Tidal Investments LLC bought a new position in shares of SL Green Realty Corp. (NYSE:SLG - Free Report) during the 3rd quarter, according to its most recent disclosure with the SEC. The fund bought 11,359 shares of the real estate investment trust's stock, valued at approximately $791,000.

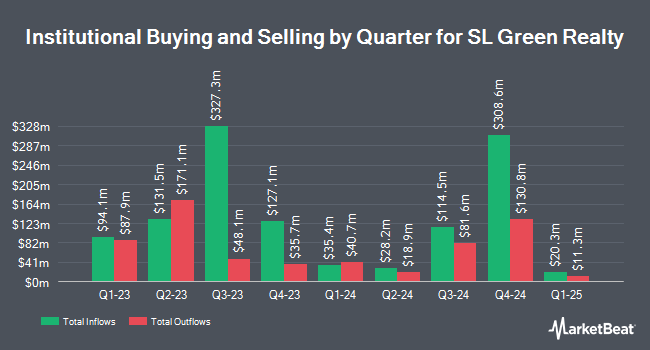

A number of other institutional investors have also recently made changes to their positions in SLG. Edgestream Partners L.P. grew its holdings in SL Green Realty by 40.1% during the 2nd quarter. Edgestream Partners L.P. now owns 122,880 shares of the real estate investment trust's stock worth $6,960,000 after acquiring an additional 35,178 shares during the period. Waterfall Asset Management LLC bought a new stake in SL Green Realty in the second quarter worth approximately $3,172,000. FMR LLC lifted its stake in SL Green Realty by 69.1% in the third quarter. FMR LLC now owns 58,185 shares of the real estate investment trust's stock valued at $4,050,000 after buying an additional 23,780 shares during the period. Weiss Asset Management LP acquired a new position in SL Green Realty in the third quarter valued at approximately $771,000. Finally, Daiwa Securities Group Inc. grew its holdings in shares of SL Green Realty by 13.2% during the second quarter. Daiwa Securities Group Inc. now owns 127,899 shares of the real estate investment trust's stock valued at $7,244,000 after buying an additional 14,871 shares during the last quarter. Institutional investors own 89.96% of the company's stock.

SL Green Realty Stock Up 1.8 %

Shares of NYSE SLG opened at $68.01 on Friday. The business has a 50-day simple moving average of $75.95 and a two-hundred day simple moving average of $67.31. The company has a quick ratio of 2.58, a current ratio of 2.58 and a debt-to-equity ratio of 1.06. SL Green Realty Corp. has a 52 week low of $41.81 and a 52 week high of $82.81. The company has a market cap of $4.48 billion, a P/E ratio of -27.20, a P/E/G ratio of 4.26 and a beta of 1.81.

SL Green Realty (NYSE:SLG - Get Free Report) last posted its quarterly earnings data on Wednesday, October 16th. The real estate investment trust reported ($0.21) earnings per share for the quarter, missing the consensus estimate of $1.21 by ($1.42). SL Green Realty had a negative return on equity of 3.76% and a negative net margin of 16.78%. The company had revenue of $229.69 million during the quarter, compared to the consensus estimate of $136.66 million. During the same quarter last year, the company posted $1.27 earnings per share. Research analysts anticipate that SL Green Realty Corp. will post 7.82 earnings per share for the current fiscal year.

SL Green Realty Increases Dividend

The company also recently disclosed a monthly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 31st will be issued a dividend of $0.2575 per share. This represents a $3.09 dividend on an annualized basis and a dividend yield of 4.54%. This is a boost from SL Green Realty's previous monthly dividend of $0.25. The ex-dividend date is Tuesday, December 31st. SL Green Realty's dividend payout ratio (DPR) is currently -123.60%.

Wall Street Analyst Weigh In

A number of research firms have issued reports on SLG. Morgan Stanley lifted their price target on SL Green Realty from $47.00 to $50.00 and gave the company an "equal weight" rating in a research note on Wednesday, October 9th. Citigroup raised SL Green Realty from a "sell" rating to a "neutral" rating and lifted their target price for the company from $44.00 to $66.00 in a research report on Friday, September 13th. Compass Point raised their price objective on SL Green Realty from $65.00 to $75.00 and gave the company a "neutral" rating in a research note on Wednesday, December 11th. Jefferies Financial Group boosted their price target on shares of SL Green Realty from $70.00 to $72.00 and gave the stock a "hold" rating in a report on Friday, November 22nd. Finally, Barclays upped their price objective on SL Green Realty from $66.00 to $78.00 and gave the company an "equal weight" rating in a research note on Tuesday, October 22nd. Two analysts have rated the stock with a sell rating, twelve have assigned a hold rating and two have given a buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Hold" and a consensus price target of $68.67.

Get Our Latest Analysis on SL Green Realty

About SL Green Realty

(

Free Report)

3SL Green Realty Corp., Manhattan's largest office landlord, is a fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing value of Manhattan commercial properties. As of June 30, 2022, SL Green held interests in 64 buildings totaling 34.4 million square feet.

Featured Articles

Before you consider SL Green Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SL Green Realty wasn't on the list.

While SL Green Realty currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.