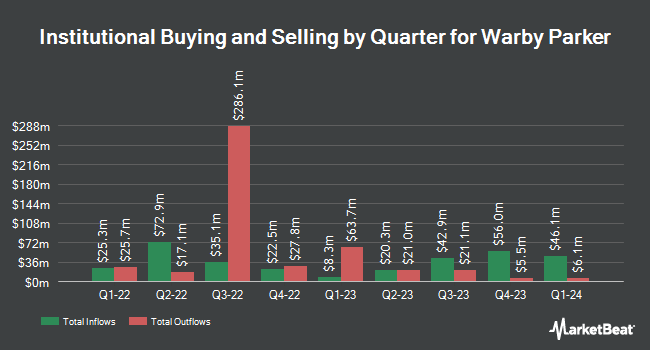

TimesSquare Capital Management LLC boosted its position in shares of Warby Parker Inc. (NYSE:WRBY - Free Report) by 12.8% during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 1,856,370 shares of the company's stock after buying an additional 211,050 shares during the period. TimesSquare Capital Management LLC owned approximately 1.84% of Warby Parker worth $30,315,000 at the end of the most recent quarter.

Other hedge funds have also recently bought and sold shares of the company. SG Americas Securities LLC boosted its position in shares of Warby Parker by 610.3% during the 2nd quarter. SG Americas Securities LLC now owns 91,598 shares of the company's stock worth $1,471,000 after acquiring an additional 78,702 shares in the last quarter. Janney Montgomery Scott LLC grew its position in Warby Parker by 302.0% in the first quarter. Janney Montgomery Scott LLC now owns 48,245 shares of the company's stock valued at $657,000 after acquiring an additional 36,245 shares during the last quarter. Vaughan Nelson Investment Management L.P. lifted its holdings in shares of Warby Parker by 113.3% in the second quarter. Vaughan Nelson Investment Management L.P. now owns 2,477,410 shares of the company's stock worth $39,787,000 after acquiring an additional 1,315,672 shares during the last quarter. Maverick Capital Ltd. acquired a new stake in shares of Warby Parker in the 2nd quarter valued at approximately $1,465,000. Finally, Russell Investments Group Ltd. grew its holdings in shares of Warby Parker by 37.1% during the 1st quarter. Russell Investments Group Ltd. now owns 225,338 shares of the company's stock valued at $3,067,000 after purchasing an additional 61,004 shares during the last quarter. 93.24% of the stock is owned by institutional investors.

Warby Parker Stock Performance

Shares of NYSE:WRBY traded up $0.20 during midday trading on Friday, reaching $19.51. The company's stock had a trading volume of 2,526,267 shares, compared to its average volume of 1,590,941. The firm has a market capitalization of $1.96 billion, a price-to-earnings ratio of -72.26 and a beta of 1.80. Warby Parker Inc. has a fifty-two week low of $9.83 and a fifty-two week high of $19.93. The firm has a 50 day moving average price of $15.92 and a two-hundred day moving average price of $15.57.

Warby Parker (NYSE:WRBY - Get Free Report) last released its quarterly earnings results on Thursday, August 8th. The company reported ($0.03) earnings per share for the quarter, beating analysts' consensus estimates of ($0.04) by $0.01. The company had revenue of $188.22 million for the quarter, compared to analyst estimates of $186.89 million. Warby Parker had a negative net margin of 4.39% and a negative return on equity of 8.40%. As a group, research analysts anticipate that Warby Parker Inc. will post -0.04 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of analysts have weighed in on WRBY shares. The Goldman Sachs Group upgraded shares of Warby Parker from a "neutral" rating to a "buy" rating and raised their target price for the company from $15.00 to $18.00 in a research report on Monday, October 21st. Robert W. Baird raised their price objective on Warby Parker from $18.00 to $23.00 and gave the company an "outperform" rating in a report on Friday. Piper Sandler upped their target price on Warby Parker from $18.00 to $22.00 and gave the stock an "overweight" rating in a report on Friday. BTIG Research lifted their price target on Warby Parker from $18.00 to $20.00 and gave the company a "buy" rating in a research note on Friday, November 1st. Finally, Telsey Advisory Group reiterated an "outperform" rating and issued a $19.00 price objective on shares of Warby Parker in a report on Thursday. Four investment analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to MarketBeat, Warby Parker presently has a consensus rating of "Moderate Buy" and an average target price of $18.18.

Get Our Latest Research Report on WRBY

Insiders Place Their Bets

In other news, CFO Steven Clive Miller sold 6,763 shares of the business's stock in a transaction on Wednesday, September 11th. The shares were sold at an average price of $13.90, for a total transaction of $94,005.70. Following the sale, the chief financial officer now owns 177,488 shares in the company, valued at approximately $2,467,083.20. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. In other news, CEO Neil Harris Blumenthal sold 50,000 shares of the business's stock in a transaction dated Monday, September 9th. The stock was sold at an average price of $13.89, for a total value of $694,500.00. Following the transaction, the chief executive officer now directly owns 12,177 shares in the company, valued at $169,138.53. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CFO Steven Clive Miller sold 6,763 shares of the stock in a transaction dated Wednesday, September 11th. The shares were sold at an average price of $13.90, for a total transaction of $94,005.70. Following the transaction, the chief financial officer now directly owns 177,488 shares of the company's stock, valued at $2,467,083.20. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 99,178 shares of company stock valued at $1,339,901 over the last ninety days. 26.55% of the stock is currently owned by insiders.

Warby Parker Company Profile

(

Free Report)

Warby Parker Inc provides eyewear products in the United States and Canada. The company offers eyeglasses, sunglasses, light-responsive lenses, blue-light-filtering lenses, non-prescription lenses, and contact lenses. It also provides accessories, such as cases, lenses kit with anti-fog spray, pouches, and anti-fog lens spray through its retail stores, website, and mobile apps.

Recommended Stories

Before you consider Warby Parker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Warby Parker wasn't on the list.

While Warby Parker currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.