Tidewater Midstream and Infrastructure (TSE:TWM - Get Free Report) had its target price dropped by CIBC from C$0.40 to C$0.30 in a note issued to investors on Friday,BayStreet.CA reports. CIBC's price objective would indicate a potential upside of 130.77% from the stock's current price.

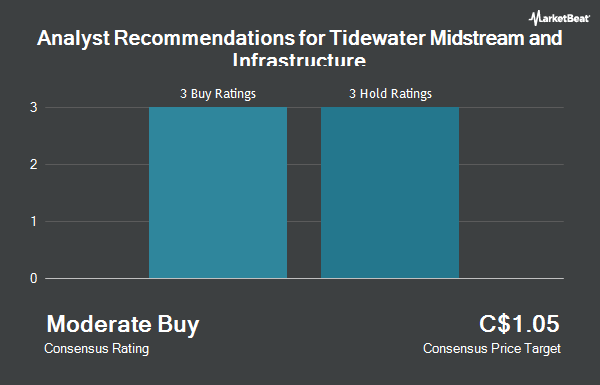

TWM has been the subject of a number of other reports. Acumen Capital lowered their target price on Tidewater Midstream and Infrastructure from C$1.10 to C$0.55 in a research note on Monday, August 19th. Scotiabank downgraded shares of Tidewater Midstream and Infrastructure from an "outperform" rating to a "sector perform" rating and lowered their price objective for the stock from C$0.85 to C$0.45 in a research report on Friday, August 16th. National Bank Financial cut shares of Tidewater Midstream and Infrastructure from a "hold" rating to a "strong sell" rating in a research report on Sunday, August 18th. Finally, ATB Capital reduced their target price on shares of Tidewater Midstream and Infrastructure from C$1.10 to C$0.80 in a research note on Friday, August 16th. One investment analyst has rated the stock with a sell rating and five have assigned a hold rating to the company's stock. According to MarketBeat.com, the company has an average rating of "Hold" and an average price target of C$0.64.

Read Our Latest Stock Report on Tidewater Midstream and Infrastructure

Tidewater Midstream and Infrastructure Trading Up 4.0 %

Shares of TWM traded up C$0.01 during trading hours on Friday, reaching C$0.13. The stock had a trading volume of 5,238,642 shares, compared to its average volume of 889,056. The firm has a 50-day moving average of C$0.28 and a 200 day moving average of C$0.46. The company has a quick ratio of 0.55, a current ratio of 0.63 and a debt-to-equity ratio of 158.54. The company has a market cap of C$55.91 million, a P/E ratio of -0.15, a P/E/G ratio of 0.64 and a beta of 1.67. Tidewater Midstream and Infrastructure has a 52 week low of C$0.12 and a 52 week high of C$1.08.

Tidewater Midstream and Infrastructure (TSE:TWM - Get Free Report) last announced its quarterly earnings results on Thursday, August 15th. The company reported C($0.01) earnings per share (EPS) for the quarter. Tidewater Midstream and Infrastructure had a negative return on equity of 71.39% and a negative net margin of 18.67%. The business had revenue of C$461.30 million during the quarter. On average, sell-side analysts expect that Tidewater Midstream and Infrastructure will post 0.0199855 earnings per share for the current fiscal year.

About Tidewater Midstream and Infrastructure

(

Get Free Report)

Tidewater Midstream and Infrastructure Ltd. operates as a diversified midstream and infrastructure company in the United States. The company primarily focuses on natural gas, natural gas liquids (NGLs), crude oil, refined products, and renewable products and services. It also engages in the sale of refined petroleum products, including gasoline, low sulphur diesel, and ancillary products, as well as renewable fuels and natural gas; and gathering, processing, transporting, extraction, and marketing of crude oil, natural gas, and NGLs.

Featured Stories

Before you consider Tidewater Midstream and Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tidewater Midstream and Infrastructure wasn't on the list.

While Tidewater Midstream and Infrastructure currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.