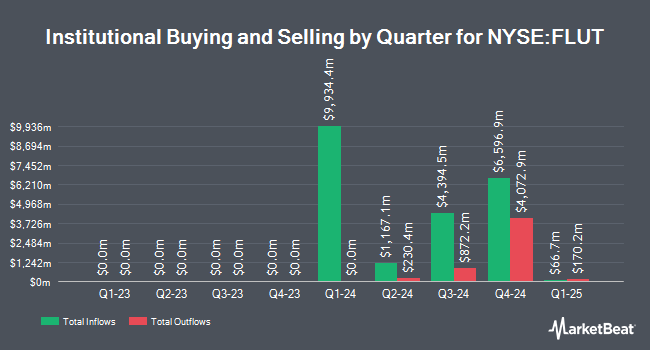

Tokio Marine Asset Management Co. Ltd. acquired a new stake in Flutter Entertainment plc (NYSE:FLUT - Free Report) in the third quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor acquired 5,548 shares of the company's stock, valued at approximately $1,316,000.

Other large investors have also recently made changes to their positions in the company. KBC Group NV bought a new position in shares of Flutter Entertainment during the 3rd quarter valued at approximately $2,093,000. Plato Investment Management Ltd bought a new position in Flutter Entertainment during the third quarter valued at $225,000. Oppenheimer & Co. Inc. purchased a new stake in Flutter Entertainment in the third quarter worth $863,000. Hiddenite Capital Partners LP purchased a new position in shares of Flutter Entertainment during the 3rd quarter valued at $4,983,000. Finally, Aigen Investment Management LP bought a new position in shares of Flutter Entertainment during the 3rd quarter worth $2,600,000.

Flutter Entertainment Trading Down 0.6 %

NYSE FLUT traded down $1.55 during trading hours on Friday, reaching $265.45. 2,583,160 shares of the stock traded hands, compared to its average volume of 1,138,311. The stock has a 50 day simple moving average of $233.95 and a two-hundred day simple moving average of $210.01. Flutter Entertainment plc has a 1 year low of $149.00 and a 1 year high of $269.90.

Flutter Entertainment (NYSE:FLUT - Get Free Report) last released its earnings results on Tuesday, August 13th. The company reported $2.33 earnings per share for the quarter, topping analysts' consensus estimates of $1.07 by $1.26. The firm had revenue of $3.61 billion during the quarter, compared to the consensus estimate of $3.41 billion. Research analysts forecast that Flutter Entertainment plc will post 4.65 EPS for the current fiscal year.

Flutter Entertainment announced that its board has authorized a stock repurchase program on Wednesday, September 25th that allows the company to repurchase $5.00 billion in shares. This repurchase authorization allows the company to repurchase up to 11.7% of its shares through open market purchases. Shares repurchase programs are usually a sign that the company's leadership believes its stock is undervalued.

Analyst Ratings Changes

Several research firms have commented on FLUT. Moffett Nathanson upped their price objective on shares of Flutter Entertainment from $245.00 to $275.00 and gave the company a "buy" rating in a report on Thursday, September 26th. Bank of America initiated coverage on shares of Flutter Entertainment in a report on Monday, October 14th. They set a "buy" rating and a $300.00 target price on the stock. Susquehanna raised their price target on Flutter Entertainment from $273.00 to $286.00 and gave the stock a "positive" rating in a report on Wednesday. Needham & Company LLC increased their price objective on Flutter Entertainment from $270.00 to $300.00 and gave the stock a "buy" rating in a report on Wednesday. Finally, Wells Fargo & Company lifted their target price on Flutter Entertainment from $295.00 to $300.00 and gave the company an "overweight" rating in a report on Wednesday. Fourteen analysts have rated the stock with a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, Flutter Entertainment presently has a consensus rating of "Buy" and a consensus target price of $296.08.

View Our Latest Analysis on Flutter Entertainment

Flutter Entertainment Company Profile

(

Free Report)

Flutter Entertainment plc operates as a sports betting and gaming company in the United Kingdom, Ireland, Australia, the United States, Italy, and internationally. The company operates through four segments: UK & Ireland, Australia, International, and US. It offers sports betting, iGaming, daily fantasy sports, online racing wagering, and TV broadcasting products; sportsbooks and exchange sports betting products, and gaming products; and online sports betting.

Recommended Stories

Before you consider Flutter Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flutter Entertainment wasn't on the list.

While Flutter Entertainment currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.