Torrid (NYSE:CURV - Get Free Report)'s stock had its "market perform" rating reaffirmed by equities research analysts at Telsey Advisory Group in a research report issued on Monday,Benzinga reports. They currently have a $8.00 price objective on the stock. Telsey Advisory Group's target price indicates a potential upside of 90.93% from the company's current price.

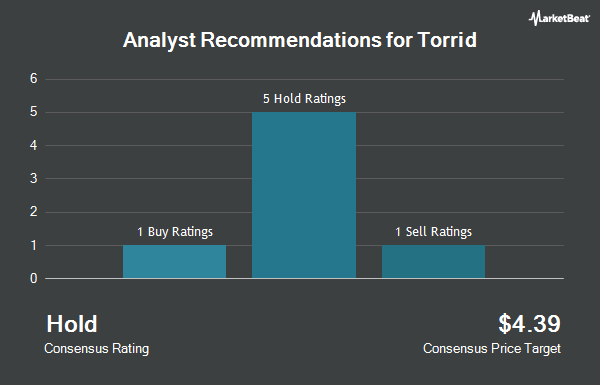

A number of other brokerages have also recently commented on CURV. The Goldman Sachs Group lowered their target price on Torrid from $7.00 to $4.50 and set a "neutral" rating on the stock in a report on Monday, October 21st. William Blair raised Torrid from a "market perform" rating to an "outperform" rating in a research report on Tuesday, September 17th. One analyst has rated the stock with a sell rating, two have issued a hold rating and two have assigned a buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus target price of $6.13.

Get Our Latest Stock Analysis on CURV

Torrid Stock Up 5.8 %

CURV traded up $0.23 on Monday, hitting $4.19. 345,797 shares of the company traded hands, compared to its average volume of 255,336. The company has a 50 day moving average of $3.84 and a 200-day moving average of $5.86. The stock has a market capitalization of $438.61 million, a PE ratio of 30.46 and a beta of 1.96. Torrid has a 12-month low of $2.18 and a 12-month high of $9.14.

Torrid (NYSE:CURV - Get Free Report) last issued its earnings results on Wednesday, September 4th. The company reported $0.08 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.07 by $0.01. Torrid had a negative return on equity of 6.77% and a net margin of 1.21%. The business had revenue of $284.60 million during the quarter, compared to the consensus estimate of $282.87 million. During the same period in the prior year, the business posted $0.06 EPS. The company's revenue for the quarter was down 1.6% on a year-over-year basis. On average, research analysts anticipate that Torrid will post 0.2 EPS for the current year.

Insider Buying and Selling

In other Torrid news, CEO Lisa M. Harper sold 498,087 shares of the business's stock in a transaction dated Friday, September 13th. The stock was sold at an average price of $3.80, for a total transaction of $1,892,730.60. Following the completion of the transaction, the chief executive officer now owns 5,596,314 shares of the company's stock, valued at approximately $21,265,993.20. The trade was a 8.17 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, major shareholder Sycamore Partners Torrid, L.L. sold 7,282,942 shares of the company's stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $3.80, for a total value of $27,675,179.60. Following the completion of the sale, the insider now owns 75,069,044 shares in the company, valued at $285,262,367.20. The trade was a 8.84 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 9,164,601 shares of company stock valued at $34,825,484 in the last 90 days. 9.77% of the stock is owned by insiders.

Hedge Funds Weigh In On Torrid

A number of institutional investors have recently modified their holdings of the company. Barclays PLC raised its holdings in shares of Torrid by 354.5% during the 3rd quarter. Barclays PLC now owns 17,416 shares of the company's stock valued at $69,000 after buying an additional 13,584 shares in the last quarter. Maven Securities LTD bought a new stake in Torrid in the third quarter worth $98,000. Quadrature Capital Ltd purchased a new position in shares of Torrid in the third quarter worth $104,000. XTX Topco Ltd purchased a new stake in shares of Torrid during the 3rd quarter valued at about $145,000. Finally, Verition Fund Management LLC bought a new stake in Torrid during the third quarter valued at about $166,000. 81.82% of the stock is owned by institutional investors and hedge funds.

About Torrid

(

Get Free Report)

Torrid Holdings Inc operates in women's plus-size apparel and intimates market in North America. The company designs, develops, and merchandises its products under the Torrid, Torrid Curve, CURV, and Lovesick brand names. It is involved in the sale of tops, bottoms, dresses, denims, activewear, intimates, sleep wear, swim wear, and outerwear products; and non-apparel products comprising accessories, footwear, and beauty products.

See Also

Before you consider Torrid, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Torrid wasn't on the list.

While Torrid currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.