Titan Machinery (NASDAQ:TITN - Get Free Report) had its price objective cut by equities research analysts at Robert W. Baird from $25.00 to $24.00 in a research note issued on Friday,Benzinga reports. The brokerage presently has an "outperform" rating on the stock. Robert W. Baird's target price would indicate a potential upside of 33.48% from the company's previous close.

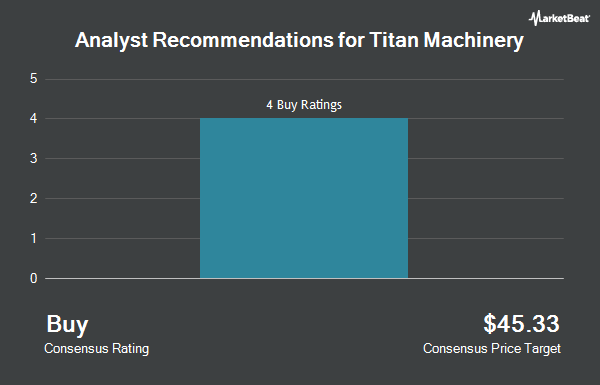

Separately, Baird R W upgraded Titan Machinery from a "hold" rating to a "strong-buy" rating in a research note on Monday, January 27th. One investment analyst has rated the stock with a sell rating, four have given a hold rating, two have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $19.00.

Read Our Latest Report on Titan Machinery

Titan Machinery Stock Up 1.2 %

NASDAQ:TITN traded up $0.21 during trading hours on Friday, hitting $17.98. The stock had a trading volume of 556,195 shares, compared to its average volume of 253,550. The company has a market cap of $415.81 million, a PE ratio of 13.42 and a beta of 1.28. The business has a 50 day simple moving average of $16.84 and a two-hundred day simple moving average of $15.18. Titan Machinery has a 1-year low of $12.30 and a 1-year high of $24.89. The company has a current ratio of 1.32, a quick ratio of 0.15 and a debt-to-equity ratio of 0.20.

Insiders Place Their Bets

In other news, Chairman David Joseph Meyer purchased 3,000 shares of the company's stock in a transaction that occurred on Monday, March 24th. The shares were acquired at an average cost of $16.86 per share, with a total value of $50,580.00. Following the transaction, the chairman now owns 138,388 shares in the company, valued at approximately $2,333,221.68. The trade was a 2.22 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. 10.28% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Titan Machinery

A number of hedge funds have recently added to or reduced their stakes in TITN. R Squared Ltd bought a new position in shares of Titan Machinery in the 4th quarter worth about $26,000. Russell Investments Group Ltd. grew its position in shares of Titan Machinery by 51.2% during the 4th quarter. Russell Investments Group Ltd. now owns 2,605 shares of the company's stock valued at $37,000 after buying an additional 882 shares during the last quarter. Truvestments Capital LLC acquired a new stake in Titan Machinery during the third quarter worth about $41,000. US Bancorp DE lifted its holdings in Titan Machinery by 23.8% in the fourth quarter. US Bancorp DE now owns 3,861 shares of the company's stock worth $55,000 after acquiring an additional 741 shares during the last quarter. Finally, FMR LLC boosted its stake in Titan Machinery by 142.5% in the third quarter. FMR LLC now owns 5,262 shares of the company's stock valued at $73,000 after acquiring an additional 3,092 shares during the period. Institutional investors and hedge funds own 78.38% of the company's stock.

About Titan Machinery

(

Get Free Report)

Titan Machinery Inc owns and operates a network of full service agricultural and construction equipment stores in the United States, Europe, and Australia. It operates through four segments: Agriculture, Construction, Europe, and Australia. The company sells new and used equipment, including agricultural and construction equipment manufactured under the CNH Industrial family of brands, as well as equipment from various other manufacturers.

Featured Stories

Before you consider Titan Machinery, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Titan Machinery wasn't on the list.

While Titan Machinery currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.