MML Investors Services LLC raised its holdings in Toast, Inc. (NYSE:TOST - Free Report) by 40.6% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 228,313 shares of the company's stock after purchasing an additional 65,957 shares during the quarter. MML Investors Services LLC's holdings in Toast were worth $6,464,000 as of its most recent filing with the Securities and Exchange Commission.

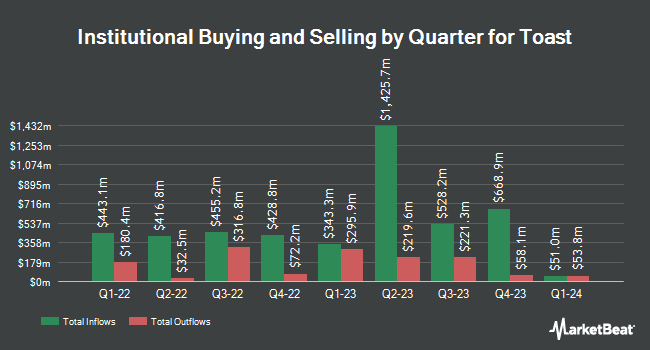

Several other institutional investors and hedge funds also recently added to or reduced their stakes in TOST. FMR LLC increased its stake in shares of Toast by 50.5% during the 3rd quarter. FMR LLC now owns 24,449,743 shares of the company's stock worth $692,172,000 after purchasing an additional 8,205,053 shares in the last quarter. ValueAct Holdings L.P. purchased a new stake in Toast during the 3rd quarter worth about $438,301,000. State Street Corp raised its stake in Toast by 2.5% in the 3rd quarter. State Street Corp now owns 8,325,292 shares of the company's stock valued at $235,689,000 after purchasing an additional 206,789 shares during the last quarter. Assenagon Asset Management S.A. lifted its holdings in Toast by 2,889.8% in the 3rd quarter. Assenagon Asset Management S.A. now owns 3,829,995 shares of the company's stock valued at $108,427,000 after purchasing an additional 3,701,893 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. lifted its holdings in Toast by 4.3% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 2,783,041 shares of the company's stock valued at $78,788,000 after purchasing an additional 113,995 shares in the last quarter. Institutional investors and hedge funds own 82.91% of the company's stock.

Toast Stock Performance

TOST stock traded down $1.46 during midday trading on Friday, reaching $38.15. The company had a trading volume of 6,648,204 shares, compared to its average volume of 7,412,207. The stock has a 50 day moving average price of $35.17 and a 200 day moving average price of $28.56. Toast, Inc. has a fifty-two week low of $16.13 and a fifty-two week high of $44.12.

Wall Street Analyst Weigh In

A number of brokerages have recently commented on TOST. Bank of America lifted their price target on shares of Toast from $26.00 to $28.00 and gave the stock a "neutral" rating in a report on Tuesday, September 17th. Deutsche Bank Aktiengesellschaft boosted their price target on Toast from $24.00 to $30.00 and gave the company a "hold" rating in a report on Monday, November 4th. Keefe, Bruyette & Woods raised their price objective on Toast from $29.00 to $40.00 and gave the stock a "market perform" rating in a report on Monday. The Goldman Sachs Group reiterated a "neutral" rating and issued a $45.00 target price (up from $34.00) on shares of Toast in a research note on Monday, December 2nd. Finally, Robert W. Baird lifted their price target on shares of Toast from $30.00 to $38.00 and gave the company a "neutral" rating in a report on Friday, November 8th. One research analyst has rated the stock with a sell rating, twelve have issued a hold rating and nine have assigned a buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $34.81.

Check Out Our Latest Research Report on Toast

Insider Activity at Toast

In other news, President Stephen Fredette sold 8,057 shares of the business's stock in a transaction that occurred on Monday, September 23rd. The stock was sold at an average price of $28.02, for a total transaction of $225,757.14. Following the completion of the transaction, the president now directly owns 2,152,442 shares in the company, valued at approximately $60,311,424.84. The trade was a 0.37 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director David Yuan sold 189,785 shares of the firm's stock in a transaction that occurred on Monday, November 25th. The shares were sold at an average price of $43.01, for a total value of $8,162,652.85. Following the completion of the sale, the director now owns 198,829 shares in the company, valued at approximately $8,551,635.29. This represents a 48.84 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 1,375,061 shares of company stock worth $44,557,182 in the last 90 days. 13.32% of the stock is currently owned by company insiders.

Toast Profile

(

Free Report)

Toast, Inc operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India. The company offers software products for restaurant operations and point of sale, such as Toast POS, Toast now, multi-location management, kitchen display system, Toast mobile order and pay, Toast catering and events, Toast invoicing, Toast tables, and restaurant retail; and hardware products, including Toast flex, Toast flex for guest, Toast go 2, Toast tap, kiosks, and Delphi by Toast.

Further Reading

Before you consider Toast, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toast wasn't on the list.

While Toast currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.