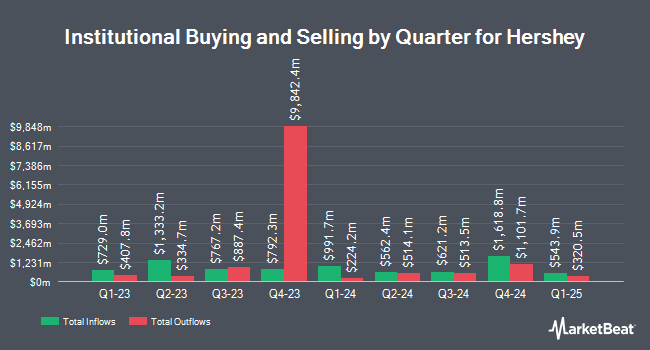

Toronto Dominion Bank lifted its holdings in The Hershey Company (NYSE:HSY - Free Report) by 5.2% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 81,506 shares of the company's stock after acquiring an additional 4,008 shares during the quarter. Toronto Dominion Bank's holdings in Hershey were worth $15,631,000 at the end of the most recent reporting period.

A number of other large investors have also bought and sold shares of the business. International Assets Investment Management LLC grew its holdings in shares of Hershey by 30,461.7% during the third quarter. International Assets Investment Management LLC now owns 573,643 shares of the company's stock worth $1,100,130,000 after purchasing an additional 571,766 shares during the last quarter. Massachusetts Financial Services Co. MA bought a new stake in Hershey during the 2nd quarter worth about $82,123,000. Principal Financial Group Inc. increased its position in Hershey by 66.7% in the 3rd quarter. Principal Financial Group Inc. now owns 972,836 shares of the company's stock valued at $186,571,000 after acquiring an additional 389,404 shares in the last quarter. State Street Corp raised its stake in shares of Hershey by 5.8% in the third quarter. State Street Corp now owns 7,029,551 shares of the company's stock worth $1,348,127,000 after acquiring an additional 386,670 shares during the last quarter. Finally, Mercer Global Advisors Inc. ADV lifted its position in shares of Hershey by 1,194.0% during the second quarter. Mercer Global Advisors Inc. ADV now owns 249,347 shares of the company's stock worth $45,837,000 after purchasing an additional 230,077 shares in the last quarter. 57.96% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several research analysts recently weighed in on the stock. Citigroup cut shares of Hershey from a "neutral" rating to a "sell" rating and dropped their price objective for the stock from $195.00 to $182.00 in a research report on Tuesday, August 27th. Piper Sandler upped their price target on Hershey from $165.00 to $168.00 and gave the company a "neutral" rating in a research note on Friday, November 8th. Redburn Atlantic initiated coverage on Hershey in a research report on Tuesday, October 22nd. They issued a "sell" rating and a $165.00 price objective for the company. Sanford C. Bernstein downgraded shares of Hershey from an "outperform" rating to a "market perform" rating and cut their target price for the company from $230.00 to $205.00 in a research report on Monday, October 7th. Finally, Mizuho lowered their price target on shares of Hershey from $200.00 to $180.00 and set a "neutral" rating for the company in a research report on Monday. Six analysts have rated the stock with a sell rating and thirteen have assigned a hold rating to the company. According to MarketBeat, the company presently has an average rating of "Hold" and a consensus price target of $185.17.

View Our Latest Research Report on HSY

Hershey Stock Down 0.5 %

Shares of NYSE:HSY traded down $0.94 during midday trading on Friday, reaching $183.01. 1,985,570 shares of the company were exchanged, compared to its average volume of 1,821,247. The firm has a market cap of $37.03 billion, a PE ratio of 21.19, a P/E/G ratio of 4.24 and a beta of 0.37. The company has a quick ratio of 0.54, a current ratio of 0.85 and a debt-to-equity ratio of 0.76. The Hershey Company has a fifty-two week low of $168.16 and a fifty-two week high of $211.92. The stock has a fifty day simple moving average of $180.11 and a two-hundred day simple moving average of $188.50.

Hershey Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, November 18th will be issued a $1.37 dividend. The ex-dividend date of this dividend is Monday, November 18th. This represents a $5.48 dividend on an annualized basis and a dividend yield of 2.99%. Hershey's dividend payout ratio (DPR) is 63.13%.

Hershey Profile

(

Free Report)

The Hershey Company, together with its subsidiaries, engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally. The company operates through three segments: North America Confectionery, North America Salty Snacks, and International. It offers chocolate and non-chocolate confectionery products; gum and mint refreshment products, including mints, chewing gums, and bubble gums; protein bars; pantry items, such as baking ingredients, toppings, beverages, and sundae syrups; and snack items comprising spreads, bars, snack bites, mixes, popcorn, and pretzels.

Featured Stories

Before you consider Hershey, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hershey wasn't on the list.

While Hershey currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.