Townsquare Capital LLC lessened its holdings in 3M (NYSE:MMM - Free Report) by 66.1% during the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 13,328 shares of the conglomerate's stock after selling 26,008 shares during the quarter. Townsquare Capital LLC's holdings in 3M were worth $1,822,000 as of its most recent filing with the Securities & Exchange Commission.

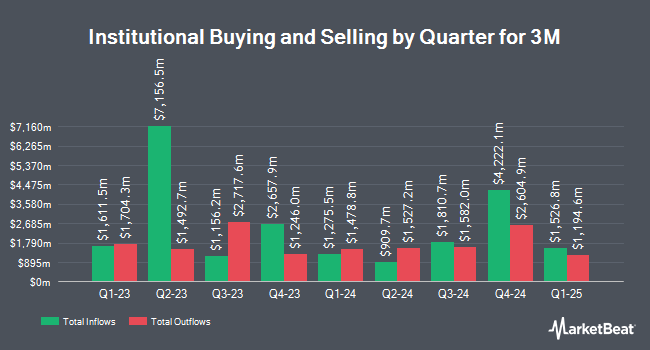

A number of other hedge funds have also added to or reduced their stakes in the stock. FMR LLC boosted its position in 3M by 88.7% in the third quarter. FMR LLC now owns 8,961,866 shares of the conglomerate's stock valued at $1,225,087,000 after buying an additional 4,212,409 shares during the last quarter. Bank of New York Mellon Corp lifted its holdings in 3M by 11.8% in the second quarter. Bank of New York Mellon Corp now owns 5,065,242 shares of the conglomerate's stock valued at $517,617,000 after acquiring an additional 533,520 shares during the last quarter. Pacer Advisors Inc. raised its stake in shares of 3M by 2.0% in the 2nd quarter. Pacer Advisors Inc. now owns 4,952,878 shares of the conglomerate's stock valued at $506,135,000 after acquiring an additional 97,340 shares during the period. AQR Capital Management LLC grew its holdings in shares of 3M by 18.6% in the second quarter. AQR Capital Management LLC now owns 2,531,422 shares of the conglomerate's stock valued at $258,686,000 after purchasing an additional 396,773 shares in the last quarter. Finally, Dimensional Fund Advisors LP boosted its stake in shares of 3M by 0.6% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,940,202 shares of the conglomerate's stock valued at $198,298,000 after buying an additional 11,315 shares during the period. 65.25% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

MMM has been the subject of several analyst reports. Mizuho upped their price target on 3M from $105.00 to $146.00 and gave the stock a "neutral" rating in a research note on Thursday, October 17th. Melius upgraded shares of 3M from a "hold" rating to a "buy" rating in a research note on Tuesday, October 22nd. JPMorgan Chase & Co. lifted their price target on 3M from $160.00 to $165.00 and gave the stock an "overweight" rating in a research note on Monday, October 28th. Wells Fargo & Company raised their price target on 3M from $130.00 to $140.00 and gave the stock an "equal weight" rating in a report on Monday, October 7th. Finally, Royal Bank of Canada upped their price objective on shares of 3M from $99.00 to $100.00 and gave the stock an "underperform" rating in a report on Wednesday, October 23rd. Two equities research analysts have rated the stock with a sell rating, four have given a hold rating and eleven have issued a buy rating to the company's stock. According to data from MarketBeat, 3M currently has a consensus rating of "Moderate Buy" and a consensus price target of $144.87.

Read Our Latest Research Report on 3M

3M Stock Performance

MMM traded down $0.64 during midday trading on Monday, reaching $132.89. The company had a trading volume of 2,929,554 shares, compared to its average volume of 4,754,283. The company has a quick ratio of 1.08, a current ratio of 1.43 and a debt-to-equity ratio of 2.41. The business has a 50-day moving average of $132.39 and a two-hundred day moving average of $120.43. The company has a market cap of $72.37 billion, a P/E ratio of 16.78, a P/E/G ratio of 2.21 and a beta of 0.95. 3M has a 1 year low of $75.40 and a 1 year high of $141.34.

3M (NYSE:MMM - Get Free Report) last posted its quarterly earnings data on Tuesday, October 22nd. The conglomerate reported $1.98 earnings per share for the quarter, topping analysts' consensus estimates of $1.93 by $0.05. The company had revenue of $6.29 billion for the quarter, compared to analyst estimates of $6.06 billion. 3M had a net margin of 15.37% and a return on equity of 104.66%. The firm's revenue for the quarter was down 24.3% on a year-over-year basis. During the same period in the prior year, the company posted $2.68 EPS. As a group, equities research analysts predict that 3M will post 7.27 earnings per share for the current fiscal year.

3M Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, December 12th. Investors of record on Friday, November 15th will be issued a dividend of $0.70 per share. This represents a $2.80 dividend on an annualized basis and a yield of 2.11%. The ex-dividend date of this dividend is Friday, November 15th. 3M's dividend payout ratio (DPR) is presently 35.35%.

About 3M

(

Free Report)

3M Company provides diversified technology services in the United States and internationally. The company's Safety and Industrial segment offers industrial abrasives and finishing for metalworking applications; autobody repair solutions; closure systems for personal hygiene products, masking, and packaging materials; electrical products and materials for construction and maintenance, power distribution, and electrical original equipment manufacturers; structural adhesives and tapes; respiratory, hearing, eye, and fall protection solutions; and natural and color-coated mineral granules for shingles.

See Also

Before you consider 3M, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 3M wasn't on the list.

While 3M currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.