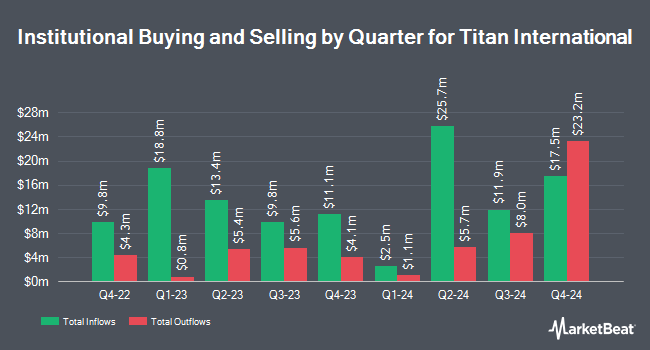

JPMorgan Chase & Co. decreased its holdings in shares of Titan International, Inc. (NYSE:TWI - Free Report) by 17.1% during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 592,087 shares of the industrial products company's stock after selling 122,007 shares during the period. JPMorgan Chase & Co. owned 0.94% of Titan International worth $4,020,000 at the end of the most recent reporting period.

Other large investors have also added to or reduced their stakes in the company. FMR LLC increased its position in Titan International by 43.7% in the 3rd quarter. FMR LLC now owns 5,343 shares of the industrial products company's stock valued at $43,000 after buying an additional 1,625 shares in the last quarter. GAMMA Investing LLC increased its holdings in shares of Titan International by 136.2% during the fourth quarter. GAMMA Investing LLC now owns 5,431 shares of the industrial products company's stock valued at $37,000 after acquiring an additional 3,132 shares in the last quarter. KLP Kapitalforvaltning AS acquired a new position in shares of Titan International during the fourth quarter worth approximately $54,000. Mraz Amerine & Associates Inc. bought a new position in shares of Titan International in the 4th quarter worth $74,000. Finally, Miller Financial Services LLC acquired a new stake in Titan International in the 4th quarter valued at $85,000. Institutional investors and hedge funds own 80.39% of the company's stock.

Titan International Stock Up 4.1 %

Shares of TWI stock traded up $0.30 on Thursday, hitting $7.55. The stock had a trading volume of 192,092 shares, compared to its average volume of 724,399. The company has a debt-to-equity ratio of 0.84, a current ratio of 2.38 and a quick ratio of 1.33. The business has a 50 day moving average of $7.97 and a 200 day moving average of $7.61. Titan International, Inc. has a 12-month low of $5.93 and a 12-month high of $11.83. The stock has a market cap of $476.89 million, a price-to-earnings ratio of -62.73 and a beta of 1.64.

Wall Street Analyst Weigh In

Several research firms have weighed in on TWI. Cantor Fitzgerald initiated coverage on shares of Titan International in a report on Thursday, March 20th. They set an "overweight" rating and a $11.00 price objective on the stock. StockNews.com downgraded Titan International from a "hold" rating to a "sell" rating in a research note on Tuesday.

Read Our Latest Report on TWI

About Titan International

(

Free Report)

Titan International, Inc, together with its subsidiaries, manufactures and sells wheels, tires, and undercarriage systems and components for off-highway vehicles in the United States and internationally. The company operates in Agricultural, Earthmoving/Construction, and Consumer segments. It offers wheels, tires, and undercarriage systems and components for various agricultural equipment, including tractors, combines, skidders, plows, planters, and irrigation equipment.

See Also

Before you consider Titan International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Titan International wasn't on the list.

While Titan International currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.