TimesSquare Capital Management LLC lifted its holdings in MYR Group Inc. (NASDAQ:MYRG - Free Report) by 178.5% in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 213,188 shares of the utilities provider's stock after buying an additional 136,643 shares during the period. TimesSquare Capital Management LLC owned about 1.32% of MYR Group worth $21,794,000 as of its most recent SEC filing.

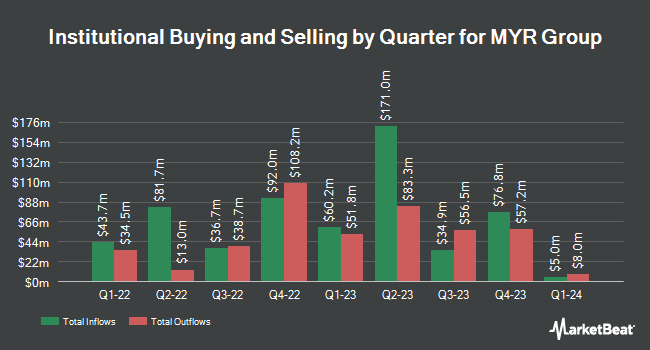

A number of other institutional investors have also recently bought and sold shares of the company. Townsend & Associates Inc boosted its position in MYR Group by 5.8% during the third quarter. Townsend & Associates Inc now owns 103,976 shares of the utilities provider's stock valued at $10,629,000 after purchasing an additional 5,694 shares during the last quarter. Principal Financial Group Inc. boosted its position in MYR Group by 3.7% during the third quarter. Principal Financial Group Inc. now owns 431,502 shares of the utilities provider's stock valued at $44,113,000 after purchasing an additional 15,361 shares during the last quarter. US Bancorp DE boosted its position in MYR Group by 2,187.8% during the third quarter. US Bancorp DE now owns 5,422 shares of the utilities provider's stock valued at $554,000 after purchasing an additional 5,185 shares during the last quarter. DekaBank Deutsche Girozentrale bought a new position in MYR Group during the third quarter valued at about $116,000. Finally, Assenagon Asset Management S.A. raised its holdings in MYR Group by 387.9% during the third quarter. Assenagon Asset Management S.A. now owns 185,644 shares of the utilities provider's stock valued at $18,978,000 after buying an additional 147,598 shares in the last quarter. Institutional investors and hedge funds own 88.90% of the company's stock.

MYR Group Stock Performance

MYRG traded up $2.12 on Monday, hitting $150.78. 188,068 shares of the stock traded hands, compared to its average volume of 180,655. MYR Group Inc. has a 52 week low of $86.60 and a 52 week high of $181.02. The company has a current ratio of 1.35, a quick ratio of 1.35 and a debt-to-equity ratio of 0.15. The firm has a market capitalization of $2.43 billion, a PE ratio of 65.84 and a beta of 0.89. The business has a fifty day moving average price of $111.93 and a two-hundred day moving average price of $127.50.

MYR Group (NASDAQ:MYRG - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The utilities provider reported $0.65 earnings per share for the quarter, beating analysts' consensus estimates of $0.25 by $0.40. The company had revenue of $888.00 million for the quarter, compared to the consensus estimate of $917.18 million. MYR Group had a return on equity of 6.05% and a net margin of 1.08%. The company's quarterly revenue was down 5.5% on a year-over-year basis. During the same period in the previous year, the business earned $1.28 earnings per share. On average, research analysts predict that MYR Group Inc. will post 1.16 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

Several equities analysts have weighed in on the company. The Goldman Sachs Group raised their target price on MYR Group from $124.00 to $153.00 and gave the company a "buy" rating in a report on Monday, November 4th. StockNews.com upgraded MYR Group from a "sell" rating to a "hold" rating in a report on Monday, November 4th. Stifel Nicolaus cut their target price on MYR Group from $172.00 to $119.00 and set a "buy" rating on the stock in a report on Monday, August 5th. Finally, Robert W. Baird lifted their price objective on MYR Group from $131.00 to $138.00 and gave the stock an "outperform" rating in a research note on Thursday, October 31st. Three investment analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $143.75.

Check Out Our Latest Report on MYR Group

MYR Group Company Profile

(

Free Report)

MYR Group Inc, through its subsidiaries, provides electrical construction services in the United States and Canada. It operates in two segments, Transmission and Distribution, and Commercial and Industrial. The Transmission and Distribution segment offers a range of services on electric transmission and distribution networks, and substation facilities, including design, engineering, procurement, construction, upgrade, maintenance, and repair services with primary focus on construction, maintenance, and repair to customers in the electric utility industry; and services, including construction and maintenance of high voltage transmission lines, substations, and lower voltage underground and overhead distribution systems, clean energy projects, and electric vehicle charging infrastructure services, as well as emergency restoration services in response to hurricane, wildfire, ice, or other related damages.

Recommended Stories

Before you consider MYR Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MYR Group wasn't on the list.

While MYR Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.