Anthracite Investment Company Inc. cut its stake in shares of Tidewater Inc. (NYSE:TDW - Free Report) by 42.9% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The fund owned 20,000 shares of the oil and gas company's stock after selling 15,000 shares during the period. Anthracite Investment Company Inc.'s holdings in Tidewater were worth $1,436,000 as of its most recent filing with the SEC.

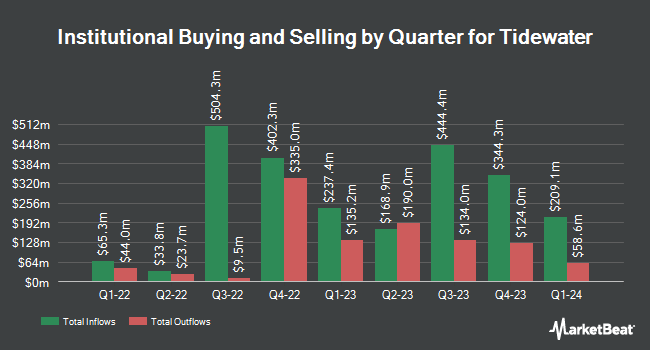

A number of other institutional investors and hedge funds also recently modified their holdings of TDW. Advisors Asset Management Inc. lifted its holdings in shares of Tidewater by 58.8% in the third quarter. Advisors Asset Management Inc. now owns 3,510 shares of the oil and gas company's stock worth $252,000 after acquiring an additional 1,299 shares during the last quarter. Empowered Funds LLC raised its stake in shares of Tidewater by 15.1% in the third quarter. Empowered Funds LLC now owns 56,252 shares of the oil and gas company's stock worth $4,038,000 after purchasing an additional 7,367 shares during the last quarter. GSA Capital Partners LLP purchased a new position in Tidewater during the third quarter worth about $243,000. Crossmark Global Holdings Inc. grew its stake in Tidewater by 31.1% in the 3rd quarter. Crossmark Global Holdings Inc. now owns 4,064 shares of the oil and gas company's stock valued at $292,000 after purchasing an additional 963 shares during the period. Finally, Villere ST Denis J & Co. LLC bought a new stake in shares of Tidewater in the third quarter valued at approximately $25,871,000. 95.13% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several research analysts recently issued reports on TDW shares. Raymond James lowered shares of Tidewater from a "strong-buy" rating to an "outperform" rating and cut their target price for the stock from $131.00 to $102.00 in a research report on Monday, November 11th. StockNews.com raised Tidewater from a "sell" rating to a "hold" rating in a research report on Thursday, November 7th. One analyst has rated the stock with a hold rating and five have given a buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $102.25.

Read Our Latest Analysis on Tidewater

Tidewater Trading Down 0.5 %

NYSE:TDW traded down $0.24 during trading hours on Wednesday, hitting $50.44. The company had a trading volume of 1,040,839 shares, compared to its average volume of 909,248. The company has a 50-day moving average of $64.84 and a 200 day moving average of $84.51. The company has a market cap of $2.64 billion, a P/E ratio of 14.84 and a beta of 1.14. The company has a current ratio of 2.29, a quick ratio of 2.19 and a debt-to-equity ratio of 0.54. Tidewater Inc. has a 1 year low of $49.86 and a 1 year high of $111.42.

Tidewater announced that its Board of Directors has authorized a stock buyback plan on Tuesday, August 6th that permits the company to repurchase $13.90 million in outstanding shares. This repurchase authorization permits the oil and gas company to buy up to 0.3% of its shares through open market purchases. Shares repurchase plans are typically an indication that the company's leadership believes its shares are undervalued.

Tidewater Profile

(

Free Report)

Tidewater Inc, together with its subsidiaries, provides offshore support vessels and marine support services to the offshore energy industry through the operation of a fleet of marine service vessels worldwide. It provides services in support of offshore oil and gas exploration, field development, and production, as well as windfarm development and maintenance, including towing of and anchor handling for mobile offshore drilling units; transporting supplies and personnel necessary to sustain drilling, workover, and production activities; offshore construction, and seismic and subsea support; geotechnical survey support for windfarm construction; and various specialized services, such as pipe and cable laying.

Featured Stories

Before you consider Tidewater, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tidewater wasn't on the list.

While Tidewater currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.