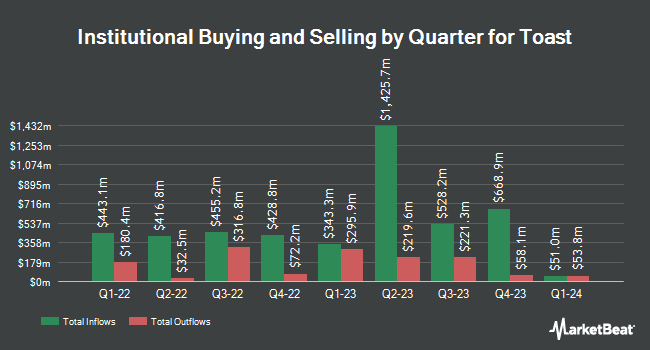

KBC Group NV lifted its position in Toast, Inc. (NYSE:TOST - Free Report) by 66.5% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 42,838 shares of the company's stock after buying an additional 17,106 shares during the quarter. KBC Group NV's holdings in Toast were worth $1,213,000 as of its most recent filing with the Securities and Exchange Commission.

Other institutional investors and hedge funds have also modified their holdings of the company. Northwestern Mutual Wealth Management Co. grew its holdings in Toast by 1.2% in the 2nd quarter. Northwestern Mutual Wealth Management Co. now owns 35,968 shares of the company's stock valued at $927,000 after buying an additional 421 shares during the last quarter. Private Advisor Group LLC boosted its stake in Toast by 1.6% during the third quarter. Private Advisor Group LLC now owns 28,151 shares of the company's stock worth $797,000 after buying an additional 441 shares in the last quarter. Farther Finance Advisors LLC increased its holdings in Toast by 32.3% in the 3rd quarter. Farther Finance Advisors LLC now owns 2,033 shares of the company's stock valued at $58,000 after buying an additional 496 shares during the period. Parkside Financial Bank & Trust raised its stake in shares of Toast by 8.4% in the 2nd quarter. Parkside Financial Bank & Trust now owns 6,742 shares of the company's stock valued at $174,000 after buying an additional 520 shares in the last quarter. Finally, Comerica Bank lifted its holdings in shares of Toast by 10.9% during the 1st quarter. Comerica Bank now owns 6,167 shares of the company's stock worth $154,000 after acquiring an additional 607 shares during the period. 82.91% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of analysts recently weighed in on TOST shares. Needham & Company LLC reissued a "buy" rating and issued a $30.00 target price on shares of Toast in a research note on Wednesday, August 7th. Robert W. Baird upped their price objective on Toast from $30.00 to $38.00 and gave the company a "neutral" rating in a research note on Friday, November 8th. JPMorgan Chase & Co. upped their price objective on Toast from $28.00 to $36.00 and gave the company a "neutral" rating in a research note on Friday, November 8th. Wells Fargo & Company upped their price objective on Toast from $23.00 to $25.00 and gave the company an "underweight" rating in a research note on Friday, November 8th. Finally, DA Davidson lifted their price target on shares of Toast from $35.00 to $44.00 and gave the company a "buy" rating in a report on Tuesday, November 12th. One analyst has rated the stock with a sell rating, nine have given a hold rating and eleven have assigned a buy rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $32.75.

Get Our Latest Stock Analysis on TOST

Insider Activity

In related news, CEO Aman Narang sold 10,106 shares of the stock in a transaction that occurred on Wednesday, October 2nd. The stock was sold at an average price of $27.77, for a total transaction of $280,643.62. Following the completion of the sale, the chief executive officer now directly owns 968,095 shares of the company's stock, valued at approximately $26,883,998.15. This represents a 1.03 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, President Stephen Fredette sold 211,686 shares of the business's stock in a transaction dated Tuesday, September 10th. The shares were sold at an average price of $23.57, for a total value of $4,989,439.02. Following the completion of the sale, the president now owns 2,638,023 shares in the company, valued at approximately $62,178,202.11. This trade represents a 7.43 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 1,475,651 shares of company stock valued at $43,037,212. 13.32% of the stock is currently owned by insiders.

Toast Price Performance

Shares of NYSE TOST traded up $2.69 during mid-day trading on Tuesday, hitting $42.51. The company's stock had a trading volume of 11,168,946 shares, compared to its average volume of 7,320,965. The stock has a market cap of $20.02 billion, a price-to-earnings ratio of -326.96, a price-to-earnings-growth ratio of 51.74 and a beta of 1.74. Toast, Inc. has a one year low of $13.77 and a one year high of $42.51. The company's fifty day simple moving average is $30.45 and its 200-day simple moving average is $26.83.

About Toast

(

Free Report)

Toast, Inc operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India. The company offers software products for restaurant operations and point of sale, such as Toast POS, Toast now, multi-location management, kitchen display system, Toast mobile order and pay, Toast catering and events, Toast invoicing, Toast tables, and restaurant retail; and hardware products, including Toast flex, Toast flex for guest, Toast go 2, Toast tap, kiosks, and Delphi by Toast.

Featured Stories

Before you consider Toast, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toast wasn't on the list.

While Toast currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.