Toronto Dominion Bank lifted its stake in shares of Mohawk Industries, Inc. (NYSE:MHK - Free Report) by 96.0% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 20,414 shares of the company's stock after acquiring an additional 9,997 shares during the quarter. Toronto Dominion Bank's holdings in Mohawk Industries were worth $3,280,000 as of its most recent filing with the Securities and Exchange Commission.

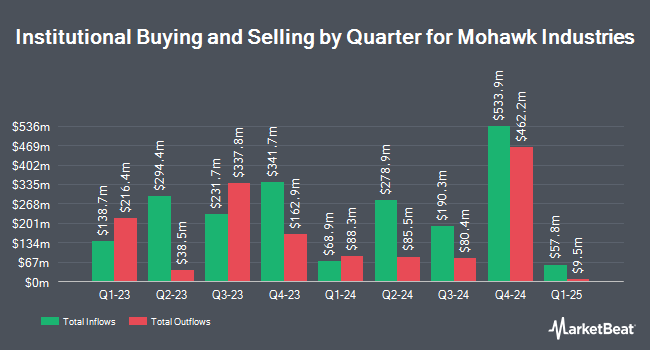

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Coldstream Capital Management Inc. acquired a new position in shares of Mohawk Industries in the 3rd quarter valued at $221,000. M&T Bank Corp lifted its position in Mohawk Industries by 9.1% in the third quarter. M&T Bank Corp now owns 3,517 shares of the company's stock valued at $565,000 after acquiring an additional 293 shares during the last quarter. Public Employees Retirement System of Ohio boosted its stake in Mohawk Industries by 1.7% in the third quarter. Public Employees Retirement System of Ohio now owns 20,569 shares of the company's stock valued at $3,305,000 after acquiring an additional 336 shares in the last quarter. Nomura Asset Management Co. Ltd. grew its holdings in shares of Mohawk Industries by 11.9% during the third quarter. Nomura Asset Management Co. Ltd. now owns 1,518 shares of the company's stock worth $244,000 after purchasing an additional 161 shares during the last quarter. Finally, MML Investors Services LLC acquired a new stake in shares of Mohawk Industries during the third quarter worth about $1,078,000. 78.98% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity

In related news, insider Suzanne L. Helen sold 2,000 shares of Mohawk Industries stock in a transaction on Tuesday, December 3rd. The stock was sold at an average price of $135.48, for a total transaction of $270,960.00. Following the completion of the sale, the insider now directly owns 2,453 shares of the company's stock, valued at $332,332.44. The trade was a 44.91 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 17.10% of the stock is owned by corporate insiders.

Mohawk Industries Stock Down 0.9 %

Shares of NYSE:MHK traded down $1.10 during trading on Monday, reaching $126.71. 679,624 shares of the company traded hands, compared to its average volume of 718,083. The firm has a market cap of $8.00 billion, a P/E ratio of 14.47, a price-to-earnings-growth ratio of 1.45 and a beta of 1.38. The firm has a fifty day simple moving average of $142.63 and a 200 day simple moving average of $139.05. Mohawk Industries, Inc. has a 1-year low of $96.28 and a 1-year high of $164.29. The company has a quick ratio of 1.09, a current ratio of 2.03 and a debt-to-equity ratio of 0.22.

Wall Street Analysts Forecast Growth

MHK has been the topic of a number of research reports. Loop Capital lowered their target price on shares of Mohawk Industries from $185.00 to $180.00 and set a "buy" rating on the stock in a research report on Wednesday, December 4th. Robert W. Baird raised shares of Mohawk Industries from a "neutral" rating to an "overweight" rating and raised their price objective for the stock from $160.00 to $196.00 in a research report on Monday, October 21st. Jefferies Financial Group upped their target price on shares of Mohawk Industries from $150.00 to $160.00 and gave the company a "hold" rating in a report on Wednesday, October 9th. Wells Fargo & Company raised Mohawk Industries from an "underweight" rating to an "equal weight" rating and raised their price target for the stock from $140.00 to $160.00 in a report on Monday, October 7th. Finally, Barclays reduced their price objective on Mohawk Industries from $146.00 to $141.00 and set an "equal weight" rating for the company in a research note on Wednesday, December 11th. Five equities research analysts have rated the stock with a hold rating, seven have given a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat.com, Mohawk Industries presently has an average rating of "Moderate Buy" and a consensus price target of $161.25.

View Our Latest Stock Report on MHK

Mohawk Industries Company Profile

(

Free Report)

Mohawk Industries, Inc designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels in the United States, Europe, Latin America, and internationally. It operates through three segments: Global Ceramic, Flooring North America, and Flooring Rest of the World.

Recommended Stories

Before you consider Mohawk Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mohawk Industries wasn't on the list.

While Mohawk Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.