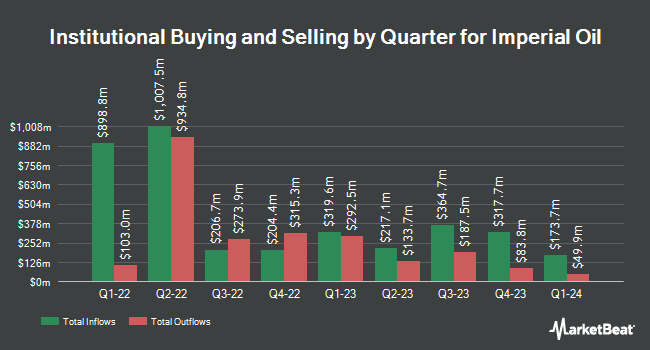

Toronto Dominion Bank cut its stake in shares of Imperial Oil Limited (NYSEAMERICAN:IMO - Free Report) TSE: IMO by 7.8% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 758,463 shares of the energy company's stock after selling 64,015 shares during the period. Toronto Dominion Bank owned about 0.15% of Imperial Oil worth $53,434,000 as of its most recent SEC filing.

Other hedge funds have also recently bought and sold shares of the company. CWM LLC boosted its stake in shares of Imperial Oil by 8.7% in the 2nd quarter. CWM LLC now owns 2,319 shares of the energy company's stock worth $158,000 after buying an additional 185 shares during the last quarter. M&G Plc purchased a new stake in shares of Imperial Oil during the 2nd quarter valued at $627,000. Assenagon Asset Management S.A. bought a new stake in shares of Imperial Oil during the 2nd quarter worth $257,000. Blue Trust Inc. boosted its holdings in shares of Imperial Oil by 20.0% in the 2nd quarter. Blue Trust Inc. now owns 8,900 shares of the energy company's stock worth $615,000 after buying an additional 1,485 shares during the last quarter. Finally, Diversified LLC purchased a new position in shares of Imperial Oil in the 2nd quarter worth about $363,000. 20.74% of the stock is owned by hedge funds and other institutional investors.

Imperial Oil Price Performance

Shares of IMO stock traded down $5.11 on Thursday, hitting $68.24. 831,436 shares of the company's stock traded hands, compared to its average volume of 409,868. The company has a debt-to-equity ratio of 0.17, a quick ratio of 1.23 and a current ratio of 1.44. The firm has a market cap of $35.34 billion, a P/E ratio of 10.39 and a beta of 1.42. Imperial Oil Limited has a one year low of $53.39 and a one year high of $80.17.

Imperial Oil Cuts Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, January 1st. Stockholders of record on Tuesday, December 3rd will be issued a $0.4304 dividend. This represents a $1.72 annualized dividend and a dividend yield of 2.52%. The ex-dividend date of this dividend is Tuesday, December 3rd. Imperial Oil's dividend payout ratio is 26.38%.

Analysts Set New Price Targets

Several research analysts have recently weighed in on the company. Scotiabank reiterated a "sector perform" rating and set a $110.00 price target on shares of Imperial Oil in a research note on Wednesday, September 25th. StockNews.com downgraded shares of Imperial Oil from a "buy" rating to a "hold" rating in a research note on Wednesday, August 28th.

Check Out Our Latest Report on IMO

Imperial Oil Profile

(

Free Report)

Imperial Oil Limited engages in exploration, production, and sale of crude oil and natural gas in Canada. The company operates through three segments: Upstream, Downstream and Chemical segments. The Upstream segment explores and produces crude oil, natural gas, synthetic crude oil, and bitumen. The Downstream segment transports and refines crude oil, blends refined products, and distributes and markets of refined products.

Further Reading

Before you consider Imperial Oil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Imperial Oil wasn't on the list.

While Imperial Oil currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.