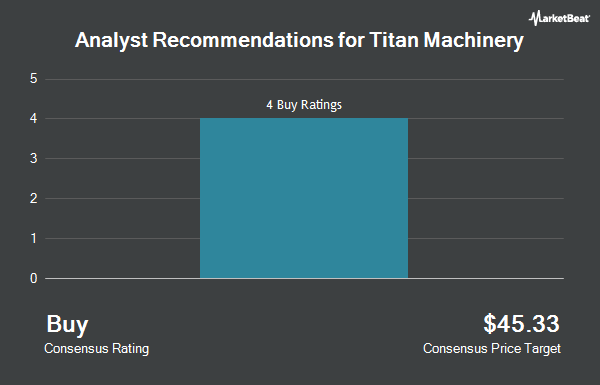

Northland Securities upgraded shares of Titan Machinery (NASDAQ:TITN - Free Report) from a market perform rating to an outperform rating in a research note issued to investors on Friday morning, MarketBeat.com reports. Northland Securities currently has $25.00 target price on the stock.

TITN has been the topic of a number of other reports. B. Riley assumed coverage on shares of Titan Machinery in a research note on Thursday, March 27th. They issued a "neutral" rating and a $19.00 target price on the stock. Baird R W raised shares of Titan Machinery from a "hold" rating to a "strong-buy" rating in a report on Monday, January 27th. Finally, Robert W. Baird reduced their target price on Titan Machinery from $25.00 to $24.00 and set an "outperform" rating on the stock in a research note on Friday, March 21st. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating, three have issued a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $19.80.

Check Out Our Latest Analysis on Titan Machinery

Titan Machinery Price Performance

TITN stock traded down $0.32 during mid-day trading on Friday, reaching $15.79. 51,917 shares of the company traded hands, compared to its average volume of 266,935. The company has a fifty day moving average price of $16.51 and a 200-day moving average price of $15.45. The company has a debt-to-equity ratio of 0.20, a current ratio of 1.32 and a quick ratio of 0.15. Titan Machinery has a 52-week low of $12.30 and a 52-week high of $24.28. The company has a market capitalization of $365.13 million, a P/E ratio of 11.78 and a beta of 1.27.

Insider Buying and Selling

In other Titan Machinery news, Chairman David Joseph Meyer bought 22,524 shares of the firm's stock in a transaction that occurred on Friday, March 21st. The stock was bought at an average price of $16.83 per share, for a total transaction of $379,078.92. Following the completion of the acquisition, the chairman now directly owns 135,388 shares in the company, valued at $2,278,580.04. The trade was a 19.96 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the SEC, which is available at this hyperlink. Insiders have bought a total of 26,182 shares of company stock valued at $439,661 over the last three months. 10.28% of the stock is owned by company insiders.

Institutional Trading of Titan Machinery

Several large investors have recently added to or reduced their stakes in the stock. US Bancorp DE boosted its position in Titan Machinery by 23.8% during the 4th quarter. US Bancorp DE now owns 3,861 shares of the company's stock valued at $55,000 after acquiring an additional 741 shares in the last quarter. SummerHaven Investment Management LLC increased its position in shares of Titan Machinery by 1.5% during the first quarter. SummerHaven Investment Management LLC now owns 51,255 shares of the company's stock valued at $873,000 after acquiring an additional 768 shares in the last quarter. Russell Investments Group Ltd. raised its stake in shares of Titan Machinery by 51.2% in the fourth quarter. Russell Investments Group Ltd. now owns 2,605 shares of the company's stock worth $37,000 after purchasing an additional 882 shares during the last quarter. Empowered Funds LLC lifted its holdings in shares of Titan Machinery by 5.1% during the fourth quarter. Empowered Funds LLC now owns 20,000 shares of the company's stock valued at $283,000 after purchasing an additional 962 shares in the last quarter. Finally, Bridgeway Capital Management LLC boosted its position in shares of Titan Machinery by 5.1% during the fourth quarter. Bridgeway Capital Management LLC now owns 20,000 shares of the company's stock valued at $283,000 after buying an additional 962 shares during the last quarter. Institutional investors own 78.38% of the company's stock.

Titan Machinery Company Profile

(

Get Free Report)

Titan Machinery Inc owns and operates a network of full service agricultural and construction equipment stores in the United States, Europe, and Australia. It operates through four segments: Agriculture, Construction, Europe, and Australia. The company sells new and used equipment, including agricultural and construction equipment manufactured under the CNH Industrial family of brands, as well as equipment from various other manufacturers.

Featured Stories

Before you consider Titan Machinery, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Titan Machinery wasn't on the list.

While Titan Machinery currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.