Tidewater Renewables (TSE:LCFS - Get Free Report) had its price objective hoisted by analysts at Acumen Capital from C$2.25 to C$3.50 in a research note issued to investors on Friday,BayStreet.CA reports. The firm presently has a "hold" rating on the stock. Acumen Capital's target price indicates a potential upside of 15.51% from the company's previous close.

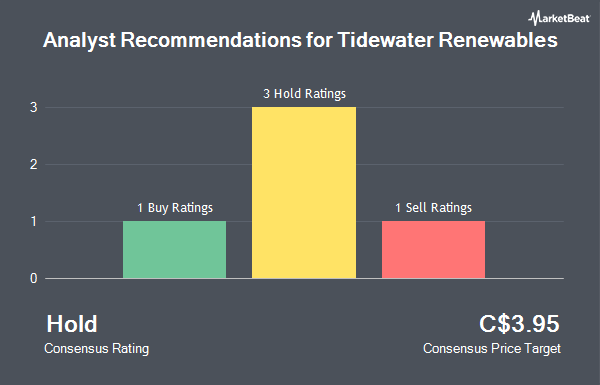

Several other research analysts have also recently weighed in on the stock. Royal Bank of Canada increased their price target on shares of Tidewater Renewables from C$5.00 to C$5.50 and gave the company a "sector perform" rating in a report on Monday, January 13th. ATB Capital increased their target price on Tidewater Renewables from C$3.00 to C$4.00 and gave the stock a "speculative buy" rating in a research note on Friday. One research analyst has rated the stock with a sell rating, four have issued a hold rating and one has given a buy rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of C$4.79.

Check Out Our Latest Research Report on Tidewater Renewables

Tidewater Renewables Stock Performance

LCFS traded down C$0.22 during trading hours on Friday, reaching C$3.03. The company's stock had a trading volume of 23,542 shares, compared to its average volume of 57,504. The company's 50-day moving average is C$1.48 and its 200-day moving average is C$1.42. Tidewater Renewables has a 52 week low of C$0.58 and a 52 week high of C$9.00. The firm has a market cap of C$105.50 million, a PE ratio of -0.28 and a beta of 1.36. The company has a debt-to-equity ratio of 114.04, a quick ratio of 0.10 and a current ratio of 1.15.

About Tidewater Renewables

(

Get Free Report)

Tidewater Renewables Ltd has been formed to become a multi-faceted, energy transition company. It is focused on the production of low carbon fuels, including renewable diesel, renewable hydrogen and renewable natural gas, as well as carbon capture. The corporation generates revenue from the sale of renewable products.

Featured Stories

Before you consider Tidewater Renewables, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tidewater Renewables wasn't on the list.

While Tidewater Renewables currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.