Toronto-Dominion Bank (NYSE:TD - Get Free Report) TSE: TD was downgraded by StockNews.com from a "hold" rating to a "sell" rating in a research report issued to clients and investors on Tuesday.

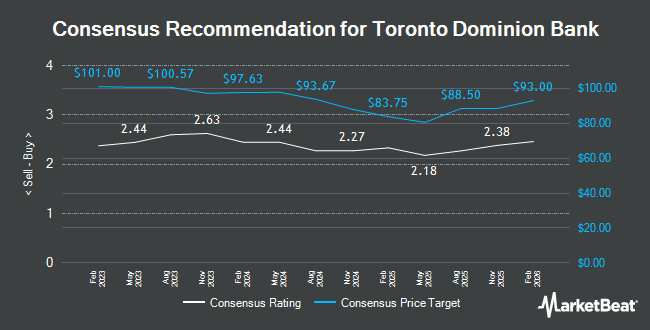

A number of other analysts have also recently weighed in on TD. National Bank Financial raised shares of Toronto-Dominion Bank from an "underperform" rating to a "sector perform" rating in a report on Thursday, August 22nd. Jefferies Financial Group raised shares of Toronto-Dominion Bank from a "hold" rating to a "buy" rating in a research report on Thursday, December 12th. Royal Bank of Canada cut their target price on shares of Toronto-Dominion Bank from $82.00 to $77.00 and set a "sector perform" rating on the stock in a report on Friday, December 6th. Barclays lowered Toronto-Dominion Bank from an "equal weight" rating to an "underweight" rating in a report on Thursday, November 21st. Finally, Scotiabank downgraded Toronto-Dominion Bank from a "sector outperform" rating to a "sector perform" rating in a report on Friday, December 6th. Two research analysts have rated the stock with a sell rating, seven have given a hold rating, one has given a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Hold" and a consensus price target of $80.50.

Check Out Our Latest Analysis on TD

Toronto-Dominion Bank Stock Down 1.0 %

Shares of TD traded down $0.55 during midday trading on Tuesday, hitting $52.55. The company had a trading volume of 1,379,315 shares, compared to its average volume of 2,718,467. The company has a quick ratio of 1.02, a current ratio of 1.03 and a debt-to-equity ratio of 0.11. Toronto-Dominion Bank has a 52 week low of $51.74 and a 52 week high of $65.12. The company's 50 day moving average price is $55.85 and its 200 day moving average price is $57.53. The stock has a market cap of $91.98 billion, a price-to-earnings ratio of 15.14, a PEG ratio of 1.69 and a beta of 0.82.

Institutional Investors Weigh In On Toronto-Dominion Bank

Several institutional investors and hedge funds have recently modified their holdings of TD. Mackenzie Financial Corp raised its holdings in Toronto-Dominion Bank by 0.8% in the 2nd quarter. Mackenzie Financial Corp now owns 25,997,122 shares of the bank's stock worth $1,429,186,000 after acquiring an additional 218,807 shares during the period. 1832 Asset Management L.P. grew its stake in shares of Toronto-Dominion Bank by 6.0% in the second quarter. 1832 Asset Management L.P. now owns 25,803,480 shares of the bank's stock worth $1,418,159,000 after acquiring an additional 1,462,794 shares during the last quarter. CIBC Asset Management Inc increased its position in Toronto-Dominion Bank by 5.4% during the third quarter. CIBC Asset Management Inc now owns 16,515,643 shares of the bank's stock worth $1,046,825,000 after acquiring an additional 853,313 shares during the period. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp boosted its holdings in Toronto-Dominion Bank by 9.6% in the 2nd quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 13,814,269 shares of the bank's stock valued at $759,449,000 after purchasing an additional 1,206,574 shares during the period. Finally, The Manufacturers Life Insurance Company grew its position in Toronto-Dominion Bank by 24.9% in the 3rd quarter. The Manufacturers Life Insurance Company now owns 13,509,261 shares of the bank's stock worth $854,815,000 after purchasing an additional 2,689,532 shares during the last quarter. Institutional investors and hedge funds own 52.37% of the company's stock.

About Toronto-Dominion Bank

(

Get Free Report)

The Toronto-Dominion Bank, together with its subsidiaries, provides various financial products and services in Canada, the United States, and internationally. It operates through four segments: Canadian Personal and Commercial Banking, U.S. Retail, Wealth Management and Insurance, and Wholesale Banking.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Toronto-Dominion Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toronto-Dominion Bank wasn't on the list.

While Toronto-Dominion Bank currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.