Townsquare Capital LLC boosted its position in Carrier Global Co. (NYSE:CARR - Free Report) by 67.9% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 16,337 shares of the company's stock after buying an additional 6,608 shares during the period. Townsquare Capital LLC's holdings in Carrier Global were worth $1,315,000 as of its most recent filing with the Securities & Exchange Commission.

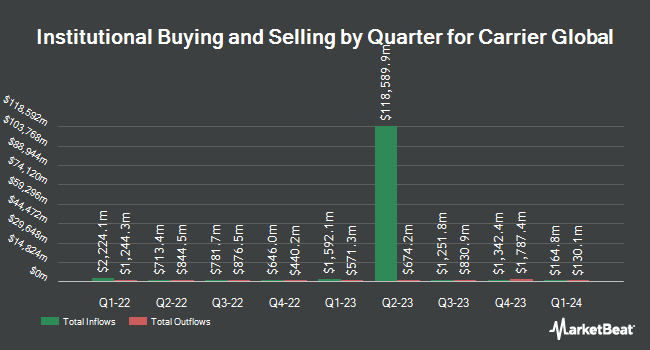

Several other hedge funds and other institutional investors have also recently bought and sold shares of the stock. FSM Wealth Advisors LLC boosted its holdings in shares of Carrier Global by 2.2% during the 3rd quarter. FSM Wealth Advisors LLC now owns 6,373 shares of the company's stock worth $513,000 after purchasing an additional 136 shares during the last quarter. Meridian Wealth Management LLC lifted its stake in Carrier Global by 2.3% during the 3rd quarter. Meridian Wealth Management LLC now owns 6,030 shares of the company's stock worth $485,000 after acquiring an additional 137 shares in the last quarter. Essex Savings Bank increased its stake in Carrier Global by 2.2% during the 3rd quarter. Essex Savings Bank now owns 6,608 shares of the company's stock worth $532,000 after buying an additional 144 shares during the period. Boston Financial Mangement LLC grew its stake in Carrier Global by 1.7% during the 3rd quarter. Boston Financial Mangement LLC now owns 9,208 shares of the company's stock worth $741,000 after purchasing an additional 150 shares in the last quarter. Finally, Sittner & Nelson LLC lifted its stake in Carrier Global by 4.9% in the third quarter. Sittner & Nelson LLC now owns 3,187 shares of the company's stock worth $257,000 after acquiring an additional 150 shares during the last quarter. 91.00% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several equities analysts have commented on the stock. Mizuho increased their price target on shares of Carrier Global from $65.00 to $78.00 and gave the company a "neutral" rating in a research note on Thursday, October 17th. Wells Fargo & Company lowered their target price on Carrier Global from $82.00 to $76.00 and set an "equal weight" rating on the stock in a research note on Friday, October 25th. Oppenheimer raised their price target on Carrier Global from $74.00 to $88.00 and gave the company an "outperform" rating in a report on Wednesday, October 2nd. Wolfe Research raised Carrier Global from an "underperform" rating to a "peer perform" rating in a research note on Friday, September 6th. Finally, Northcoast Research began coverage on Carrier Global in a research report on Friday, November 22nd. They set a "neutral" rating for the company. Eight equities research analysts have rated the stock with a hold rating, seven have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $82.31.

Get Our Latest Stock Report on CARR

Carrier Global Stock Performance

Shares of CARR stock traded down $1.08 during trading on Monday, reaching $76.29. 3,420,702 shares of the company's stock were exchanged, compared to its average volume of 4,220,476. The stock has a market capitalization of $68.45 billion, a PE ratio of 19.31, a PEG ratio of 2.86 and a beta of 1.34. The firm's fifty day moving average price is $77.75 and its 200-day moving average price is $70.75. Carrier Global Co. has a twelve month low of $52.28 and a twelve month high of $83.32. The company has a quick ratio of 0.82, a current ratio of 1.08 and a debt-to-equity ratio of 0.69.

Carrier Global Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Monday, November 18th. Investors of record on Friday, October 25th were given a dividend of $0.19 per share. The ex-dividend date was Friday, October 25th. This represents a $0.76 annualized dividend and a dividend yield of 1.00%. Carrier Global's dividend payout ratio is currently 19.24%.

Carrier Global declared that its board has initiated a stock buyback plan on Thursday, October 24th that permits the company to repurchase $3.00 billion in shares. This repurchase authorization permits the company to buy up to 4.6% of its shares through open market purchases. Shares repurchase plans are typically a sign that the company's board of directors believes its stock is undervalued.

About Carrier Global

(

Free Report)

Carrier Global Corporation provides heating, ventilating, and air conditioning (HVAC), refrigeration, fire, security, and building automation technologies in the United States, Europe, the Asia Pacific, and internationally. It operates through three segments: HVAC, Refrigeration, and Fire & Security.

Recommended Stories

Before you consider Carrier Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carrier Global wasn't on the list.

While Carrier Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.