 after buying an additional 77,830 shares during the last quarter. Geode Capital Management LLC grew its holdings in shares of Trane Technologies by 1.4% in the 3rd quarter. Geode Capital Management LLC now owns 4,638,914 shares of the company's stock valued at $1,797,700,000 after acquiring an additional 65,991 shares in the last quarter. Massachusetts Financial Services Co. MA increased its position in shares of Trane Technologies by 35.8% in the third quarter. Massachusetts Financial Services Co. MA now owns 2,550,511 shares of the company's stock valued at $991,460,000 after acquiring an additional 671,691 shares during the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its holdings in Trane Technologies by 0.9% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 2,142,081 shares of the company's stock worth $832,691,000 after acquiring an additional 20,151 shares in the last quarter. 82.97% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In other news, SVP Mairead Magner sold 4,329 shares of the company's stock in a transaction on Wednesday, December 4th. The stock was sold at an average price of $416.00, for a total transaction of $1,800,864.00. Following the completion of the sale, the senior vice president now directly owns 12,893 shares in the company, valued at approximately $5,363,488. This represents a 25.14 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. 0.38% of the stock is owned by insiders.

Trane Technologies Stock Performance

TT stock traded down $0.30 during mid-day trading on Friday, hitting $399.36. 852,589 shares of the company were exchanged, compared to its average volume of 1,116,656. Trane Technologies plc has a 1-year low of $233.76 and a 1-year high of $422.00. The business has a 50 day simple moving average of $402.05 and a 200-day simple moving average of $364.28. The company has a current ratio of 1.22, a quick ratio of 0.92 and a debt-to-equity ratio of 0.57. The stock has a market capitalization of $89.87 billion, a PE ratio of 37.06, a price-to-earnings-growth ratio of 2.43 and a beta of 1.03.

Trane Technologies (NYSE:TT - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The company reported $3.37 earnings per share for the quarter, topping the consensus estimate of $3.23 by $0.14. Trane Technologies had a return on equity of 34.62% and a net margin of 12.73%. The business had revenue of $5.44 billion during the quarter, compared to analysts' expectations of $5.32 billion. During the same period last year, the firm posted $2.79 EPS. The firm's revenue for the quarter was up 10.0% compared to the same quarter last year. On average, equities analysts forecast that Trane Technologies plc will post 11.13 earnings per share for the current year.

Trane Technologies Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Friday, December 6th will be paid a $0.84 dividend. The ex-dividend date is Friday, December 6th. This represents a $3.36 annualized dividend and a dividend yield of 0.84%. Trane Technologies's dividend payout ratio (DPR) is presently 31.17%.

Analyst Ratings Changes

TT has been the subject of a number of analyst reports. The Goldman Sachs Group raised their price target on Trane Technologies from $364.00 to $407.00 and gave the company a "neutral" rating in a research note on Wednesday, October 9th. Barclays boosted their target price on shares of Trane Technologies from $440.00 to $500.00 and gave the stock an "overweight" rating in a report on Thursday, December 5th. Morgan Stanley started coverage on shares of Trane Technologies in a research note on Friday, September 6th. They issued an "overweight" rating and a $425.00 price target for the company. Mizuho lifted their price objective on shares of Trane Technologies from $325.00 to $400.00 and gave the company a "neutral" rating in a research report on Thursday, October 17th. Finally, Wells Fargo & Company upped their target price on shares of Trane Technologies from $320.00 to $360.00 and gave the company an "underweight" rating in a report on Monday, October 7th. One analyst has rated the stock with a sell rating, eight have given a hold rating and six have issued a buy rating to the company's stock. Based on data from MarketBeat.com, Trane Technologies has an average rating of "Hold" and an average target price of $409.93.

View Our Latest Stock Analysis on Trane Technologies

Trane Technologies Profile

(

Free Report)

Trane Technologies plc, together with its subsidiaries, designs, manufactures, sells, and services of solutions for heating, ventilation, air conditioning, custom, and custom and transport refrigeration in Ireland and internationally. It offers air conditioners, exchangers, and handlers; airside and terminal devices; air sourced heat pumps, auxiliary power units; chillers; coils and condensers; gensets; dehumidifiers; ductless; furnaces; home automation products; humidifiers; indoor air quality assessments and related products; large and light commercial unitary products; refrigerant reclamation products; thermostats/controls; transport heater products; variable refrigerant flow products; and water source heat pumps.

Featured Articles

Before you consider Trane Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trane Technologies wasn't on the list.

While Trane Technologies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.