Topgolf Callaway Brands (NYSE:MODG - Get Free Report) is set to announce its earnings results after the market closes on Tuesday, November 12th. Analysts expect the company to announce earnings of ($0.18) per share for the quarter. Investors interested in registering for the company's conference call can do so using this link.

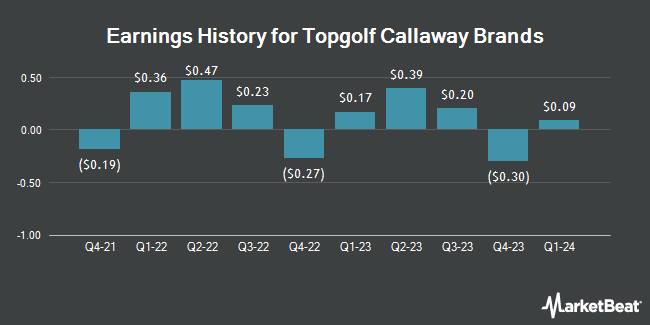

Topgolf Callaway Brands (NYSE:MODG - Get Free Report) last announced its earnings results on Wednesday, August 7th. The company reported $0.42 earnings per share for the quarter, topping the consensus estimate of $0.28 by $0.14. Topgolf Callaway Brands had a net margin of 0.50% and a return on equity of 2.07%. The firm had revenue of $1.16 billion for the quarter, compared to the consensus estimate of $1.19 billion. During the same period in the prior year, the firm earned $0.39 EPS. The firm's revenue for the quarter was down 1.9% on a year-over-year basis. On average, analysts expect Topgolf Callaway Brands to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Topgolf Callaway Brands Stock Down 3.7 %

MODG traded down $0.38 during trading hours on Wednesday, hitting $9.69. 2,219,572 shares of the company's stock were exchanged, compared to its average volume of 2,491,654. Topgolf Callaway Brands has a 12-month low of $9.05 and a 12-month high of $16.89. The firm has a 50 day moving average of $10.25 and a 200 day moving average of $13.16. The firm has a market cap of $1.78 billion, a P/E ratio of 96.91, a price-to-earnings-growth ratio of 6.29 and a beta of 1.75. The company has a current ratio of 1.93, a quick ratio of 1.15 and a debt-to-equity ratio of 0.37.

Analyst Upgrades and Downgrades

MODG has been the topic of several recent research reports. Morgan Stanley lowered their price target on shares of Topgolf Callaway Brands from $11.00 to $10.00 and set an "underweight" rating for the company in a report on Thursday, August 8th. Roth Mkm reiterated a "buy" rating and set a $17.00 price target on shares of Topgolf Callaway Brands in a report on Thursday, September 5th. Truist Financial lowered their price target on shares of Topgolf Callaway Brands from $20.00 to $16.00 and set a "buy" rating for the company in a report on Thursday, August 8th. Jefferies Financial Group cut shares of Topgolf Callaway Brands from a "buy" rating to a "hold" rating and lowered their price target for the stock from $40.00 to $12.00 in a report on Thursday, August 29th. Finally, Raymond James cut shares of Topgolf Callaway Brands from an "outperform" rating to an "underperform" rating in a report on Friday, August 23rd. Two investment analysts have rated the stock with a sell rating, eight have issued a hold rating and three have assigned a buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and a consensus target price of $15.31.

Check Out Our Latest Analysis on Topgolf Callaway Brands

About Topgolf Callaway Brands

(

Get Free Report)

Topgolf Callaway Brands Corp. designs, manufactures, and sells golf equipment, golf and lifestyle apparel, and other accessories in the United States, Europe, Asia, and Internationally. The Topgolf segment operates Topgolf venues equipped with technology-enabled hitting bays, bars, dining areas, and event spaces, as well as Toptracer ball-flight tracking technology; and World Golf Tour digital golf game.

See Also

Before you consider Topgolf Callaway Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Topgolf Callaway Brands wasn't on the list.

While Topgolf Callaway Brands currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.