HighTower Advisors LLC grew its holdings in shares of TKO Group Holdings, Inc. (NYSE:TKO - Free Report) by 177.2% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 26,197 shares of the company's stock after purchasing an additional 16,746 shares during the quarter. HighTower Advisors LLC's holdings in TKO Group were worth $3,225,000 as of its most recent filing with the Securities and Exchange Commission.

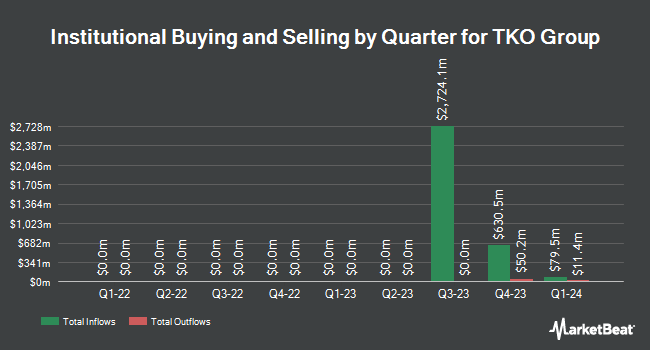

Other institutional investors and hedge funds have also modified their holdings of the company. Massachusetts Financial Services Co. MA lifted its holdings in TKO Group by 267.9% in the 2nd quarter. Massachusetts Financial Services Co. MA now owns 1,320,859 shares of the company's stock worth $142,640,000 after purchasing an additional 961,880 shares during the last quarter. Ninety One UK Ltd boosted its holdings in shares of TKO Group by 15.9% during the 2nd quarter. Ninety One UK Ltd now owns 4,065,230 shares of the company's stock worth $439,004,000 after buying an additional 557,444 shares during the period. Allspring Global Investments Holdings LLC lifted its position in TKO Group by 59.7% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 969,526 shares of the company's stock worth $119,940,000 after acquiring an additional 362,460 shares during the last quarter. American Century Companies Inc. boosted its holdings in TKO Group by 1,439.7% during the second quarter. American Century Companies Inc. now owns 307,405 shares of the company's stock valued at $33,197,000 after acquiring an additional 287,440 shares during the period. Finally, Clearbridge Investments LLC grew its position in shares of TKO Group by 9.5% in the second quarter. Clearbridge Investments LLC now owns 1,800,784 shares of the company's stock valued at $194,467,000 after purchasing an additional 155,940 shares during the last quarter. Institutional investors and hedge funds own 89.79% of the company's stock.

Analyst Ratings Changes

Several research firms recently weighed in on TKO. Roth Mkm boosted their price objective on TKO Group from $146.00 to $148.00 and gave the stock a "buy" rating in a research report on Wednesday, October 16th. Pivotal Research increased their target price on shares of TKO Group from $145.00 to $165.00 and gave the company a "buy" rating in a research note on Tuesday, November 26th. Guggenheim boosted their price target on TKO Group from $135.00 to $140.00 and gave the company a "buy" rating in a research note on Monday, September 30th. TD Cowen raised their price objective on TKO Group from $140.00 to $143.00 and gave the stock a "buy" rating in a research report on Tuesday, October 29th. Finally, Bank of America started coverage on shares of TKO Group in a research note on Tuesday, August 20th. They issued a "buy" rating and a $140.00 price objective for the company. Three analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the stock. According to data from MarketBeat.com, TKO Group presently has an average rating of "Moderate Buy" and an average price target of $133.93.

Read Our Latest Stock Analysis on TKO

Insider Activity

In other news, major shareholder Patrick Whitesell acquired 245,887 shares of TKO Group stock in a transaction on Friday, December 13th. The shares were purchased at an average price of $142.45 per share, with a total value of $35,026,603.15. Following the acquisition, the insider now owns 1,825,030 shares in the company, valued at $259,975,523.50. This represents a 15.57 % increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, insider Mark S. Shapiro sold 31,026 shares of TKO Group stock in a transaction on Monday, September 16th. The shares were sold at an average price of $114.76, for a total value of $3,560,543.76. Following the completion of the sale, the insider now directly owns 42,156 shares of the company's stock, valued at $4,837,822.56. This trade represents a 42.40 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders acquired 337,447 shares of company stock worth $48,133,224. 53.80% of the stock is owned by corporate insiders.

TKO Group Price Performance

Shares of NYSE TKO traded down $1.47 during mid-day trading on Friday, hitting $141.96. 855,172 shares of the stock were exchanged, compared to its average volume of 1,047,224. TKO Group Holdings, Inc. has a twelve month low of $74.25 and a twelve month high of $145.69. The stock's fifty day simple moving average is $128.24 and its two-hundred day simple moving average is $118.28. The company has a debt-to-equity ratio of 0.34, a quick ratio of 1.17 and a current ratio of 1.17. The company has a market cap of $24.24 billion, a P/E ratio of -338.00 and a beta of 1.09.

TKO Group (NYSE:TKO - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The company reported $0.28 earnings per share for the quarter, missing analysts' consensus estimates of $0.56 by ($0.28). The business had revenue of $681.20 million for the quarter, compared to analyst estimates of $665.12 million. TKO Group had a negative net margin of 1.26% and a positive return on equity of 3.39%. The company's revenue for the quarter was up 51.7% on a year-over-year basis. During the same period in the prior year, the business earned $0.52 earnings per share. As a group, analysts forecast that TKO Group Holdings, Inc. will post 3.88 EPS for the current fiscal year.

TKO Group Profile

(

Free Report)

TKO Group Holdings, Inc operates as a sports and entertainment company. The company produces and licenses live events, television programs, and long-form and short-form content, reality series, and other filmed entertainment on digital and linear channels and via pay-per-view. It is involved in the merchandising of video games, apparel, equipment, trading cards, memorabilia, digital goods, and toys, as well as sale of travel packages and tickets.

Featured Articles

Before you consider TKO Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TKO Group wasn't on the list.

While TKO Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report