Tokio Marine Asset Management Co. Ltd. raised its holdings in Kellanova (NYSE:K - Free Report) by 1,079.4% during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The fund owned 120,842 shares of the company's stock after purchasing an additional 110,596 shares during the quarter. Tokio Marine Asset Management Co. Ltd.'s holdings in Kellanova were worth $9,753,000 at the end of the most recent reporting period.

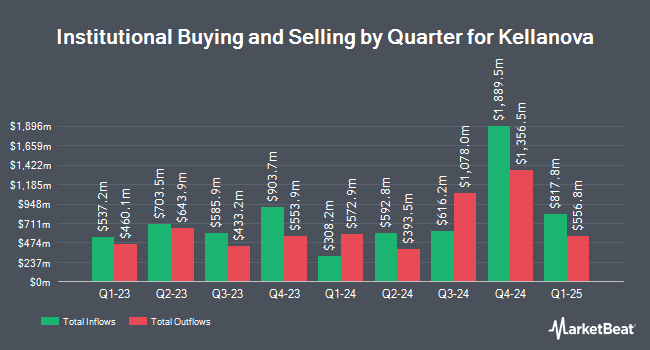

A number of other institutional investors have also modified their holdings of the stock. Blue Trust Inc. increased its stake in shares of Kellanova by 57.2% in the 2nd quarter. Blue Trust Inc. now owns 467 shares of the company's stock valued at $27,000 after purchasing an additional 170 shares in the last quarter. Family Firm Inc. purchased a new position in Kellanova during the second quarter valued at $29,000. CVA Family Office LLC increased its stake in Kellanova by 529.3% during the 3rd quarter. CVA Family Office LLC now owns 365 shares of the company's stock worth $29,000 after buying an additional 307 shares in the last quarter. Newbridge Financial Services Group Inc. grew its holdings in shares of Kellanova by 61.9% during the second quarter. Newbridge Financial Services Group Inc. now owns 523 shares of the company's stock worth $30,000 after buying an additional 200 shares in the last quarter. Finally, MCF Advisors LLC raised its position in shares of Kellanova by 48.8% in the third quarter. MCF Advisors LLC now owns 418 shares of the company's stock valued at $34,000 after buying an additional 137 shares during the last quarter. Hedge funds and other institutional investors own 83.87% of the company's stock.

Kellanova Trading Down 0.4 %

K stock traded down $0.32 during midday trading on Thursday, reaching $80.86. 2,453,684 shares of the company's stock traded hands, compared to its average volume of 3,036,640. Kellanova has a fifty-two week low of $51.02 and a fifty-two week high of $81.34. The business has a 50-day moving average price of $80.69 and a two-hundred day moving average price of $69.67. The company has a market capitalization of $27.87 billion, a P/E ratio of 27.86, a PEG ratio of 2.60 and a beta of 0.39. The company has a debt-to-equity ratio of 1.34, a current ratio of 0.77 and a quick ratio of 0.53.

Kellanova (NYSE:K - Get Free Report) last released its quarterly earnings results on Thursday, October 31st. The company reported $0.91 EPS for the quarter, topping the consensus estimate of $0.85 by $0.06. Kellanova had a return on equity of 37.05% and a net margin of 7.85%. The firm had revenue of $3.23 billion for the quarter, compared to analyst estimates of $3.16 billion. During the same period in the previous year, the company posted $1.03 EPS. Kellanova's revenue for the quarter was down .7% on a year-over-year basis. Equities research analysts forecast that Kellanova will post 3.74 EPS for the current fiscal year.

Kellanova Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Monday, December 2nd will be paid a $0.57 dividend. The ex-dividend date of this dividend is Monday, December 2nd. This represents a $2.28 dividend on an annualized basis and a dividend yield of 2.82%. Kellanova's dividend payout ratio (DPR) is presently 78.35%.

Analyst Ratings Changes

Several research analysts have recently commented on the company. Deutsche Bank Aktiengesellschaft lifted their price target on Kellanova from $76.00 to $83.50 and gave the stock a "hold" rating in a report on Thursday, August 15th. DA Davidson lowered shares of Kellanova from a "buy" rating to a "neutral" rating and boosted their target price for the company from $80.00 to $83.50 in a report on Monday, August 26th. Evercore ISI upgraded Kellanova to a "hold" rating in a report on Friday, August 2nd. Wells Fargo & Company lifted their target price on Kellanova from $76.00 to $83.50 and gave the company an "equal weight" rating in a research report on Thursday, August 15th. Finally, Royal Bank of Canada cut Kellanova from an "outperform" rating to a "sector perform" rating and increased their price target for the stock from $76.00 to $83.50 in a report on Thursday, August 15th. Fifteen equities research analysts have rated the stock with a hold rating and one has given a buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Hold" and an average price target of $76.35.

Get Our Latest Stock Analysis on Kellanova

Insider Activity at Kellanova

In other Kellanova news, major shareholder Kellogg W. K. Foundation Trust sold 77,800 shares of the business's stock in a transaction on Wednesday, August 28th. The shares were sold at an average price of $80.62, for a total transaction of $6,272,236.00. Following the completion of the sale, the insider now owns 50,597,438 shares in the company, valued at $4,079,165,451.56. The trade was a 0.15 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Insiders have sold 1,072,264 shares of company stock valued at $86,452,375 over the last ninety days. Corporate insiders own 1.80% of the company's stock.

About Kellanova

(

Free Report)

Kellanova, together with its subsidiaries, manufactures and markets snacks and convenience foods in North America, Europe, Latin America, the Asia Pacific, the Middle East, Australia, and Africa. Its principal products include crackers, crisps, savory snacks, toaster pastries, cereal bars, granola bars and bites, ready-to-eat cereals, frozen waffles, veggie foods, and noodles.

Read More

Before you consider Kellanova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kellanova wasn't on the list.

While Kellanova currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.