Townsquare Capital LLC acquired a new stake in shares of Zai Lab Limited (NASDAQ:ZLAB - Free Report) during the 4th quarter, according to the company in its most recent Form 13F filing with the SEC. The firm acquired 9,290 shares of the company's stock, valued at approximately $243,000.

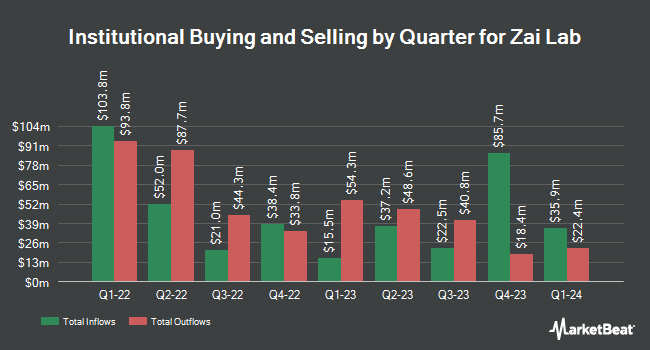

A number of other hedge funds have also recently made changes to their positions in the company. Pictet Asset Management Holding SA bought a new stake in shares of Zai Lab in the 4th quarter valued at about $31,000. US Bancorp DE increased its holdings in Zai Lab by 1,671.9% during the 4th quarter. US Bancorp DE now owns 5,865 shares of the company's stock worth $154,000 after purchasing an additional 5,534 shares in the last quarter. China Universal Asset Management Co. Ltd. raised its holdings in shares of Zai Lab by 15.7% in the fourth quarter. China Universal Asset Management Co. Ltd. now owns 11,061 shares of the company's stock valued at $290,000 after purchasing an additional 1,502 shares during the last quarter. Orion Portfolio Solutions LLC purchased a new stake in shares of Zai Lab during the fourth quarter valued at approximately $313,000. Finally, Daiwa Securities Group Inc. raised its position in Zai Lab by 44.7% in the fourth quarter. Daiwa Securities Group Inc. now owns 13,833 shares of the company's stock worth $362,000 after acquiring an additional 4,276 shares during the period. 41.65% of the stock is owned by institutional investors and hedge funds.

Insiders Place Their Bets

In other Zai Lab news, CEO Ying Du sold 50,000 shares of the firm's stock in a transaction dated Monday, March 3rd. The stock was sold at an average price of $32.44, for a total value of $1,622,000.00. Following the transaction, the chief executive officer now directly owns 494,117 shares of the company's stock, valued at approximately $16,029,155.48. This trade represents a 9.19 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Frazor Titus Edmondson III sold 14,544 shares of the company's stock in a transaction dated Friday, February 28th. The shares were sold at an average price of $32.98, for a total transaction of $479,661.12. Following the sale, the insider now directly owns 14,328 shares of the company's stock, valued at $472,537.44. The trade was a 50.37 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 138,744 shares of company stock valued at $4,685,294. Insiders own 13.88% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts recently commented on the stock. Bank of America restated a "neutral" rating and set a $36.10 price target (up from $29.00) on shares of Zai Lab in a research note on Monday, March 3rd. JPMorgan Chase & Co. increased their target price on shares of Zai Lab from $44.00 to $51.00 and gave the company an "overweight" rating in a report on Thursday, March 13th. Cantor Fitzgerald reaffirmed an "overweight" rating on shares of Zai Lab in a research note on Thursday, March 27th. Finally, Scotiabank started coverage on shares of Zai Lab in a report on Friday, March 7th. They set a "sector outperform" rating and a $55.00 target price for the company.

View Our Latest Stock Analysis on ZLAB

Zai Lab Stock Up 9.5 %

NASDAQ ZLAB opened at $32.53 on Wednesday. The stock's 50 day moving average is $33.08 and its 200 day moving average is $29.34. The firm has a market capitalization of $3.57 billion, a PE ratio of -11.74 and a beta of 1.09. Zai Lab Limited has a twelve month low of $15.00 and a twelve month high of $39.77.

Zai Lab (NASDAQ:ZLAB - Get Free Report) last released its earnings results on Thursday, February 27th. The company reported ($0.80) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.61) by ($0.19). Zai Lab had a negative net margin of 76.14% and a negative return on equity of 36.97%. The business had revenue of $109.07 million for the quarter, compared to analysts' expectations of $110.15 million. On average, research analysts anticipate that Zai Lab Limited will post -2.58 earnings per share for the current year.

About Zai Lab

(

Free Report)

Zai Lab Limited develops and commercializes therapies to treat oncology, autoimmune disorders, infectious diseases, and neuroscience. Its commercial products include Zejula, an orally administered poly polymerase 1/2 inhibitor; Optune, a cancer therapy that uses electric fields tuned to specific frequencies to kill tumor cells; NUZYRA for acute bacterial skin and skin structure infections, and community acquired bacterial pneumonia; Qinlock to treat gastrointestinal stromal tumors, and VYVGART, a human IgG1 antibody fragment for myesthenia gravis.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Zai Lab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zai Lab wasn't on the list.

While Zai Lab currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.