Townsquare Capital LLC raised its stake in AAON, Inc. (NASDAQ:AAON - Free Report) by 5.1% in the 3rd quarter, according to its most recent disclosure with the SEC. The fund owned 124,274 shares of the construction company's stock after purchasing an additional 6,012 shares during the quarter. Townsquare Capital LLC owned 0.15% of AAON worth $13,402,000 at the end of the most recent quarter.

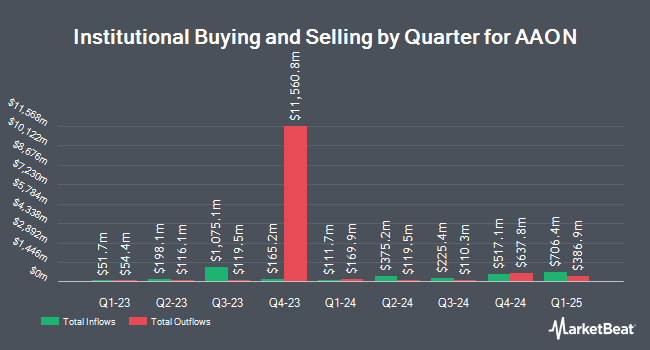

A number of other institutional investors have also recently made changes to their positions in the stock. Conestoga Capital Advisors LLC lifted its stake in AAON by 1.9% in the third quarter. Conestoga Capital Advisors LLC now owns 2,125,186 shares of the construction company's stock worth $229,180,000 after acquiring an additional 39,059 shares during the period. FMR LLC lifted its stake in AAON by 9.6% in the third quarter. FMR LLC now owns 1,729,498 shares of the construction company's stock worth $186,509,000 after acquiring an additional 151,540 shares during the period. Geneva Capital Management LLC lifted its stake in AAON by 1.5% in the third quarter. Geneva Capital Management LLC now owns 1,698,207 shares of the construction company's stock worth $183,135,000 after acquiring an additional 24,384 shares during the period. Dimensional Fund Advisors LP lifted its stake in AAON by 1.6% in the second quarter. Dimensional Fund Advisors LP now owns 1,568,746 shares of the construction company's stock worth $136,857,000 after acquiring an additional 24,095 shares during the period. Finally, Vaughan Nelson Investment Management L.P. lifted its stake in AAON by 12.5% in the third quarter. Vaughan Nelson Investment Management L.P. now owns 1,225,600 shares of the construction company's stock worth $132,169,000 after acquiring an additional 136,530 shares during the period. Hedge funds and other institutional investors own 70.81% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on AAON shares. Baird R W upgraded AAON from a "hold" rating to a "strong-buy" rating in a report on Monday, October 28th. StockNews.com upgraded shares of AAON from a "sell" rating to a "hold" rating in a report on Friday, September 20th. Robert W. Baird upped their price objective on AAON from $130.00 to $138.00 and gave the company an "outperform" rating in a research report on Friday, November 8th. Sidoti lowered AAON from a "buy" rating to a "neutral" rating and lifted their target price for the stock from $102.00 to $111.00 in a report on Tuesday, October 22nd. Finally, DA Davidson increased their price objective on AAON from $102.00 to $150.00 and gave the company a "buy" rating in a research report on Friday, November 8th. Two analysts have rated the stock with a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, AAON has a consensus rating of "Moderate Buy" and a consensus target price of $133.00.

Get Our Latest Research Report on AAON

AAON Stock Down 2.6 %

AAON stock traded down $3.63 during midday trading on Wednesday, hitting $136.82. 317,053 shares of the company's stock were exchanged, compared to its average volume of 599,025. The company has a market cap of $11.12 billion, a PE ratio of 61.87 and a beta of 0.79. The firm has a 50-day moving average of $116.63 and a two-hundred day moving average of $95.84. The company has a debt-to-equity ratio of 0.07, a quick ratio of 1.79 and a current ratio of 3.06. AAON, Inc. has a 12 month low of $61.09 and a 12 month high of $144.07.

AAON (NASDAQ:AAON - Get Free Report) last released its quarterly earnings results on Thursday, November 7th. The construction company reported $0.63 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.57 by $0.06. The business had revenue of $327.25 million for the quarter, compared to analyst estimates of $315.80 million. AAON had a net margin of 15.78% and a return on equity of 24.98%. The business's revenue for the quarter was up 4.9% on a year-over-year basis. During the same period in the previous year, the company earned $0.64 earnings per share. As a group, analysts expect that AAON, Inc. will post 2.26 earnings per share for the current fiscal year.

AAON Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, December 19th. Shareholders of record on Friday, November 29th will be given a $0.08 dividend. The ex-dividend date of this dividend is Friday, November 29th. This represents a $0.32 dividend on an annualized basis and a dividend yield of 0.23%. AAON's dividend payout ratio (DPR) is currently 14.10%.

Insiders Place Their Bets

In other AAON news, VP Stephen E. Wakefield sold 5,750 shares of the firm's stock in a transaction that occurred on Monday, November 25th. The shares were sold at an average price of $139.86, for a total value of $804,195.00. Following the completion of the transaction, the vice president now owns 9,920 shares of the company's stock, valued at $1,387,411.20. This trade represents a 36.69 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at this link. Also, CEO Gary D. Fields sold 35,000 shares of the firm's stock in a transaction that occurred on Friday, November 15th. The shares were sold at an average price of $132.03, for a total transaction of $4,621,050.00. Following the completion of the transaction, the chief executive officer now directly owns 64,295 shares of the company's stock, valued at $8,488,868.85. This represents a 35.25 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 46,967 shares of company stock worth $6,271,357. Company insiders own 18.55% of the company's stock.

AAON Company Profile

(

Free Report)

AAON, Inc, together with its subsidiaries, engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada. The company operates through three segments: AAON Oklahoma, AAON Coil Products, and BASX. It offers rooftop units, data center cooling solutions, cleanroom systems, chillers, packaged outdoor mechanical rooms, air handling units, makeup air units, energy recovery units, condensing units, geothermal/water-source heat pumps, coils, and controls.

Read More

Before you consider AAON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AAON wasn't on the list.

While AAON currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report