Toronto Dominion Bank lessened its stake in Quanta Services, Inc. (NYSE:PWR - Free Report) by 30.6% in the 3rd quarter, according to its most recent filing with the SEC. The fund owned 50,937 shares of the construction company's stock after selling 22,447 shares during the period. Toronto Dominion Bank's holdings in Quanta Services were worth $15,187,000 at the end of the most recent quarter.

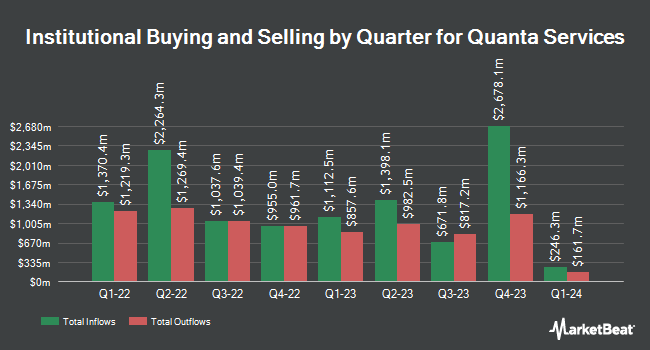

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Prestige Wealth Management Group LLC acquired a new position in shares of Quanta Services in the third quarter valued at approximately $30,000. Legacy Investment Solutions LLC purchased a new stake in shares of Quanta Services during the third quarter worth $31,000. Valley Wealth Managers Inc. acquired a new stake in shares of Quanta Services in the second quarter valued at $33,000. Quest Partners LLC acquired a new position in Quanta Services during the 2nd quarter worth $35,000. Finally, CarsonAllaria Wealth Management Ltd. purchased a new stake in Quanta Services during the 2nd quarter worth about $38,000. Hedge funds and other institutional investors own 90.49% of the company's stock.

Analyst Ratings Changes

PWR has been the subject of a number of analyst reports. Jefferies Financial Group initiated coverage on Quanta Services in a research report on Wednesday, September 4th. They set a "hold" rating and a $256.00 price objective for the company. UBS Group raised their price objective on shares of Quanta Services from $313.00 to $367.00 and gave the company a "buy" rating in a report on Wednesday, October 23rd. Daiwa Capital Markets initiated coverage on shares of Quanta Services in a research note on Friday, December 6th. They set an "outperform" rating and a $355.00 target price for the company. Daiwa America raised Quanta Services to a "strong-buy" rating in a report on Friday, December 6th. Finally, TD Cowen raised their target price on Quanta Services from $280.00 to $335.00 and gave the stock a "buy" rating in a research report on Tuesday, October 15th. Four research analysts have rated the stock with a hold rating, thirteen have issued a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, Quanta Services has an average rating of "Moderate Buy" and an average target price of $321.69.

View Our Latest Analysis on PWR

Quanta Services Stock Performance

Shares of Quanta Services stock traded up $1.52 during trading hours on Friday, hitting $337.62. 1,121,229 shares of the company were exchanged, compared to its average volume of 898,372. The business has a 50-day moving average of $322.72 and a 200-day moving average of $287.10. Quanta Services, Inc. has a 1 year low of $187.27 and a 1 year high of $350.19. The company has a current ratio of 1.23, a quick ratio of 1.19 and a debt-to-equity ratio of 0.58. The stock has a market capitalization of $49.84 billion, a price-to-earnings ratio of 62.29 and a beta of 1.03.

Quanta Services (NYSE:PWR - Get Free Report) last released its earnings results on Thursday, October 31st. The construction company reported $2.72 EPS for the quarter, topping the consensus estimate of $2.46 by $0.26. Quanta Services had a net margin of 3.54% and a return on equity of 16.71%. The company had revenue of $6.49 billion during the quarter, compared to analysts' expectations of $6.56 billion. During the same quarter last year, the business earned $2.08 EPS. The business's revenue was up 15.5% on a year-over-year basis. As a group, analysts expect that Quanta Services, Inc. will post 7.9 EPS for the current fiscal year.

Quanta Services Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, January 13th. Investors of record on Thursday, January 2nd will be paid a $0.10 dividend. The ex-dividend date of this dividend is Thursday, January 2nd. This is an increase from Quanta Services's previous quarterly dividend of $0.09. This represents a $0.40 dividend on an annualized basis and a dividend yield of 0.12%. Quanta Services's payout ratio is 6.64%.

Quanta Services Profile

(

Free Report)

Quanta Services, Inc provides infrastructure solutions for the electric and gas utility, renewable energy, communications, and pipeline and energy industries in the United States, Canada, Australia, and internationally. The company's Electric Power Infrastructure Solutions segment engages in the design, procurement, construction, upgrade, repair, and maintenance of electric power transmission and distribution infrastructure and substation facilities; installation, maintenance, and upgrade of electric power infrastructure projects; installation of smart grid technologies on electric power networks; and design, installation, maintenance, and repair of commercial and industrial wirings.

Featured Stories

Before you consider Quanta Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quanta Services wasn't on the list.

While Quanta Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.