Clal Insurance Enterprises Holdings Ltd boosted its holdings in Tower Semiconductor Ltd. (NASDAQ:TSEM - Free Report) by 0.2% during the third quarter, according to its most recent Form 13F filing with the SEC. The fund owned 5,631,160 shares of the semiconductor company's stock after acquiring an additional 13,900 shares during the period. Tower Semiconductor accounts for about 2.2% of Clal Insurance Enterprises Holdings Ltd's portfolio, making the stock its 16th largest holding. Clal Insurance Enterprises Holdings Ltd owned approximately 5.08% of Tower Semiconductor worth $249,706,000 at the end of the most recent quarter.

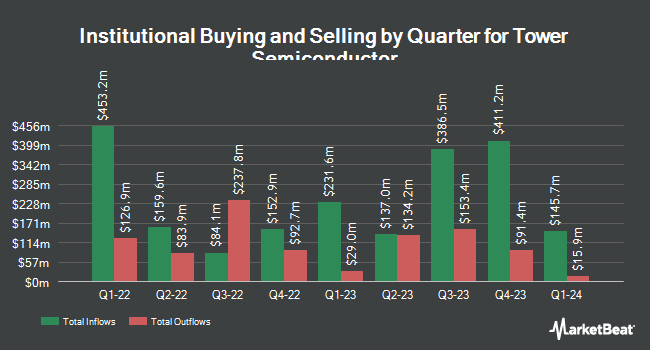

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Y.D. More Investments Ltd boosted its position in shares of Tower Semiconductor by 9,622.0% during the 2nd quarter. Y.D. More Investments Ltd now owns 911,926 shares of the semiconductor company's stock worth $35,952,000 after purchasing an additional 902,546 shares during the period. Point72 Asset Management L.P. grew its stake in shares of Tower Semiconductor by 169.0% in the second quarter. Point72 Asset Management L.P. now owns 1,022,121 shares of the semiconductor company's stock valued at $40,180,000 after buying an additional 642,121 shares in the last quarter. Meitav Investment House Ltd. raised its holdings in shares of Tower Semiconductor by 25.6% in the 2nd quarter. Meitav Investment House Ltd. now owns 2,431,817 shares of the semiconductor company's stock valued at $95,686,000 after buying an additional 495,380 shares during the period. Boston Partners boosted its holdings in Tower Semiconductor by 453.9% during the 1st quarter. Boston Partners now owns 328,843 shares of the semiconductor company's stock valued at $10,995,000 after acquiring an additional 269,476 shares during the period. Finally, Assenagon Asset Management S.A. acquired a new position in Tower Semiconductor in the 3rd quarter valued at about $11,094,000. Institutional investors and hedge funds own 70.51% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts have issued reports on the stock. Susquehanna increased their target price on shares of Tower Semiconductor from $55.00 to $60.00 and gave the stock a "positive" rating in a report on Thursday, November 14th. StockNews.com cut Tower Semiconductor from a "buy" rating to a "hold" rating in a research note on Tuesday, November 12th. Benchmark reaffirmed a "buy" rating and issued a $55.00 price target on shares of Tower Semiconductor in a research report on Thursday, November 14th. Finally, Craig Hallum upped their target price on shares of Tower Semiconductor from $54.00 to $60.00 and gave the stock a "buy" rating in a research note on Thursday, November 14th. One analyst has rated the stock with a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat, Tower Semiconductor has an average rating of "Moderate Buy" and a consensus target price of $58.33.

Read Our Latest Research Report on Tower Semiconductor

Tower Semiconductor Stock Up 0.0 %

Tower Semiconductor stock traded up $0.02 during midday trading on Friday, reaching $47.83. The company's stock had a trading volume of 357,367 shares, compared to its average volume of 768,672. Tower Semiconductor Ltd. has a fifty-two week low of $27.11 and a fifty-two week high of $50.25. The company has a market cap of $5.30 billion, a P/E ratio of 25.85 and a beta of 0.90. The company has a quick ratio of 4.89, a current ratio of 5.82 and a debt-to-equity ratio of 0.05. The business has a 50-day simple moving average of $44.22 and a 200-day simple moving average of $41.11.

Tower Semiconductor (NASDAQ:TSEM - Get Free Report) last posted its earnings results on Wednesday, November 13th. The semiconductor company reported $0.57 earnings per share for the quarter, topping the consensus estimate of $0.45 by $0.12. The firm had revenue of $370.50 million during the quarter, compared to analysts' expectations of $370.30 million. Tower Semiconductor had a return on equity of 8.22% and a net margin of 14.75%. The firm's revenue was up 3.4% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.47 earnings per share. On average, research analysts expect that Tower Semiconductor Ltd. will post 1.82 earnings per share for the current fiscal year.

Tower Semiconductor Profile

(

Free Report)

Tower Semiconductor Ltd., an independent semiconductor foundry, focus on specialty process technologies to manufacture analog intensive mixed-signal semiconductor devices in Israel, the United States, Japan, Europe, and internationally. It provides various customizable process technologies, including SiGe, BiCMOS, mixed signal/CMOS, RF CMOS, CMOS image sensor, integrated power management, and MEMS.

Featured Articles

Before you consider Tower Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tower Semiconductor wasn't on the list.

While Tower Semiconductor currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.