Saturna Capital Corp decreased its position in Tractor Supply (NASDAQ:TSCO - Free Report) by 54.0% in the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 2,330 shares of the specialty retailer's stock after selling 2,730 shares during the period. Saturna Capital Corp's holdings in Tractor Supply were worth $678,000 as of its most recent SEC filing.

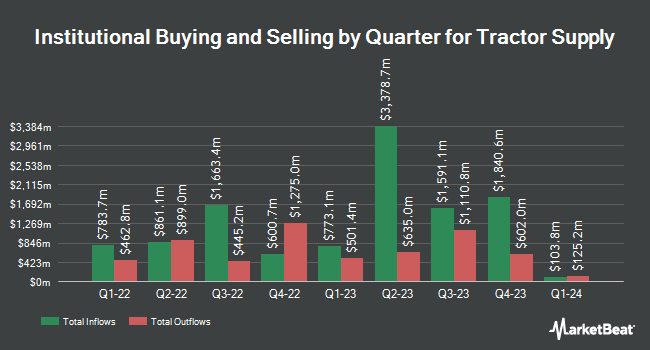

Other hedge funds also recently modified their holdings of the company. LRI Investments LLC bought a new position in Tractor Supply in the first quarter worth $28,000. J.Safra Asset Management Corp boosted its position in shares of Tractor Supply by 700.0% during the 1st quarter. J.Safra Asset Management Corp now owns 112 shares of the specialty retailer's stock valued at $29,000 after acquiring an additional 98 shares in the last quarter. Future Financial Wealth Managment LLC acquired a new stake in shares of Tractor Supply during the 3rd quarter valued at about $29,000. First Personal Financial Services bought a new stake in Tractor Supply in the third quarter valued at about $29,000. Finally, Whittier Trust Co. raised its position in Tractor Supply by 60.9% in the second quarter. Whittier Trust Co. now owns 111 shares of the specialty retailer's stock worth $30,000 after purchasing an additional 42 shares in the last quarter. Institutional investors own 98.72% of the company's stock.

Tractor Supply Trading Down 0.2 %

NASDAQ TSCO traded down $0.44 during trading hours on Wednesday, hitting $278.75. The company's stock had a trading volume of 570,642 shares, compared to its average volume of 1,056,218. Tractor Supply has a twelve month low of $193.73 and a twelve month high of $307.64. The firm has a market capitalization of $29.78 billion, a P/E ratio of 27.09, a PEG ratio of 3.50 and a beta of 0.82. The company has a quick ratio of 0.17, a current ratio of 1.48 and a debt-to-equity ratio of 0.81. The stock has a fifty day moving average of $283.98 and a 200 day moving average of $275.28.

Tractor Supply Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, December 10th. Stockholders of record on Monday, November 25th will be paid a $1.10 dividend. This represents a $4.40 dividend on an annualized basis and a dividend yield of 1.58%. The ex-dividend date is Monday, November 25th. Tractor Supply's dividend payout ratio (DPR) is currently 42.80%.

Insider Transactions at Tractor Supply

In related news, CFO Kurt D. Barton sold 23,532 shares of the stock in a transaction that occurred on Tuesday, October 1st. The shares were sold at an average price of $295.64, for a total value of $6,957,000.48. Following the sale, the chief financial officer now directly owns 9,683 shares in the company, valued at $2,862,682.12. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. 0.24% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

TSCO has been the topic of several analyst reports. Truist Financial lowered their price objective on Tractor Supply from $325.00 to $317.00 and set a "buy" rating on the stock in a research note on Friday, October 25th. Loop Capital upped their price target on Tractor Supply from $250.00 to $260.00 and gave the company a "hold" rating in a research report on Friday, September 6th. Robert W. Baird set a $320.00 price objective on Tractor Supply in a report on Thursday, October 17th. DA Davidson upped their target price on shares of Tractor Supply from $300.00 to $325.00 and gave the stock a "buy" rating in a report on Friday, October 25th. Finally, Wells Fargo & Company increased their target price on shares of Tractor Supply from $295.00 to $325.00 and gave the stock an "overweight" rating in a research report on Friday, October 11th. Two analysts have rated the stock with a sell rating, nine have given a hold rating and twelve have given a buy rating to the stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $282.82.

Check Out Our Latest Analysis on Tractor Supply

Tractor Supply Company Profile

(

Free Report)

Tractor Supply Company operates as a rural lifestyle retailer in the United States. The company offers various merchandise, including livestock and equine feed and equipment, poultry, fencing, and sprayers and chemicals; food, treats, and equipment for dogs, cats, and other small animals, as well as dog wellness products; seasonal and recreation products comprising tractors and riders, lawn and garden, bird feeding, power equipment, and other recreational products; truck, tool, and hardware products, such as truck accessories, trailers, generators, lubricants, batteries, and hardware and tools; and clothing, gift, and décor products consist of clothing, footwear, toys, snacks, and decorative merchandise.

Featured Stories

Before you consider Tractor Supply, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tractor Supply wasn't on the list.

While Tractor Supply currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.